Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, Chris and Wilson formed a partnership by investing $350,000 cash and $210,000 cash, respectively. During its first year, the firm

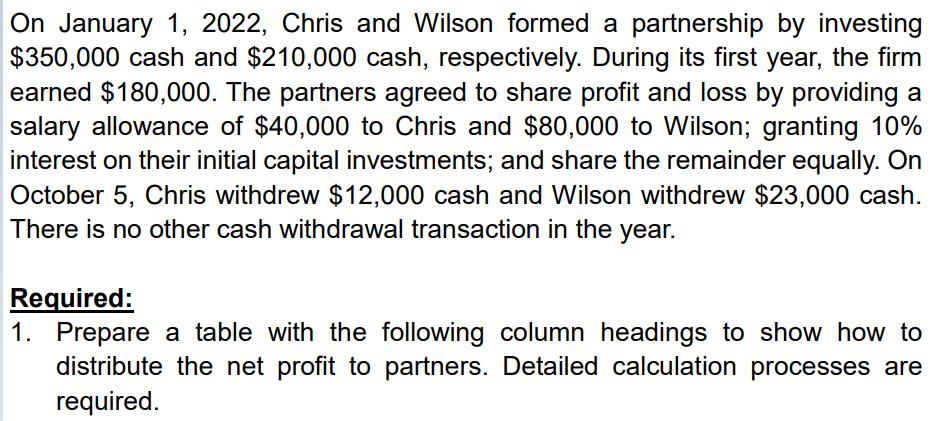

On January 1, 2022, Chris and Wilson formed a partnership by investing $350,000 cash and $210,000 cash, respectively. During its first year, the firm earned $180,000. The partners agreed to share profit and loss by providing a salary allowance of $40,000 to Chris and $80,000 to Wilson; granting 10% interest on their initial capital investments; and share the remainder equally. On October 5, Chris withdrew $12,000 cash and Wilson withdrew $23,000 cash. There is no other cash withdrawal transaction in the year. Required: 1. Prepare a table with the following column headings to show how to distribute the net profit to partners. Detailed calculation processes are required. Calculations Chris Wilson Total 2. Prepare the December 31 journal entry to close Income Summary account. 3. Prepare the December 31 journal entry to close partner's withdrawal accounts.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Calculate the profit distribution to partners Total Initial Capital Investment Chris 3500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started