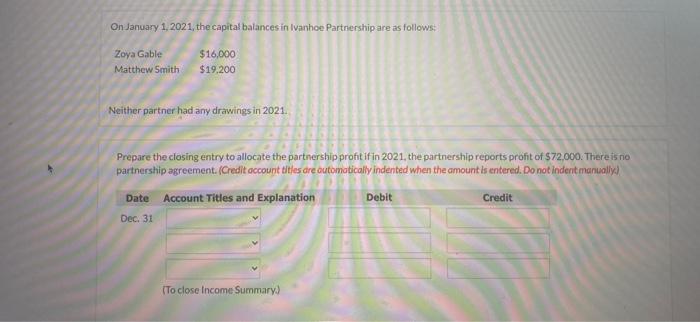

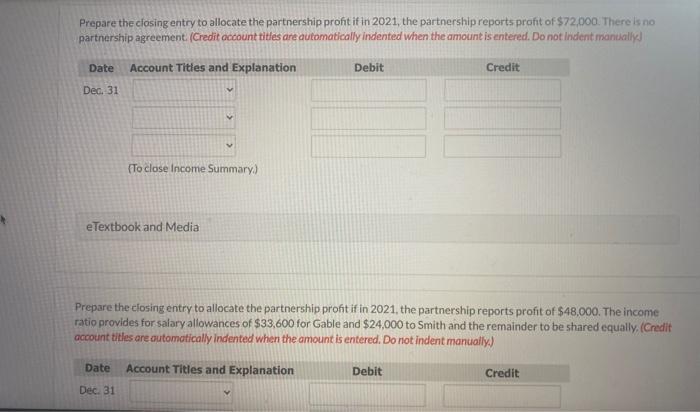

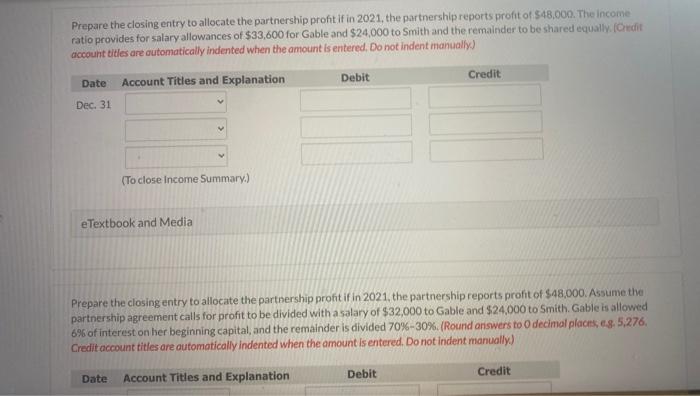

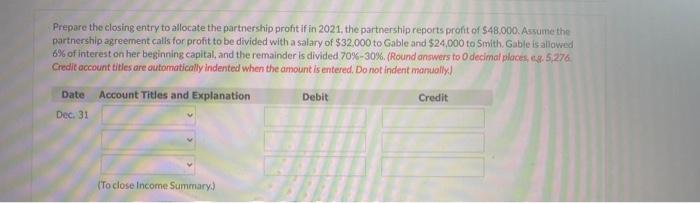

On January 1, 2021, the capital balances in Ivanhoe Partnership are as follows: Zoya Gable Matthew Smith $16,000 $19,200 Neither partner had any drawings in 2021. Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $72,000. There is no partnership agreement. (Credit account titles are automatically indented when the amount is entered. Do not inderit manually) Date Account Titles and Explanation Debit Credit Dec. 31 (To close Income Summary) Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $72,000. There is no partnership agreement. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually Date Account Tities and Explanation Debit Credit Dec. 31 V {To close Income Summary) eTextbook and Media Prepare the closing entry to allocate the partnership proht if in 2021, the partnership reports profit of $48.000. The income ratio provides for salary allowances of $33,600 for Gable and $24,000 to Smith and the remainder to be shared equally. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $48,000. The income ratio provides for salary allowances of $33,600 for Gable and $24,000 to Smith and the remainder to be shared equally. (Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Credit Debit Account Titles and Explanation Dec. 31 (To close Income Summary.) e Textbook and Media Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $48,000. Assume the partnership agreement calls for profit to be divided with a salary of $32,000 to Gable and $24,000 to Smith. Gable is allowed 6% of interest on her beginning capital, and the remainder is divided 70%-30%. (Round answers to decimal places, c9.5,276, Credit account titles are automatically indented when the amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $48.000. Assume the partnership agreement calls for profit to be divided with a salary of $32,000 to Gable and $24,000 to Smith Gable is allowed 8% of interest on her beginning capital, and the remainder is divided 70%-30%. (Round answers to decimal places, 8.5,276 Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Dec. 31 (To close Income Summary:)