Question

On January 1, 2023, the Davis Company sold $100,000 face value 12% 10-year bonds with interest payable on December 31 of each year. The

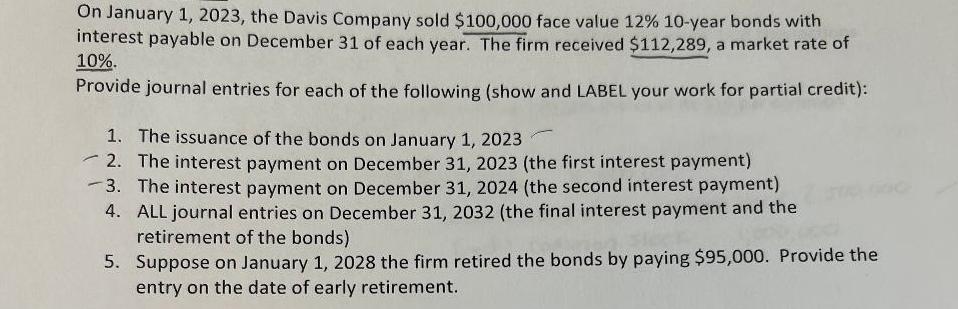

On January 1, 2023, the Davis Company sold $100,000 face value 12% 10-year bonds with interest payable on December 31 of each year. The firm received $112,289, a market rate of 10%. Provide journal entries for each of the following (show and LABEL your work for partial credit): 1. The issuance of the bonds on January 1, 2023 2. The interest payment on December 31, 2023 (the first interest payment) 3. The interest payment on December 31, 2024 (the second interest payment) 4. ALL journal entries on December 31, 2032 (the final interest payment and the retirement of the bonds) 5. Suppose on January 1, 2028 the firm retired the bonds by paying $95,000. Provide the entry on the date of early retirement.

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Issuance of the bonds on January 1 2023 Cash 112289 Bonds Payabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting an introduction to concepts, methods and uses

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis

13th Edition

978-0538776080, 324651147, 538776080, 9780324651140, 978-0324789003

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App