Answered step by step

Verified Expert Solution

Question

1 Approved Answer

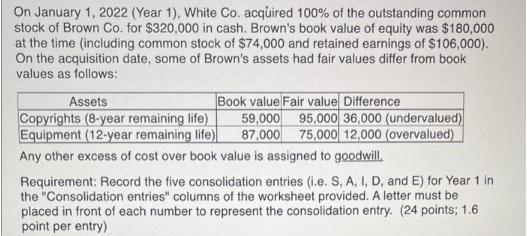

On January 1, 2022 (Year 1), White Co. acquired 100% of the outstanding common stock of Brown Co. for $320,000 in cash. Brown's book

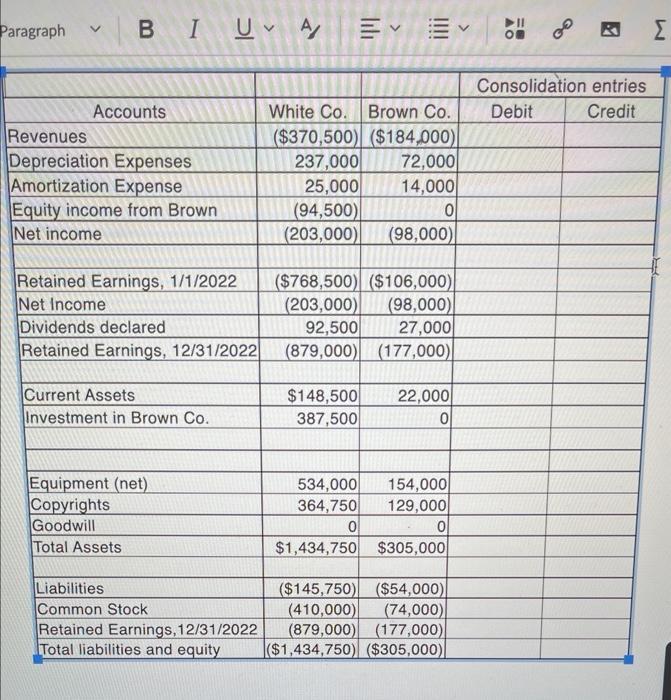

On January 1, 2022 (Year 1), White Co. acquired 100% of the outstanding common stock of Brown Co. for $320,000 in cash. Brown's book value of equity was $180,000 at the time (including common stock of $74,000 and retained earnings of $106,000). On the acquisition date, some of Brown's assets had fair values differ from book values as follows: Assets Book value Fair value Difference Copyrights (8-year remaining life) 59,000 95,000 36,000 (undervalued) Equipment (12-year remaining life) 87,000 75,000 12,000 (overvalued) Any other excess of cost over book value is assigned to goodwill. Requirement: Record the five consolidation entries (i.e. S, A, I, D, and E) for Year 1 in the "Consolidation entries" columns of the worksheet provided. A letter must be placed in front of each number to represent the consolidation entry. (24 points; 1.6 point per entry) Paragraph BIU A E Accounts Revenues Depreciation Expenses Amortization Expense Equity income from Brown Net income Retained Earnings, 1/1/2022 Net Income Dividends declared Retained Earnings, 12/31/2022 Current Assets Investment in Brown Co. Equipment (net) Copyrights Goodwill Total Assets Liabilities Common Stock Retained Earnings, 12/31/2022 Total liabilities and equity White Co. Brown Co. ($370,500) ($184,000) 237,000 25,000 (94,500) (203,000) (98,000) 72,000 14,000 0 ($768,500) ($106,000) (203,000) (98,000) 92,500 27,000 (879,000) (177,000) $148,500 387,500 22,000 0 534,000 154,000 364,750 129,000 0 0 $1,434,750 $305,000 ($145,750) ($54,000) (410,000) (74,000) (879,000) (177,000) ($1,434,750) ($305,000) 11 OF Consolidation entries Credit Debit

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Consolidation Entries S To record the cash payment for the acquisition of Brown Co Debit Br...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started