Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, a company acquired an established coal mine. The company anticipates operating the mine for four years, and subsequently, it is

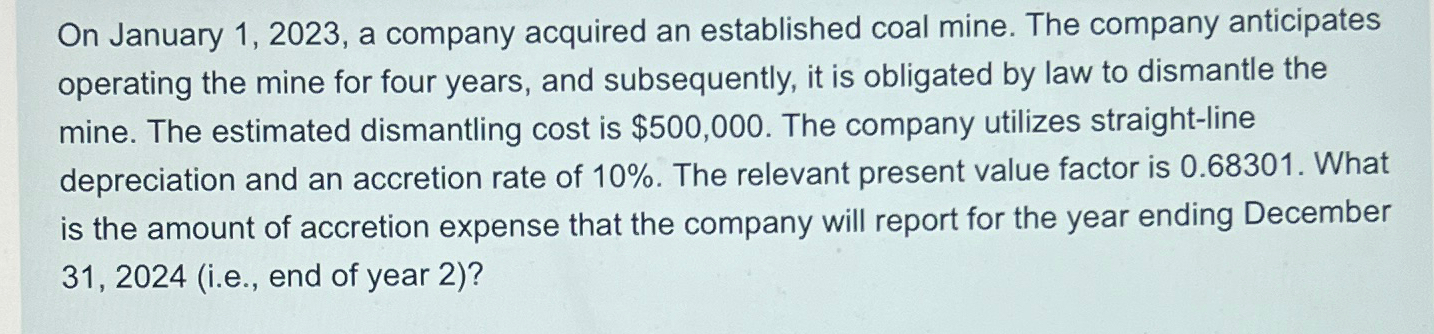

On January 1, 2023, a company acquired an established coal mine. The company anticipates operating the mine for four years, and subsequently, it is obligated by law to dismantle the mine. The estimated dismantling cost is $500,000. The company utilizes straight-line depreciation and an accretion rate of 10%. The relevant present value factor is 0.68301. What is the amount of accretion expense that the company will report for the year ending December 31, 2024 (i.e., end of year 2)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the accretion expense for the year ending December 31 2024 end of year 2 we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started