Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, Avion Blue Inc. acquired 100% of the voting common shares of Plane Corporation Inc. by issuing 10,000 common shares. At

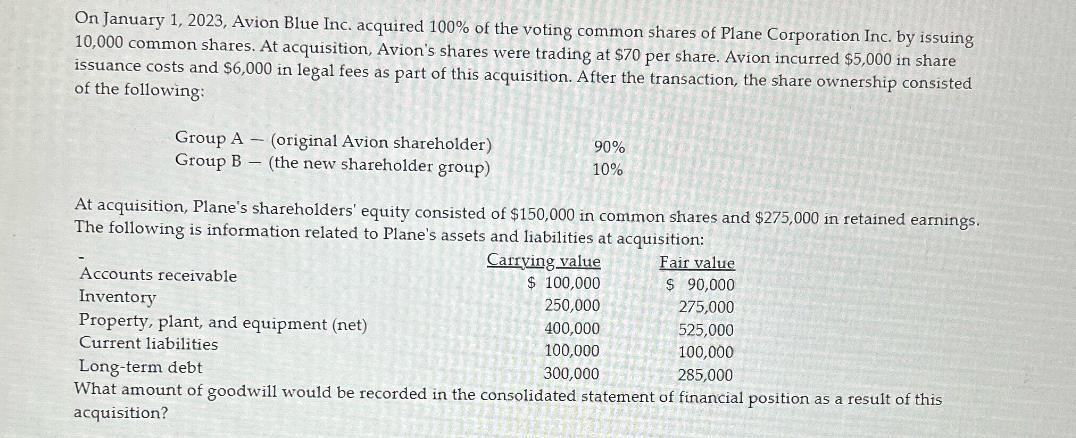

On January 1, 2023, Avion Blue Inc. acquired 100% of the voting common shares of Plane Corporation Inc. by issuing 10,000 common shares. At acquisition, Avion's shares were trading at $70 per share. Avion incurred $5,000 in share issuance costs and $6,000 in legal fees as part of this acquisition. After the transaction, the share ownership consisted of the following: (original Avion shareholder) Group A Group B - - (the new shareholder group) 90% 10% At acquisition, Plane's shareholders' equity consisted of $150,000 in common shares and $275,000 in retained earnings. The following is information related to Plane's assets and liabilities at acquisition: Accounts receivable Inventory Property, plant, and equipment (net) Current liabilities Carrying value $ 100,000 Fair value $ 90,000 250,000 275,000 400,000 525,000 100,000 100,000 300,000 285,000 Long-term debt What amount of goodwill would be recorded in the consolidated statement of financial position as a result of this acquisition?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Goodwill is the amount that represents the excess of the purchase price over the fair value of the identifiable net assets acquired in a business comb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642e11c6345b_973387.pdf

180 KBs PDF File

6642e11c6345b_973387.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started