Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, Shrek Inc. enters into a seven-year non-cancellable lease with Fiona Ltd. for machinery having an estimated useful life of nine

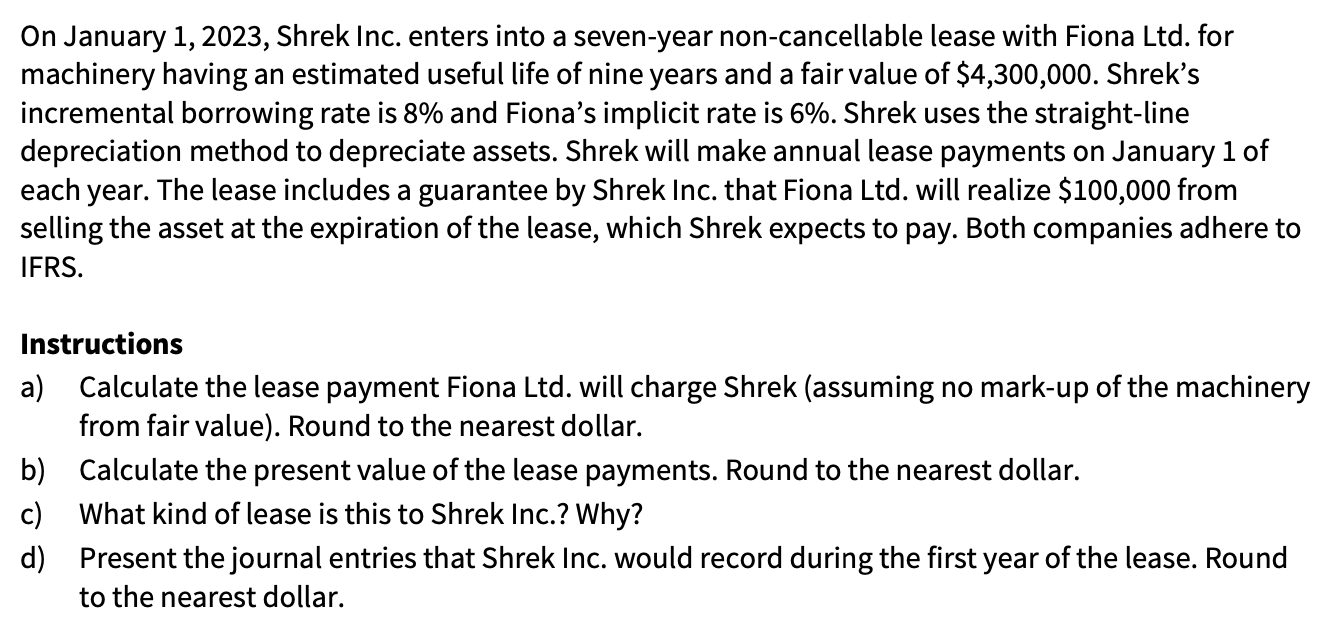

On January 1, 2023, Shrek Inc. enters into a seven-year non-cancellable lease with Fiona Ltd. for machinery having an estimated useful life of nine years and a fair value of $4,300,000. Shrek's incremental borrowing rate is 8% and Fiona's implicit rate is 6%. Shrek uses the straight-line depreciation method to depreciate assets. Shrek will make annual lease payments on January 1 of each year. The lease includes a guarantee by Shrek Inc. that Fiona Ltd. will realize $100,000 from selling the asset at the expiration of the lease, which Shrek expects to pay. Both companies adhere to IFRS. Instructions a) Calculate the lease payment Fiona Ltd. will charge Shrek (assuming no mark-up of the machinery from fair value). Round to the nearest dollar. b) Calculate the present value of the lease payments. Round to the nearest dollar. c) What kind of lease is this to Shrek Inc.? Why? d) Present the journal entries that Shrek Inc. would record during the first year of the lease. Round to the nearest dollar.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Shrek Inc Lease Analysis a Lease Payment Calculation We can calculate the annual lease payment using the Present Value PV of an annuity formula considering Fiona Ltd wants to recover the fair value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started