Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023. Parent Company Inc. acquired 100% of Subsidiary Corp.'s outstanding common stock by exchanging 37.500 shares of Parent's $2 par value common

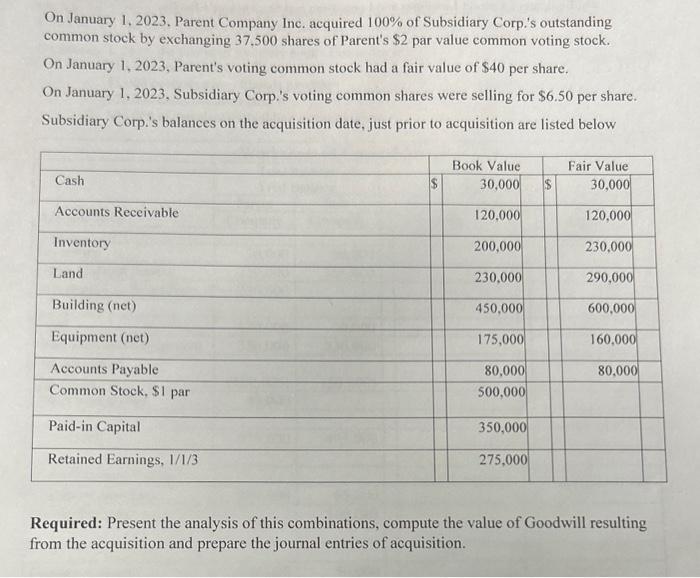

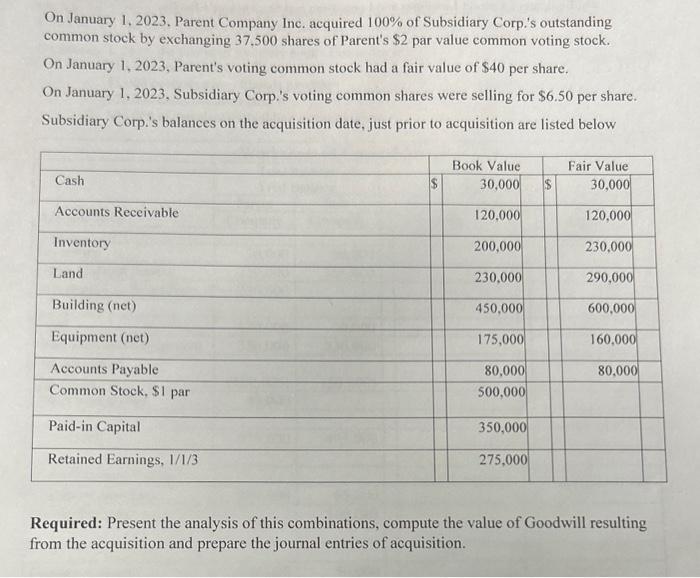

On January 1, 2023. Parent Company Inc. acquired 100\% of Subsidiary Corp.'s outstanding common stock by exchanging 37.500 shares of Parent's $2 par value common voting stock. On January 1, 2023, Parent's voting common stock had a fair value of $40 per share. On January 1, 2023, Subsidiary Corp.'s voting common shares were selling for $6.50 per share. Subsidiary Corp.'s balances on the acquisition date, just prior to acquisition are listed below Required: Present the analysis of this combinations, compute the value of Goodwill resulting from the acquisition and prepare the journal entries of acquisition

On January 1, 2023. Parent Company Inc. acquired 100\% of Subsidiary Corp.'s outstanding common stock by exchanging 37.500 shares of Parent's $2 par value common voting stock. On January 1, 2023, Parent's voting common stock had a fair value of $40 per share. On January 1, 2023, Subsidiary Corp.'s voting common shares were selling for $6.50 per share. Subsidiary Corp.'s balances on the acquisition date, just prior to acquisition are listed below Required: Present the analysis of this combinations, compute the value of Goodwill resulting from the acquisition and prepare the journal entries of acquisition

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analysis of the Acquisition 1 Consideration Transferred Parent Company Inc issued 37500 shares of its 2 par value common voting stock The fair value per share on the date of acquisition is 40 Therefor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started