Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, Spalding Co. issued $600,000 of 10%, 5-year bonds to yield 8%. The bonds pay interest on Juanary 1 and July

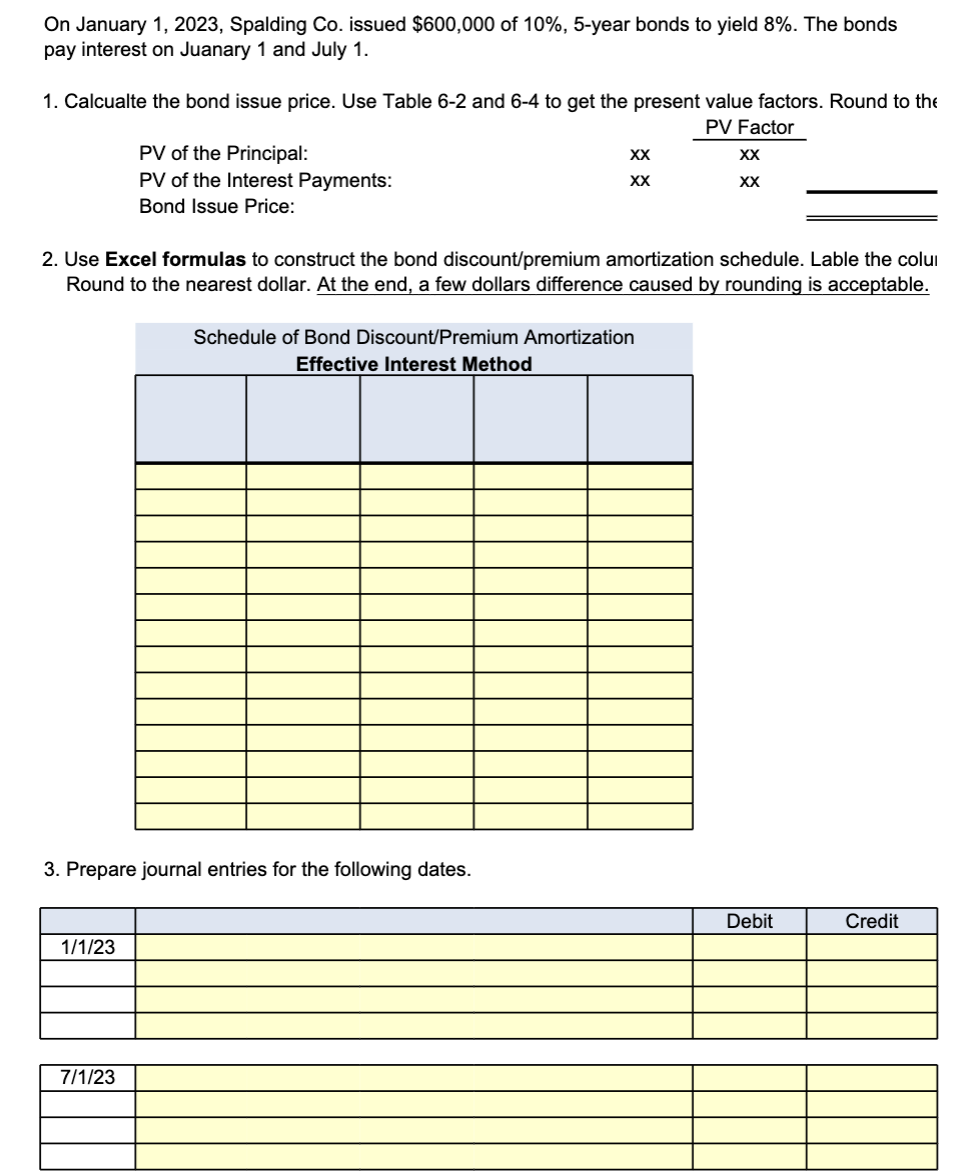

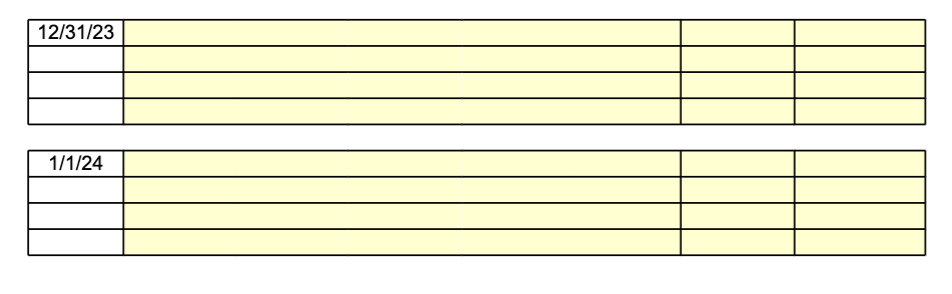

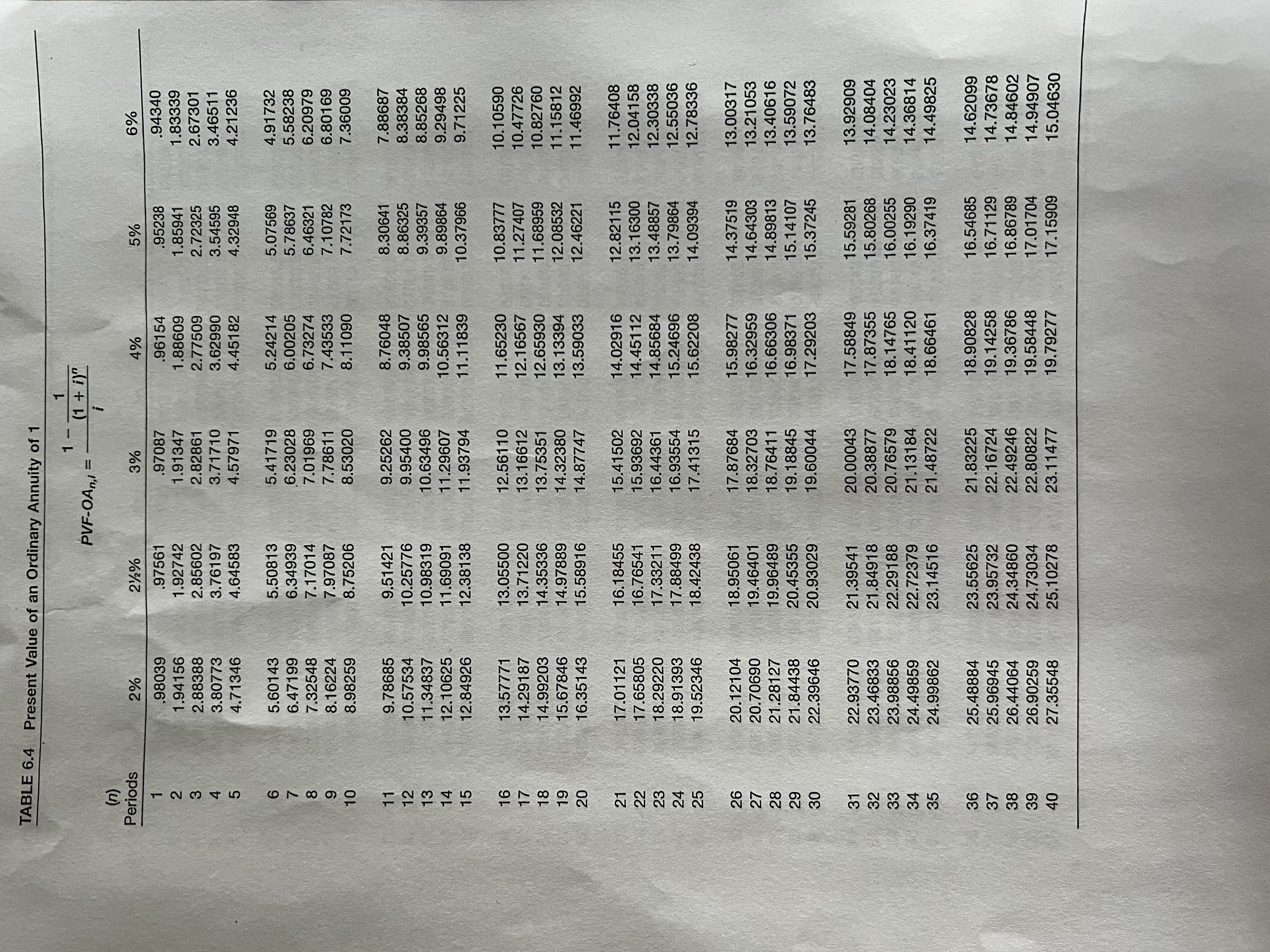

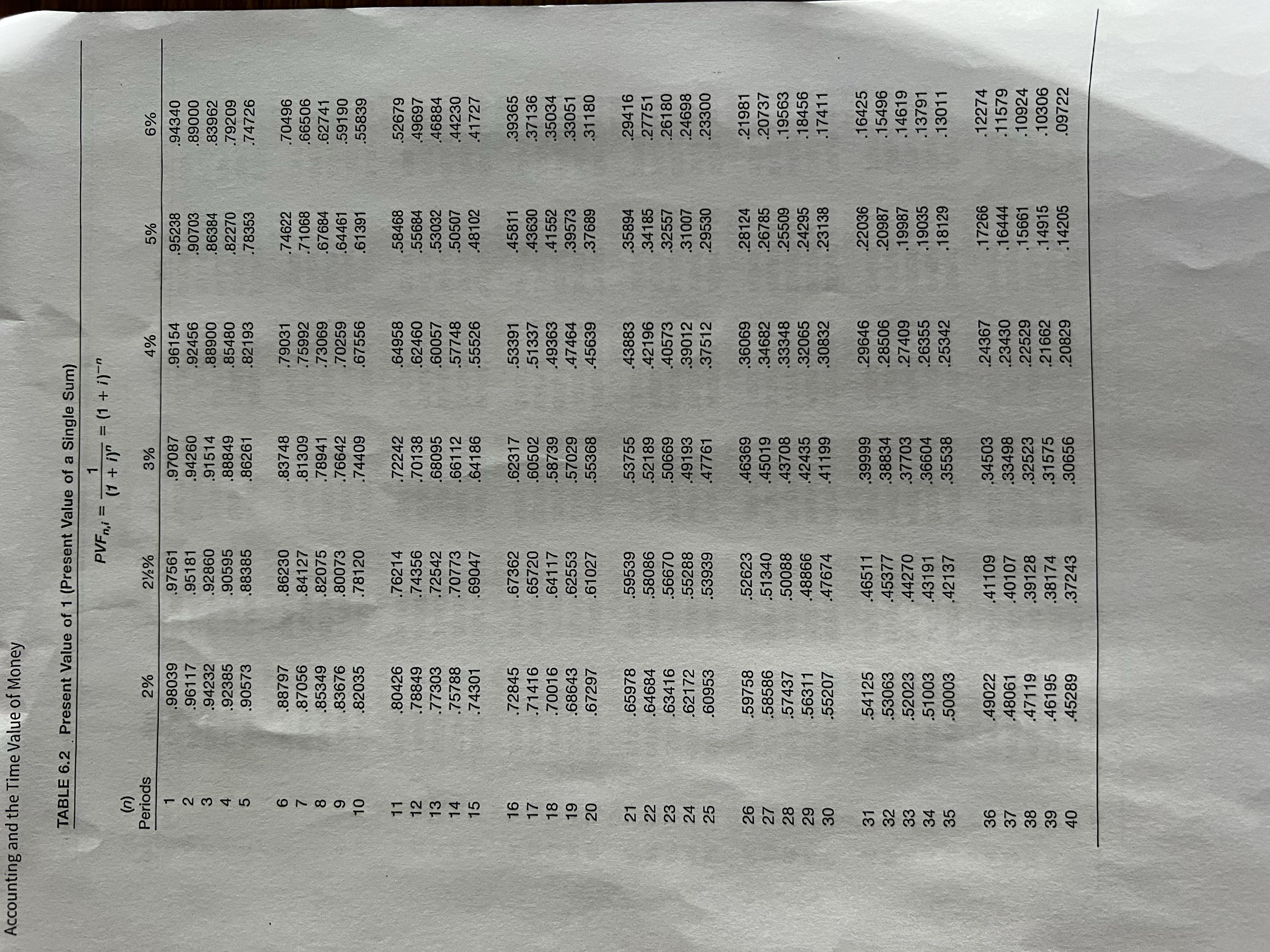

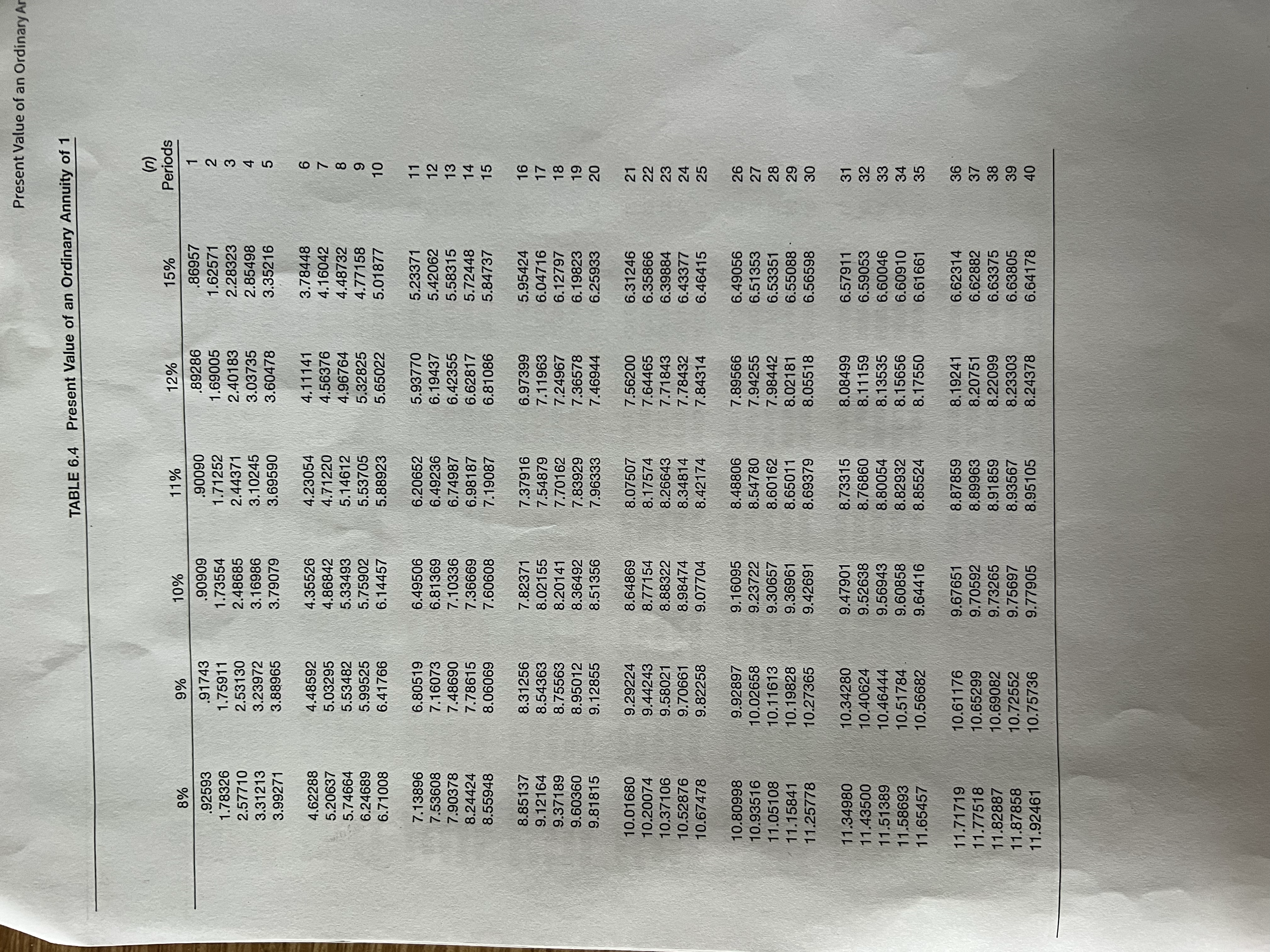

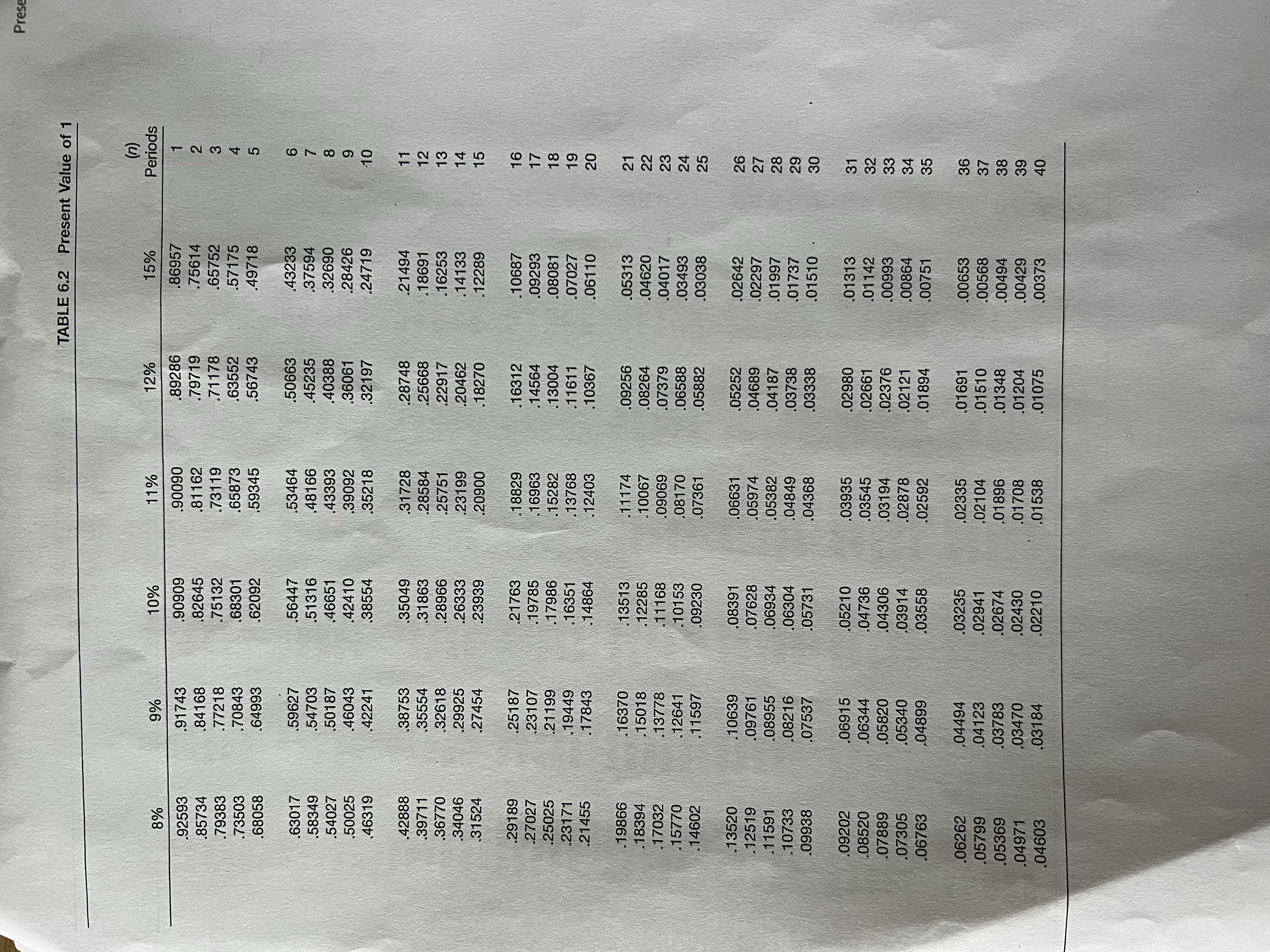

On January 1, 2023, Spalding Co. issued $600,000 of 10%, 5-year bonds to yield 8%. The bonds pay interest on Juanary 1 and July 1. 1. Calcualte the bond issue price. Use Table 6-2 and 6-4 to get the present value factors. Round to the PV of the Principal: PV of the Interest Payments: Bond Issue Price: PV Factor XX XX XX XX 2. Use Excel formulas to construct the bond discount/premium amortization schedule. Lable the colui Round to the nearest dollar. At the end, a few dollars difference caused by rounding is acceptable. Schedule of Bond Discount/Premium Amortization Effective Interest Method 3. Prepare journal entries for the following dates. 1/1/23 7/1/23 Debit Credit 12/31/23 1/1/24 TABLE 6.4 Present Value of an Ordinary Annuity of 1 1 PVF-OAn,i = (1 + i)" i (n) Periods 2% 21% 3% 4% 5% 6% 12345 .98039 .97561 .97087 .96154 .95238 .94340 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 3.80773 3.76197 3.71710 3.62990 3.54595 3.46511 4.71346 4.64583 4.57971 4.45182 4.32948 4.21236 6 5.60143 5.50813 5.41719 5.24214 5.07569 4.91732 7 6.47199 6.34939 6.23028 6.00205 5.78637 5.58238 8 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 9 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 10 8.98259 8.75206 8.53020 8.11090 7.72173 7.36009 21 24 25 26 27 28 29 30 31 34 35 12015 OTO 2222 22223 2333 9.78685 9.51421 9.25262 8.76048 8.30641 7.88687 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 13 11.34837 10.98319 10.63496 9.98565 9.39357 8.85268 14 12.10625 11.69091 11.29607 10.56312 9.89864 9.29498 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 16 13.57771 13.05500 12.56110 11.65230 10.83777 10.10590 17 14.29187 13.71220 13.16612 12.16567 11.27407 10.47726 18 14.99203 14.35336 13.75351 12.65930 11.68959 10.82760 19 15.67846 14.97889 14.32380 13.13394 12.08532 11.15812 20 16.35143 15.58916 14.87747 13.59033 12.46221 11.46992 17.01121 16.18455 15.41502 14.02916 12.82115 11.76408 17.65805 16.76541 15.93692 14.45112 13.16300 12.04158 23 18.29220 17.33211 16.44361 14.85684 13.48857 12.30338 18.91393 17.88499 16.93554 15.24696 13.79864 12.55036 19.52346 18.42438 17.41315 15.62208 14.09394 12.78336 20.12104 18.95061 17.87684 15.98277 14.37519 13.00317 20.70690 19.46401 18.32703 16.32959 14.64303 13.21053 21.28127 19.96489 18.76411 16.66306 14.89813 13.40616 21.84438 20.45355 19.18845 16.98371 15.14107 13.59072 22.39646 20.93029 19.60044 17.29203 15.37245 13.76483 22.93770 21.39541 20.00043 17.58849 15.59281 13.92909 23.46833 21.84918 20.38877 17.87355 15.80268 14.08404 23.98856 22.29188 20.76579 18.14765 16.00255 14.23023 24.49859 22.72379 21.13184 18.41120 16.19290 14.36814 24.99862 23.14516 21.48722 18.66461 16.37419 14.49825 36 25.48884 23.55625 21.83225 18.90828 16.54685 14.62099 37 25.96945 23.95732 22.16724 19.14258 16.71129 14.73678 38 26.44064 24.34860 22.49246 19.36786 16.86789 14.84602 39 26.90259 24.73034 22.80822 19.58448 17.01704 14.94907 40 27.35548 25.10278 23.11477 19.79277 17.15909 15.04630 Accounting and the Time Value of Money TABLE 6.2 Present Value of 1 (Present Value of a Single Sum) 1 PVFn,i = = (1 + i)-n (1 + i)" (n) Periods 2% 21% 3% 4% 5% 6% 1 .98039 .97561 .97087 .96154 .95238 .94340 9 10 2345 67820 .96117 .95181 .94260 .92456 .90703 .89000 .94232 .92860 .91514 .88900 .86384 .83962 .92385 .90595 .88849 .85480 .82270 .79209 .90573 .88385 .86261 .82193 .78353 .74726 .88797 .86230 .83748 .79031 .74622 .70496 .87056 .84127 .81309 .75992 .71068 .66506 .85349 .82075 .78941 .73069 .67684 .62741 .83676 .80073 .76642 .70259 .64461 .59190 .82035 .78120 .74409 .67556 .61391 .55839 11 .80426 .76214 .72242 .64958 .58468 .52679 12 .78849 .74356 .70138 .62460 .55684 .49697 114 13 .77303 .72542 .68095 .60057 .53032 .46884 14 15 45 .75788 .70773 .66112 .57748 .50507 .44230 .74301 .69047 .64186 .55526 .48102 .41727 16 .72845 .67362 .62317 .53391 .45811 .39365 17 .71416 .65720 .60502 .51337 .43630 .37136 18 .70016 .64117 .58739 .49363 .41552 .35034 28 30 33 35 36 37 38 39 40 222 22222 22220 23 334 19 .68643 .62553 .57029 .47464 .39573 .33051 20 .67297 .61027 .55368 .45639 .37689 .31180 .65978 .59539 .53755 .43883 .35894 .29416 .64684 .58086 .52189 .42196 .34185 .27751 23 .63416 .56670 .50669 .40573 .32557 .26180 24 .62172 .55288 .49193 .39012 .31007 .24698 .60953 .53939 .47761 .37512 .29530 .23300 26 .59758 .52623 .46369 .36069 .28124 .21981 27 .58586 .51340 .45019 .34682 .26785 .20737 .57437 .50088 .43708 .33348 .25509 .19563 .56311 .48866 .42435 .32065 .24295 .18456 .55207 .47674 .41199 .30832 .23138 .17411 .54125 .46511 .39999 .29646 .22036 .16425 .53063 .45377 .38834 .28506 .20987 .15496 .52023 .44270 .37703 .27409 .19987 .14619 .51003 .43191 .36604 .26355 .19035 .13791 .50003 .42137 .35538 .25342 .18129 .13011 .49022 .41109 .34503 .24367 .17266 .12274 .48061 .40107 .33498 .23430 .16444 .11579 .47119 .39128 .32523 .22529 .15661 .10924 .46195 .38174 .31575 .21662 .14915 .10306 .45289 .37243 .30656 .20829 .14205 .09722 Present Value of an Ordinary Ar TABLE 6.4 Present Value of an Ordinary Annuity of 1 (n) 8% 9% 10% 11% .92593 .91743 .90909 .90090 1.78326 1.75911 1.73554 1.71252 12% .89286 1.69005 15% Periods .86957 1.62571 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 12345 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 10 66220 8 9 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 11 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 14 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 12375 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 10.01680 9.29224 8.64869 8.07507 7.56200 6.31246 10.20074 9.44243 8.77154 8.17574 7.64465 6.35866 10.37106 9.58021 8.88322 8.26643 7.71843 6.39884 10.52876 9.70661 8.98474 8.34814 7.78432 6.43377 10.67478 9.82258 9.07704 8.42174 7.84314 6.46415 25 10.80998 9.92897 9.16095 8.48806 7.89566 10.93516 10.02658 9.23722 8.54780 7.94255 11.05108 10.11613 9.30657 8.60162 7.98442 11.15841 10.19828 9.36961 8.65011 8.02181 6.49056 6.51353 6.53351 6.55088 26 27 28 11.25778 10.27365 9.42691 8.69379 8.05518 6.56598 30 11.34980 10.34280 9.47901 8.73315 8.08499 6.57911 31 11.43500 10.40624 9.52638 8.76860 8.11159 6.59053 32 11.51389 10.46444 9.56943 8.80054 8.13535 6.60046 11.58693 10.51784 9.60858 8.82932 8.15656 6.60910 11.65457 10.56682 9.64416 8.85524 8.17550 6.61661 11.71719 10.61176 9.67651 8.87859 8.19241 6.62314 36 11.77518 10.65299 9.70592 8.89963 8.20751 6.62882 11.82887 10.69082 9.73265 8.91859 8.22099 6.63375 11.87858 10.72552 9.75697 8.93567 8.23303 6.63805 39 11.92461 10.75736 9.77905 8.95105 8.24378 6.64178 STRO 2222 22220 373 CM334 16 17 18 19 20 23 24 29 TABLE 6.2 Present Value of 1 (n) 8% 9% 10% 11% 12% 15% Periods .92593 .91743 .90909 .90090 .89286 .86957 .85734 .84168 .82645 .81162 .79719 .75614 .79383 .77218 .75132 .73119 .71178 .65752 .73503 .70843 .68301 .65873 .63552 .57175 .68058 .64993 .62092 .59345 .56743 .49718 12345 .63017 .59627 .56447 .53464 .50663 .43233 .58349 .54703 .51316 .48166 .45235 .37594 .54027 .50187 .46651 .43393 .40388 .32690 .50025 .46043 .42410 .39092 .36061 .28426 .46319 .42241 .38554 .35218 .32197 .24719 .42888 .38753 .35049 .31728 .28748 .39711 .35554 .31863 .28584 .25668 .21494 .18691 .36770 .32618 .28966 .25751 .22917 .16253 .34046 .29925 .26333 .23199 20462 .31524 .27454 .23939 .20900 .18270 .14133 .12289 .29189 .25187 .21763 .18829 .16312 .27027 .23107 .19785 .16963 .14564 .10687 .09293 .25025 21199 .17986 .15282 .13004 .08081 .23171 .19449 .16351 .13768 .11611 .07027 .21455 .17843 .14864 .12403 .10367 .06110 .19866 .16370 .13513 .11174 .09256 .05313 21 .18394 .15018 .12285 .10067 .08264 .04620 .17032 .13778 .11168 .09069 .07379 .04017 23 .15770 .12641 .10153 .08170 .06588 .03493 24 .14602 .11597 .09230 .07361 .05882 .03038 25 .13520 .10639 .08391 .06631 .05252 .02642 26 .12519 .09761 .07628 .05974 .04689 .02297 27 .11591 .08955 .06934 .05382 .04187 .01997 28 .10733 .08216 .06304 .04849 .03738 .01737 29 .09938 .07537 .05731 .04368 .03338 .01510 30 .09202 .06915 .05210 .03935 .02980 .01313 31 .08520 .06344 .04736 .03545 .02661 .01142 32 .07889 .05820 .04306 .03194 .02376 .00993 .07305 .05340 .03914 .02878 .02121 .00864 34 .06763 .04899 .03558 .02592 .01894 .00751 35 .06262 .04494 .03235 .02335 .01691 .00653 36 .05799 .04123 .02941 .02104 .01510 .00568 37 .05369 .03783 .02674 .01896 .01348 .00494 38 .04971 .03470 .02430 .01708 .01204 .00429 39 .04603 .03184 .02210 .01538 .01075 .00373 40 PORO NEID OFRON 22222 222 333 3334 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Prese

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started