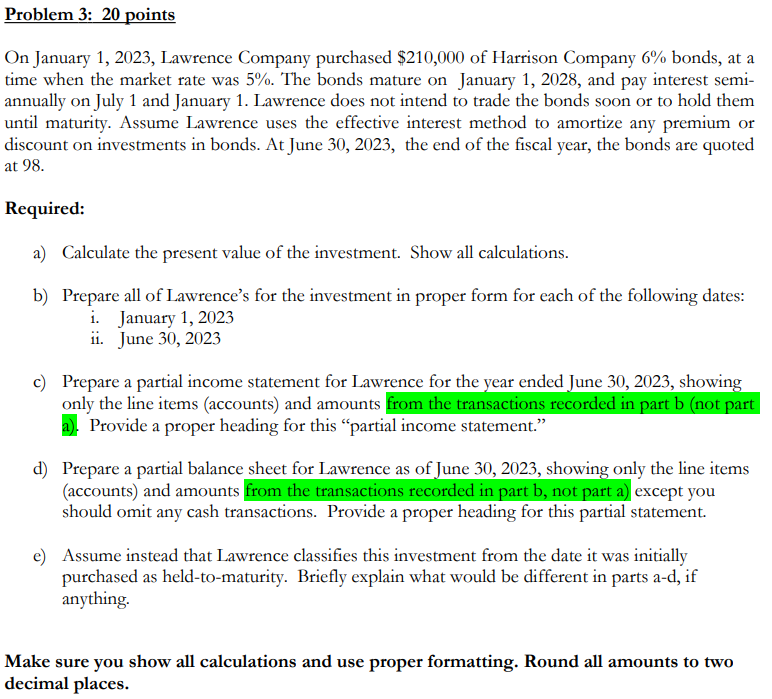

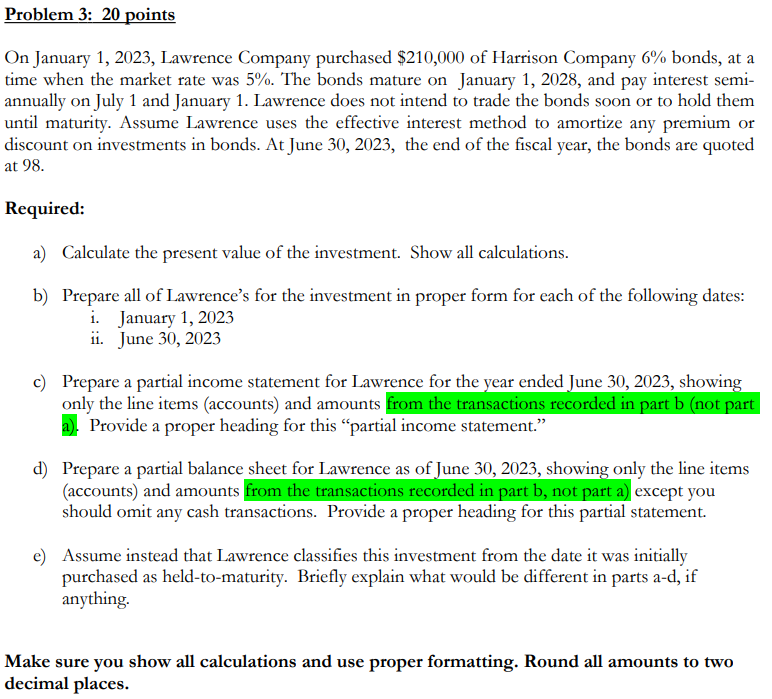

On January 1, 2023, Lawrence Company purchased $210,000 of Harrison Company 6% bonds, at a time when the market rate was 5%. The bonds mature on January 1, 2028, and pay interest semiannually on July 1 and January 1. Lawrence does not intend to trade the bonds soon or to hold them until maturity. Assume Lawrence uses the effective interest method to amortize any premium or discount on investments in bonds. At June 30, 2023, the end of the fiscal year, the bonds are quoted at 98. Required: a) Calculate the present value of the investment. Show all calculations. b) Prepare all of Lawrence's for the investment in proper form for each of the following dates: i. January 1, 2023 ii. June 30,2023 c) Prepare a partial income statement for Lawrence for the year ended June 30, 2023, showing only the line items (accounts) and amounts from the transactions recorded in part b (not part a). Provide a proper heading for this "partial income statement." d) Prepare a partial balance sheet for Lawrence as of June 30, 2023, showing only the line items (accounts) and amounts from the transactions recorded in part b, not part a) except you should omit any cash transactions. Provide a proper heading for this partial statement. e) Assume instead that Lawrence classifies this investment from the date it was initially purchased as held-to-maturity. Briefly explain what would be different in parts a-d, if anything. Make sure you show all calculations and use proper formatting. Round all amounts to two decimal places. On January 1, 2023, Lawrence Company purchased $210,000 of Harrison Company 6% bonds, at a time when the market rate was 5%. The bonds mature on January 1, 2028, and pay interest semiannually on July 1 and January 1. Lawrence does not intend to trade the bonds soon or to hold them until maturity. Assume Lawrence uses the effective interest method to amortize any premium or discount on investments in bonds. At June 30, 2023, the end of the fiscal year, the bonds are quoted at 98. Required: a) Calculate the present value of the investment. Show all calculations. b) Prepare all of Lawrence's for the investment in proper form for each of the following dates: i. January 1, 2023 ii. June 30,2023 c) Prepare a partial income statement for Lawrence for the year ended June 30, 2023, showing only the line items (accounts) and amounts from the transactions recorded in part b (not part a). Provide a proper heading for this "partial income statement." d) Prepare a partial balance sheet for Lawrence as of June 30, 2023, showing only the line items (accounts) and amounts from the transactions recorded in part b, not part a) except you should omit any cash transactions. Provide a proper heading for this partial statement. e) Assume instead that Lawrence classifies this investment from the date it was initially purchased as held-to-maturity. Briefly explain what would be different in parts a-d, if anything. Make sure you show all calculations and use proper formatting. Round all amounts to two decimal places