Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2022, East Pacific Enterprises issued 9%, 10-year bonds with a face amount of $1,350,000 for cash $1,265,880. Interest is payable semiannually

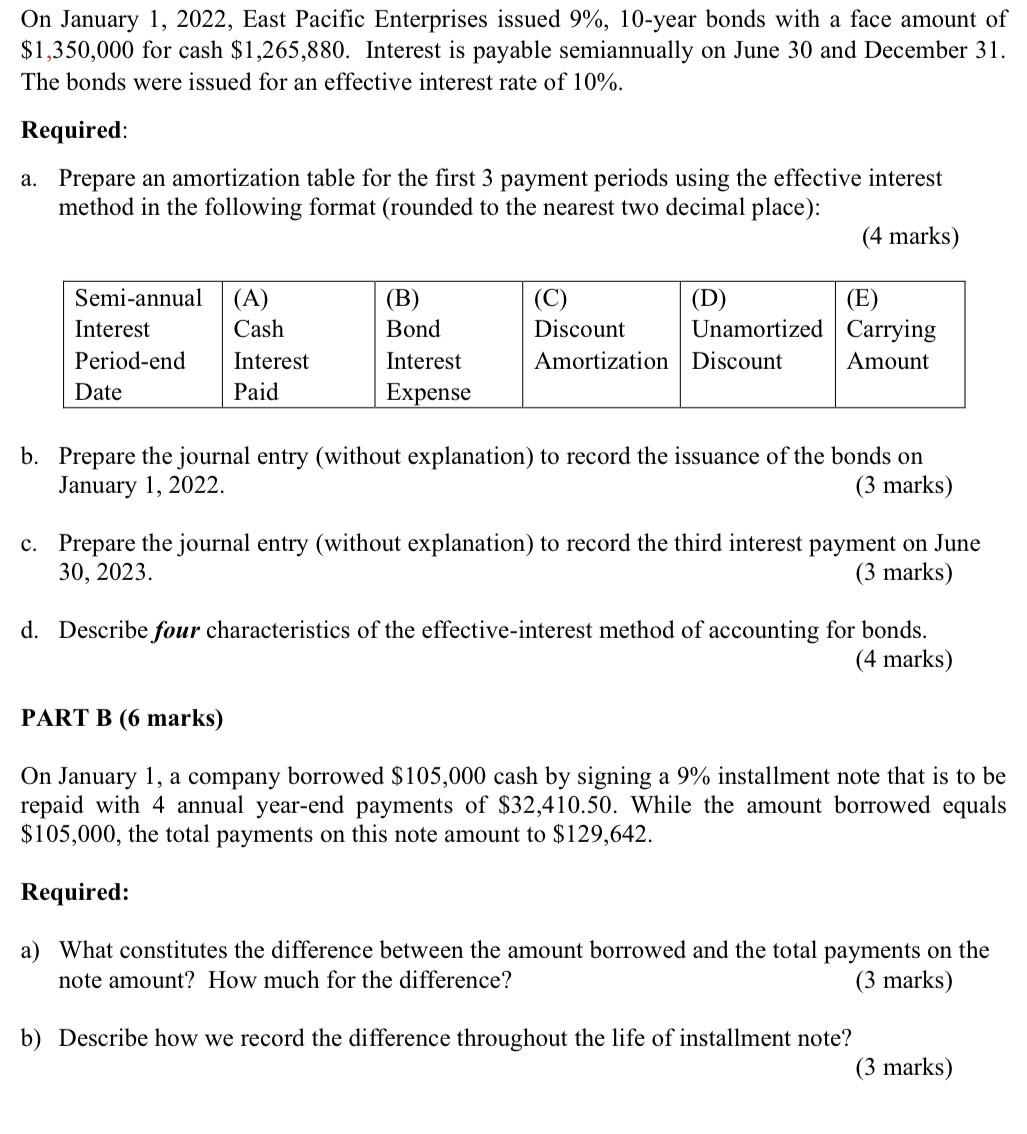

On January 1, 2022, East Pacific Enterprises issued 9%, 10-year bonds with a face amount of $1,350,000 for cash $1,265,880. Interest is payable semiannually on June 30 and December 31. The bonds were issued for an effective interest rate of 10%. Required: a. Prepare an amortization table for the first 3 payment periods using the effective interest method in the following format (rounded to the nearest two decimal place): (4 marks) Semi-annual (A) (B) (C) (D) (E) Interest Cash Bond Discount Period-end Interest Interest Amortization Discount Unamortized Carrying Amount Date Paid Expense b. Prepare the journal entry (without explanation) to record the issuance of the bonds on January 1, 2022. (3 marks) c. Prepare the journal entry (without explanation) to record the third interest payment on June 30, 2023. (3 marks) d. Describe four characteristics of the effective-interest method of accounting for bonds. PART B (6 marks) (4 marks) On January 1, a company borrowed $105,000 cash by signing a 9% installment note that is to be repaid with 4 annual year-end payments of $32,410.50. While the amount borrowed equals $105,000, the total payments on this note amount to $129,642. Required: a) What constitutes the difference between the amount borrowed and the total payments on the note amount? How much for the difference? (3 marks) b) Describe how we record the difference throughout the life of installment note? (3 marks)

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Actual labor hours Standard hours per tuneup 25 hours Number of tuneups 54 Standa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started