Answered step by step

Verified Expert Solution

Question

1 Approved Answer

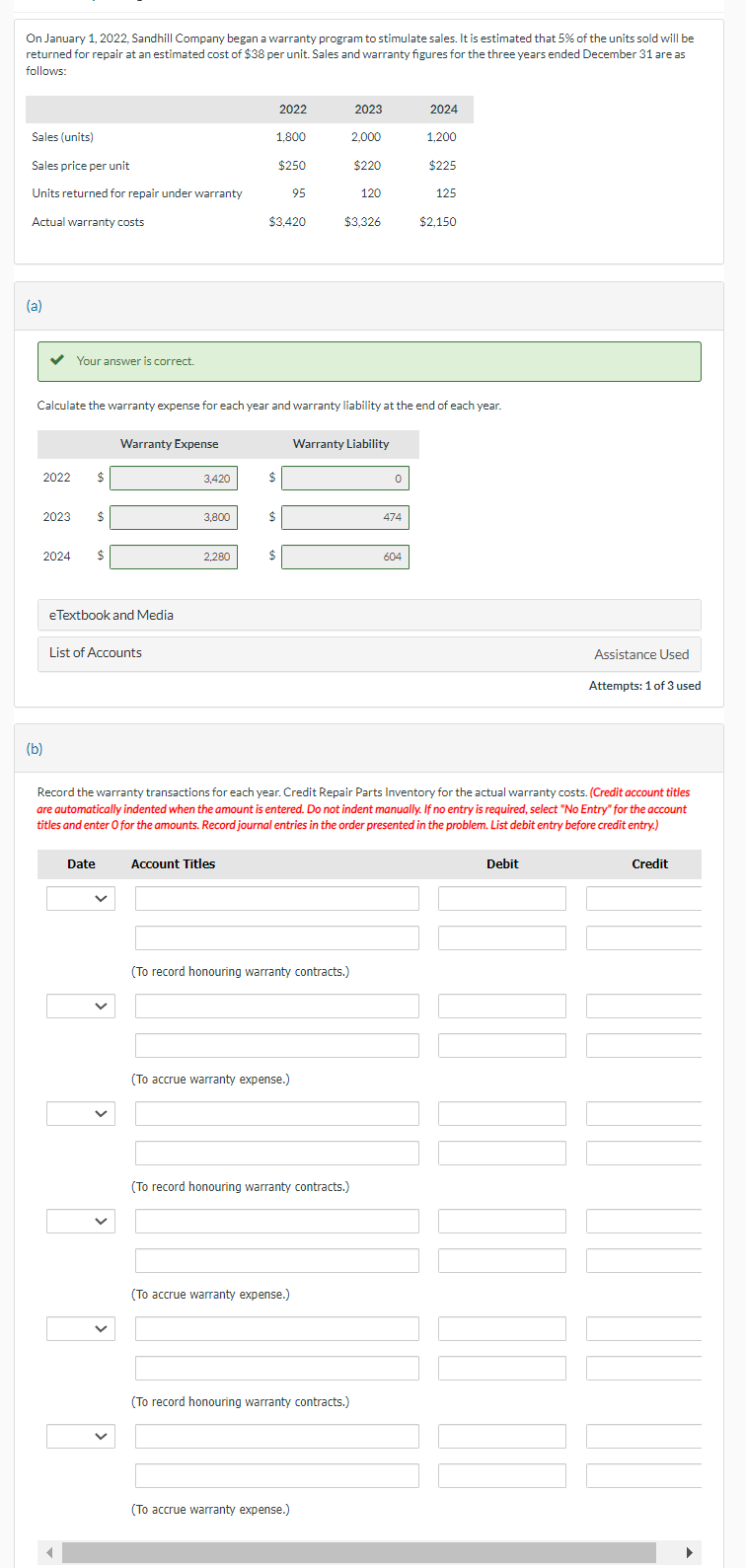

On January 1, 2022, Sandhill Company began a warranty program to stimulate sales. It is estimated that 5% of the units sold will be

On January 1, 2022, Sandhill Company began a warranty program to stimulate sales. It is estimated that 5% of the units sold will be returned for repair at an estimated cost of $38 per unit. Sales and warranty figures for the three years ended December 31 are as follows: Sales (units) Sales price per unit Units returned for repair under warranty Actual warranty costs (a) 2022 Your answer is correct. 2024 2023 $ (b) $ $ Warranty Expense eTextbook and Media List of Accounts Date 3,420 3,800 2,280 Calculate the warranty expense for each year and warranty liability at the end of each year. 1,800 Account Titles 2022 $ $3,420 $ $250 $ 95 (To accrue warranty expense.) (To record honouring warranty contracts.) (To accrue warranty expense.) 2023 (To record honouring warranty contracts.) (To accrue warranty expense.) 2,000 $3,326 $220 (To record honouring warranty contracts.) 120 Warranty Liability 0 Record the warranty transactions for each year. Credit Repair Parts Inventory for the actual warranty costs. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem. List debit entry before credit entry.) 474 2024 604 1,200 $225 125 $2,150 Assistance Used Attempts: 1 of 3 used Debit Credit On January 1, 2022, Sandhill Company began a warranty program to stimulate sales. It is estimated that 5% of the units sold will be returned for repair at an estimated cost of $38 per unit. Sales and warranty figures for the three years ended December 31 are as follows: Sales (units) Sales price per unit Units returned for repair under warranty Actual warranty costs (a) 2022 Your answer is correct. 2024 2023 $ (b) $ $ Warranty Expense eTextbook and Media List of Accounts Date 3,420 3,800 2,280 Calculate the warranty expense for each year and warranty liability at the end of each year. 1,800 Account Titles 2022 $ $3,420 $ $250 $ 95 (To accrue warranty expense.) (To record honouring warranty contracts.) (To accrue warranty expense.) 2023 (To record honouring warranty contracts.) (To accrue warranty expense.) 2,000 $3,326 $220 (To record honouring warranty contracts.) 120 Warranty Liability 0 Record the warranty transactions for each year. Credit Repair Parts Inventory for the actual warranty costs. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem. List debit entry before credit entry.) 474 2024 604 1,200 $225 125 $2,150 Assistance Used Attempts: 1 of 3 used Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image displays an accounting problem from Sandhill Company which relates to the recording of warranty expenses and liabilities over three years Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started