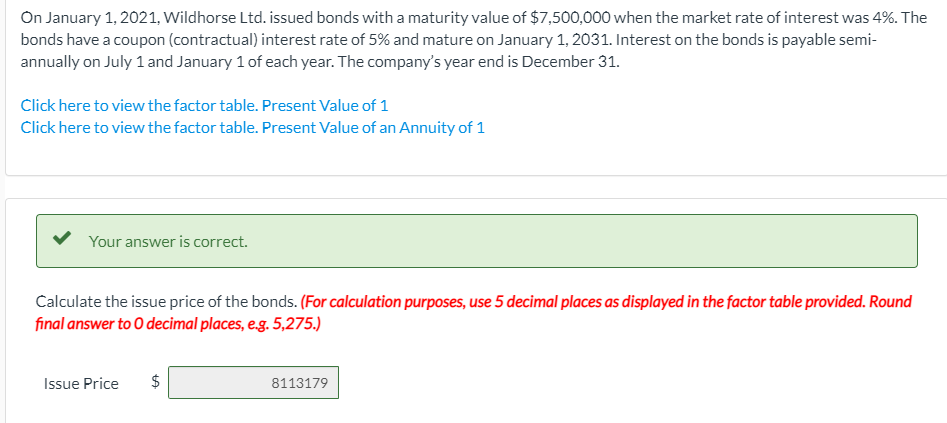

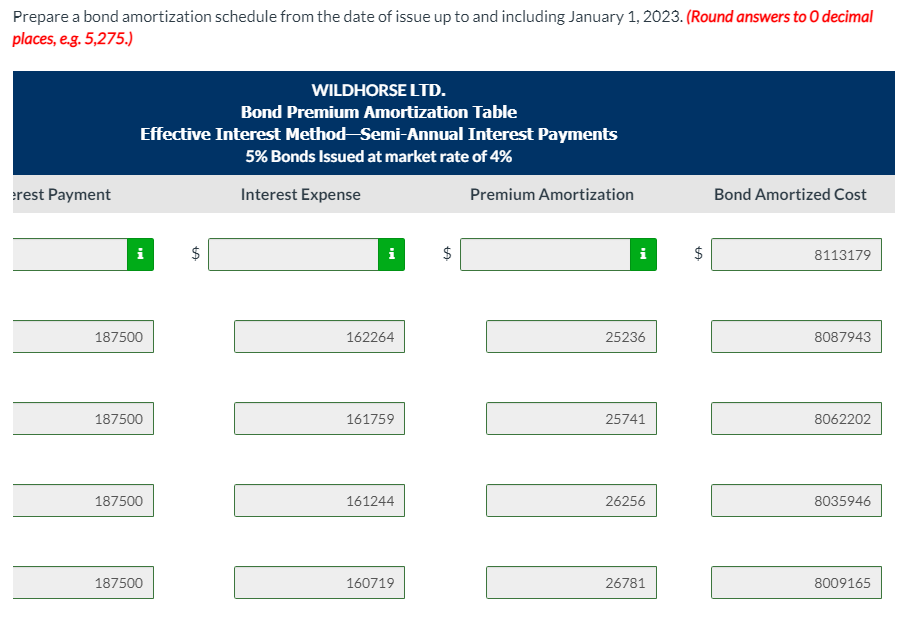

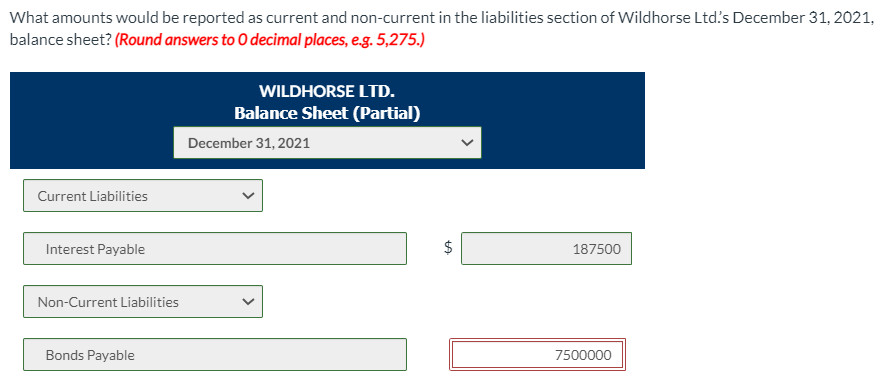

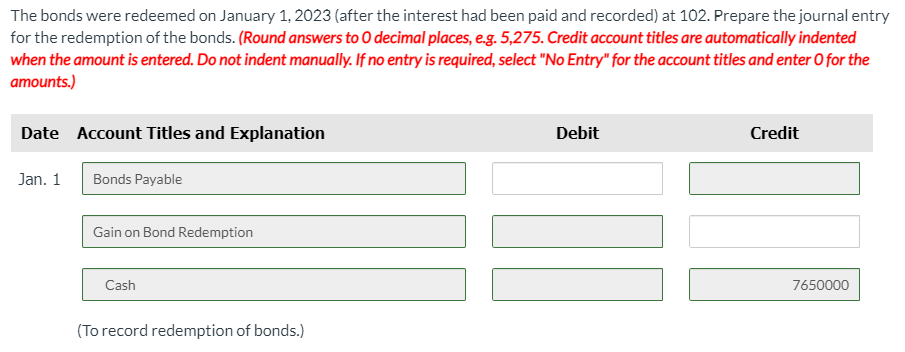

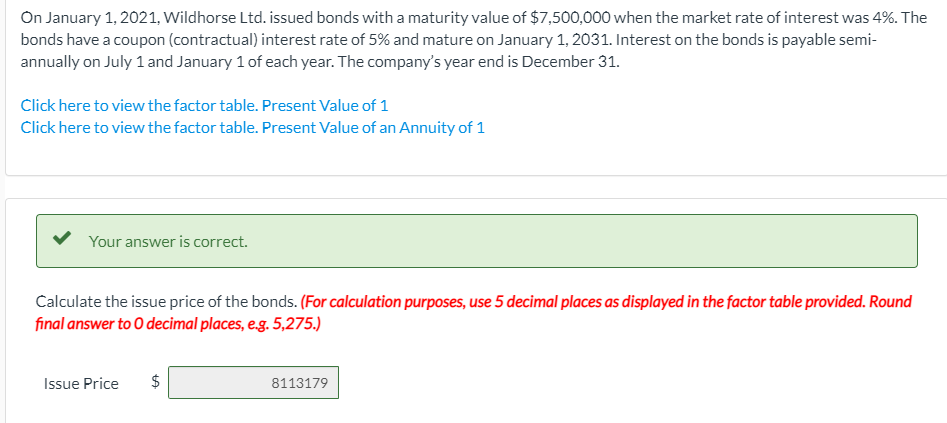

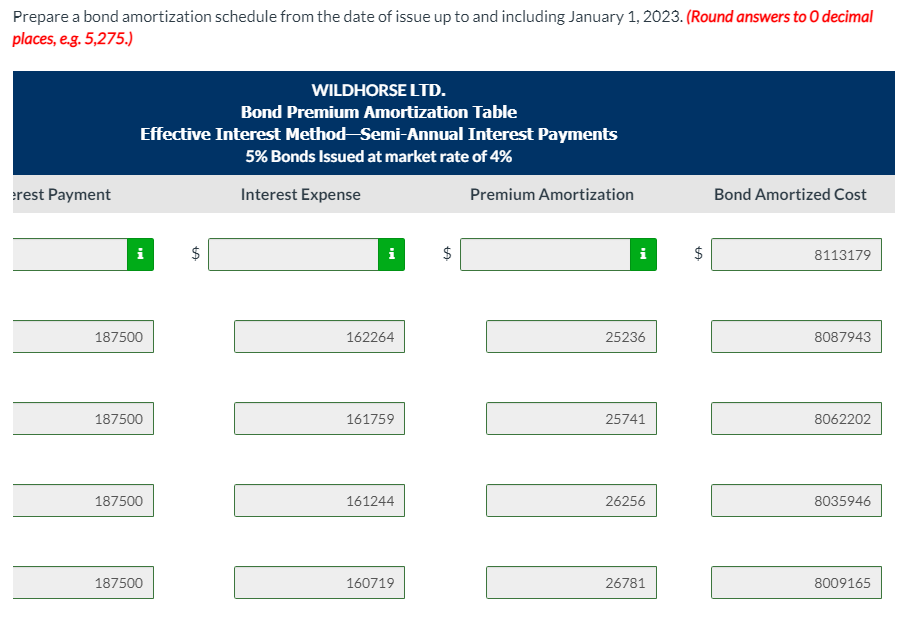

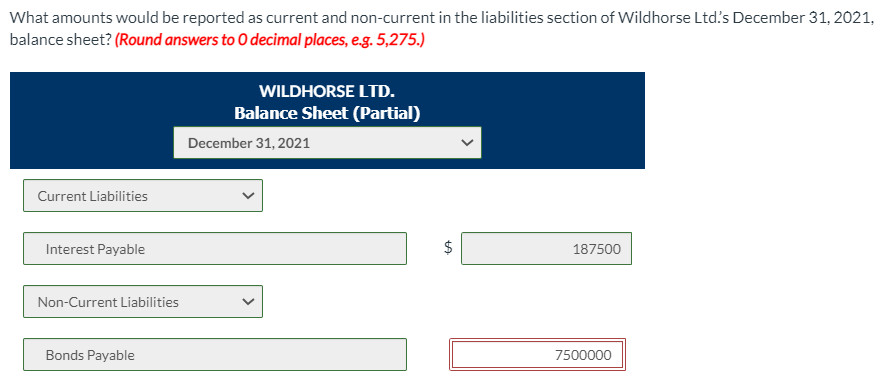

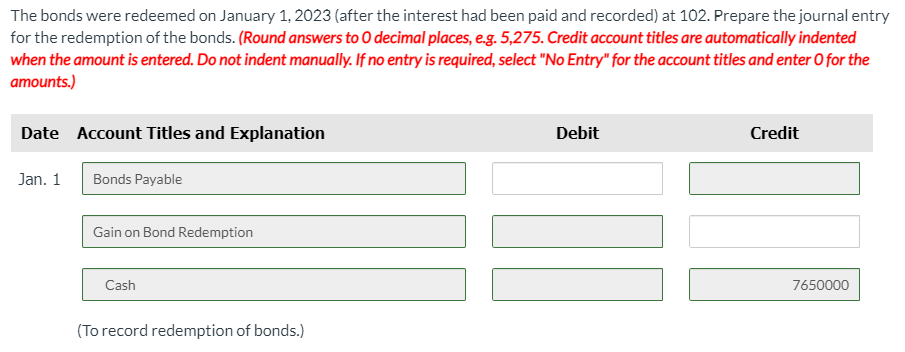

On January 1, 2021, Wildhorse Ltd. issued bonds with a maturity value of $7,500,000 when the market rate of interest was 4%. The bonds have a coupon (contractual) interest rate of 5% and mature on January 1, 2031. Interest on the bonds is payable semi- annually on July 1 and January 1 of each year. The company's year end is December 31. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 Your answer is correct. Calculate the issue price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answer to 0 decimal places, e.g. 5,275.) Issue Price $ $ 8113179 Prepare a bond amortization schedule from the date of issue up to and including January 1, 2023. (Round answers to 0 decimal places, e.g. 5,275.) WILDHORSE LTD. Bond Premium Amortization Table Effective Interest Method-Semi-Annual Interest Payments 5% Bonds Issued at market rate of 4% rest Payment Interest Expense Premium Amortization Bond Amortized Cost FO i $ $ i $ Me $ 8113179 187500 162264 25236 8087943 187500 161759 25741 8062202 187500 161244 26256 8035946 187500 160719 26781 8009165 What amounts would be reported as current and non-current in the liabilities section of Wildhorse Ltd's December 31, 2021, balance sheet? (Round answers to O decimal places, e.g. 5,275.) WILDHORSE LTD. Balance Sheet (Partial) December 31, 2021 Current Liabilities Interest Payable $ 187500 Non-Current Liabilities Bonds Payable 7500000 The bonds were redeemed on January 1, 2023 (after the interest had been paid and recorded) at 102. Prepare the journal entry for the redemption of the bonds. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1 Bonds Payable Gain on Bond Redemption Cash 7650000 (To record redemption of bonds.)