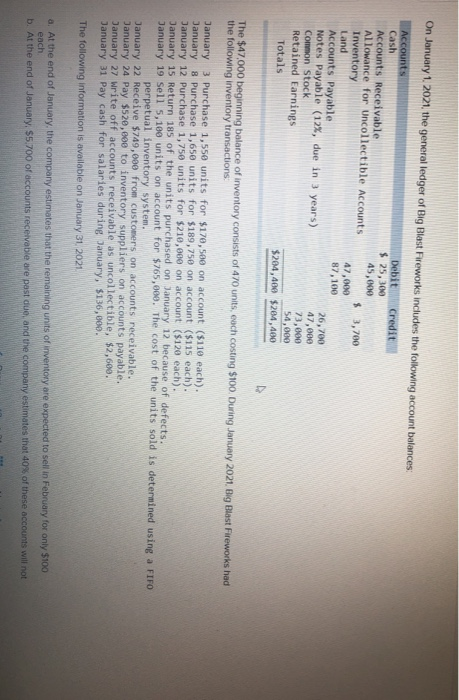

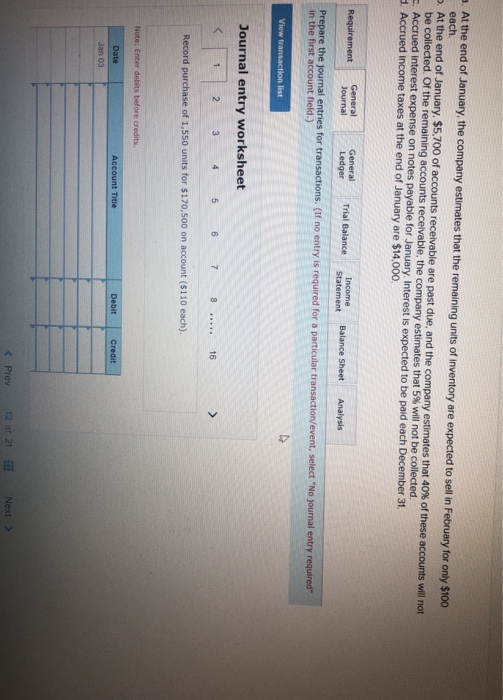

On January 1. 2021, the general ledger of Big Blast Fireworks includes the following account balances: Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Accounts Payable Notes Payable (12%, due in 3 years) Common Stock Retained Earnings $25,300 A5,000 3,700 47,000 87,100 26,700 47,000 73,800 54,000 $204,400 264,400 Totals The $47000 begning balance of iventory consists of 470 units, och costing $t00 During January 2021 the following inventory transactions BestFwkd units, each costing $100. During January 2021. Big Blast Fireworks had Danuary 3 Purchase 1,5se units for $170,500 on account ($110 each). anuary 8 Purchase 1,650 units for $189,75e on account ($115 each). January 12 Purchase 1,750 units for $21e,eee on account ($120 each). Danuary 15 Return 185 of the units purchased on January 12 because of defects. Danuary 19 sell 5,100 units on account for $765,000. The cost of the units sold is determined using a FIFO perpetual inventory system eive $749,000 from customers on accounts receivable. January 22 Rec January 24 Pay $520,800 to inventory suppliers on accounts payable. January 27 rite off accounts receivable as uncollectible, $2,600 Danuary 31 Pay cash for salaries during January, $136,800. The following information is available on January 31, 2021 a. At the end of January, the company estimates that the remaining units of inventory are expected to selil n February tor only $100 each b. At the end of January. SS 700 of accounts recevabie are past due, and the company estimates that 40% of these accounts will not . At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each. At the end of January. S5 700 of accounts receivable are past due, and the company estimates that 40% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected. . Accrued interest expense on notes payable for January. Interest is expected to be paid each December 31 Accrued income taxes at the end of January are $14,000 to be paid each December 31 General Journal General Prepare the journal entries for transactions. in the first account field.) If no entry is required for a particular transaction/event, select "No journal entry required" Journal entry worksheet 16 Record purchase of 1,550 units for $170,500 on account ($110 each). Debit Credit Account Titie Jan 03 12 of 21