On January 1, 2023, Psalm and Trisha formed PS Partnership. The articles of co-partnership provides that profit or loss shall be distributed accordingly: 15%

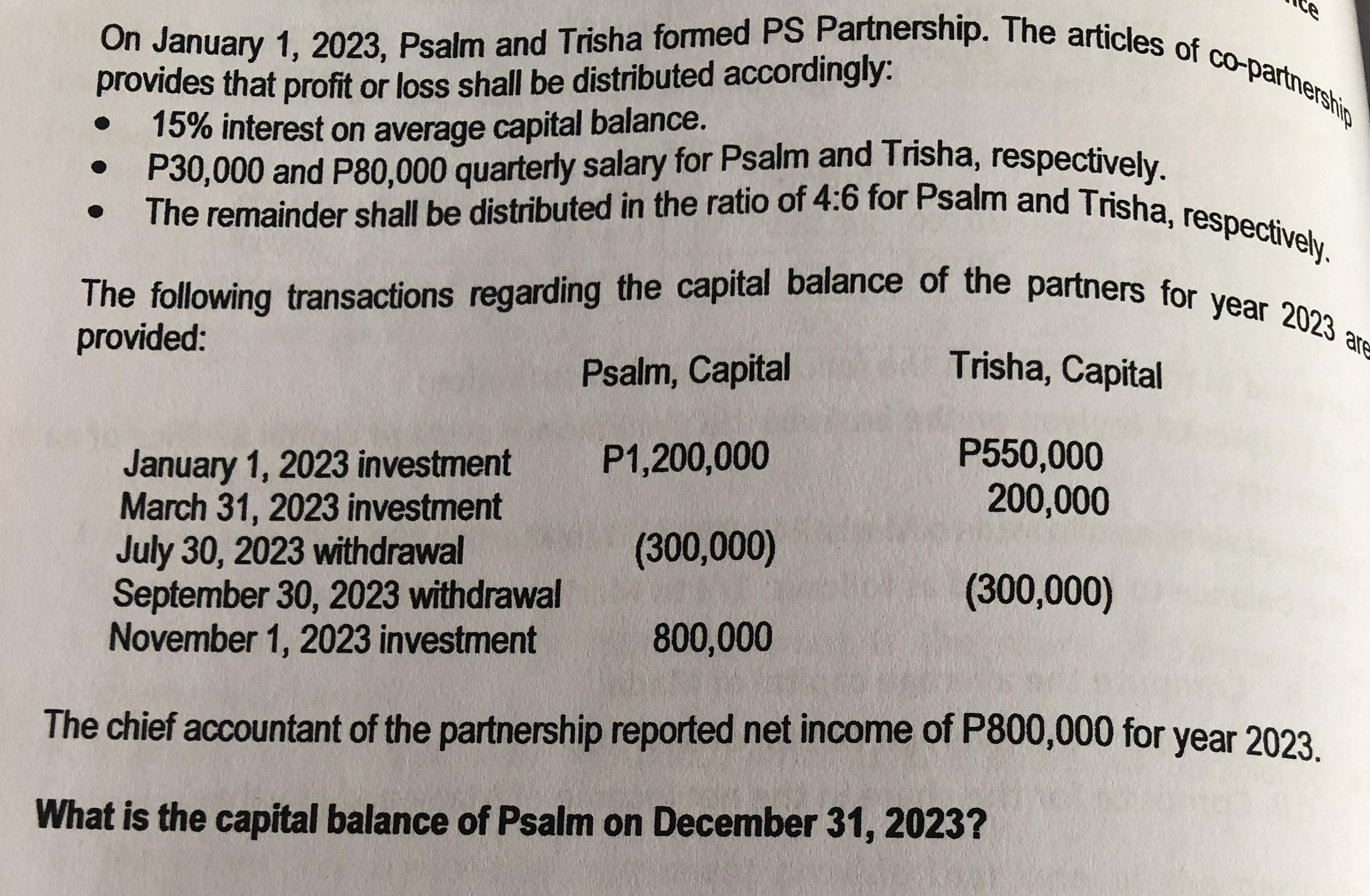

On January 1, 2023, Psalm and Trisha formed PS Partnership. The articles of co-partnership provides that profit or loss shall be distributed accordingly: 15% interest on average capital balance. P30,000 and P80,000 quarterly salary for Psalm and Trisha, respectively. The remainder shall be distributed in the ratio of 4:6 for Psalm and Trisha, respectively. The following transactions regarding the capital balance of the partners for year 2023 are provided: Psalm, Capital Trisha, Capital P550,000 200,000 (300,000) January 1, 2023 investment March 31, 2023 investment July 30, 2023 withdrawal September 30, 2023 withdrawal November 1, 2023 investment The chief accountant of the partnership reported net income of P800,000 for year 2023. What is the capital balance of Psalm on December 31, 2023? P1,200,000 (300,000) 800,000

Step by Step Solution

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Psalms initial investment on January 1 2023 P1200000 Investment on November 1 2023 P800000 Withdrawa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started