Answered step by step

Verified Expert Solution

Question

1 Approved Answer

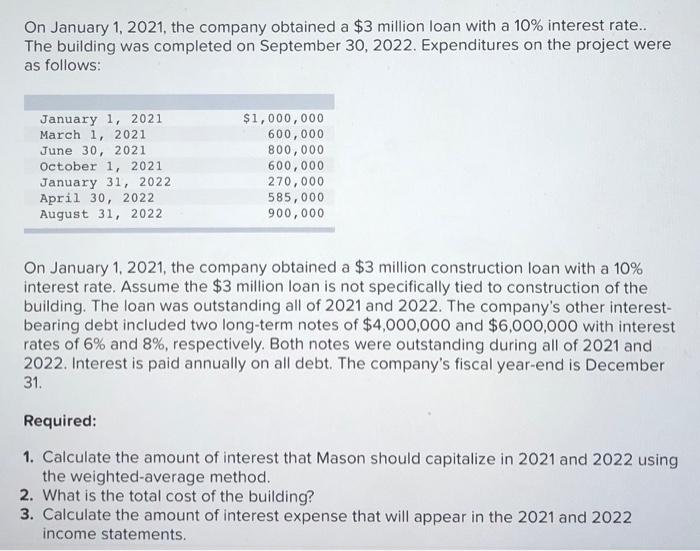

On January 1, 2021, the company obtained a $3 million loan with a 10% interest rate... The building was completed on September 30, 2022.

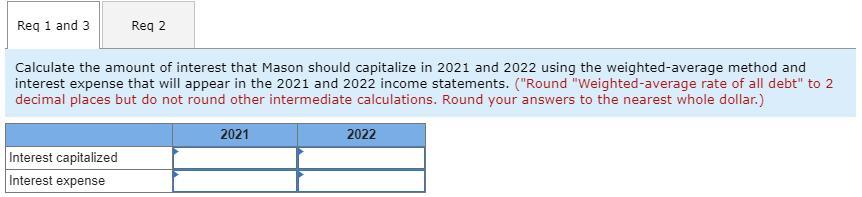

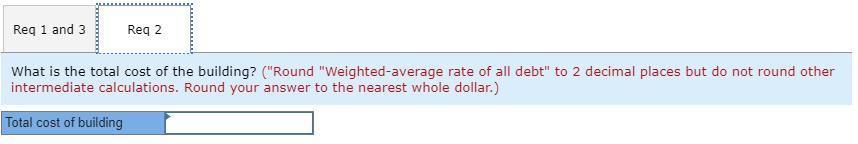

On January 1, 2021, the company obtained a $3 million loan with a 10% interest rate... The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 March 1, 2021 June 30, 2021 October 1, 2021 January 31, 2022 April 30, 2022 August 31, 2022 $1,000,000 600,000 0, 000 600,000 270,000 585,000 900,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company's other interest- bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the weighted-average method. 2. What is the total cost of the building? 3. Calculate the amount of interest expense that will appear in the 2021 and 2022 income statements. Req 1 and 3 Req 2 Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the weighted-average method and interest expense that will appear in the 2021 and 2022 income statements. ("Round "Weighted-average rate of all debt" to 2 decimal places but do not round other intermediate calculations. Round your answers to the nearest whole dollar.) 2021 2022 Interest capitalized Interest expense Req 1 and 3 Req 2 What is the total cost of the building? ("Round "Weighted-average rate of all debt" to 2 decimal places but do not round other intermediate calculations. Round your answer to the nearest whole dollar.) Total cost of building

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

solution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started