Answered step by step

Verified Expert Solution

Question

1 Approved Answer

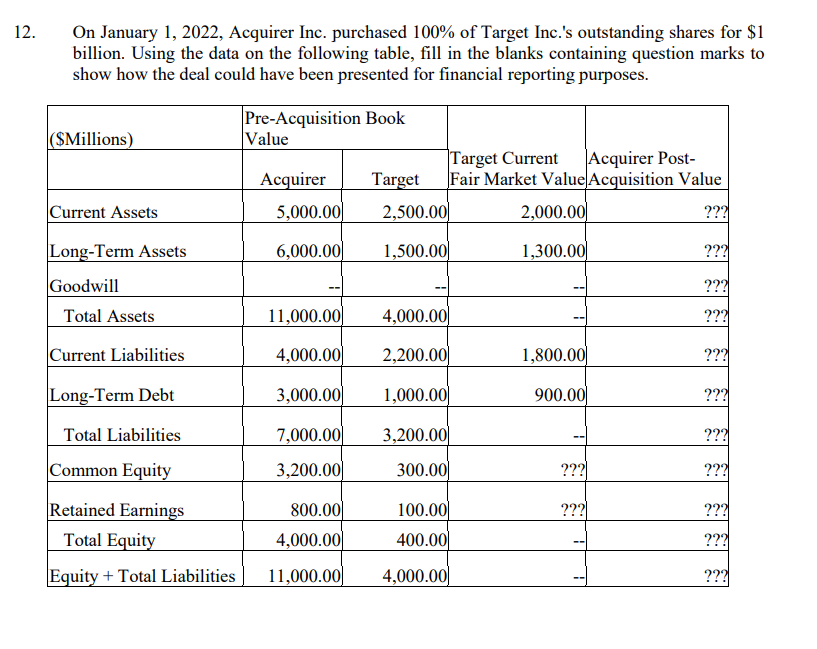

On January 1, 2022, Acquirer Inc. purchased 100% of Target Inc.'s outstanding shares for $1 billion. Using the data on the following table, fill

On January 1, 2022, Acquirer Inc. purchased 100% of Target Inc.'s outstanding shares for $1 billion. Using the data on the following table, fill in the blanks containing question marks to show how the deal could have been presented for financial reporting purposes. 12. Pre-Acquisition Book Value (SMillions) |Target Current Fair Market Value Acquisition Value Acquirer Post- Acquirer Target Current Assets 5,000.00 2,500.00 2,000.00 ??? Long-Term Assets 6,000.00 1,500.00 1,300.00 ??? Goodwill ??? -- -- Total Assets 11,000.00 4,000.00| ??? Current Liabilities 4,000.00 2,200.00 1,800.00 ??? Long-Term Debt 3,000.00 1,000.00| 900.00 ??? Total Liabilities 7,000.00| 3,200.00| ??? Common Equity 3,200.00 300.00 ??? ??? Retained Earnings 800.00 100.00 ??? ??? Total Equity 4,000.00 400.00 ??? Equity + Total Liabilities 11,000.00] 4,000.00 ???

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Current Assets 7000 Long Term A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started