Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2023, WMT Corporation issued a series of 100 convertible bonds, maturing in 5 years. The face amount of each bond was

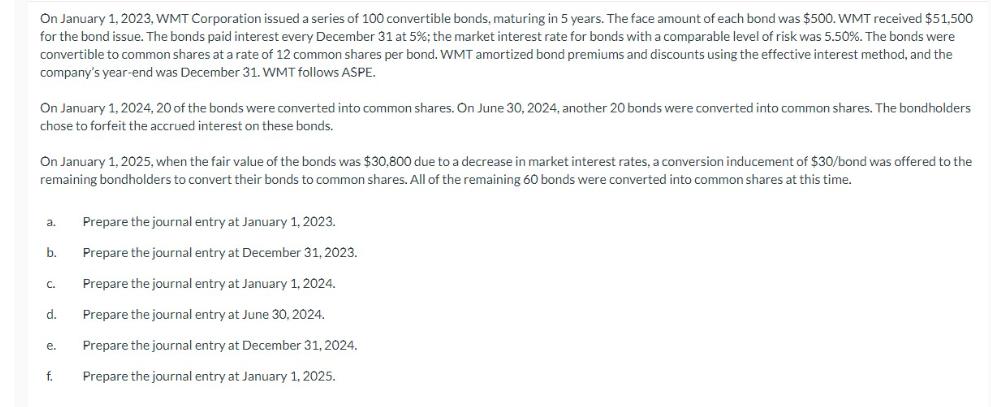

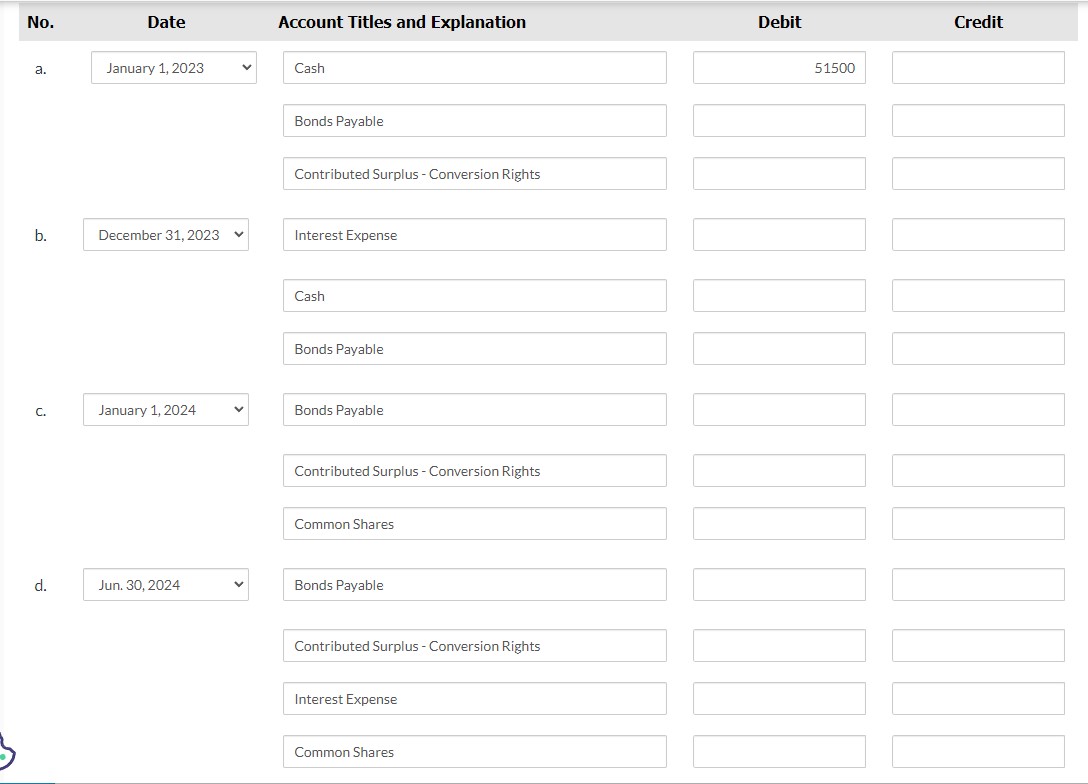

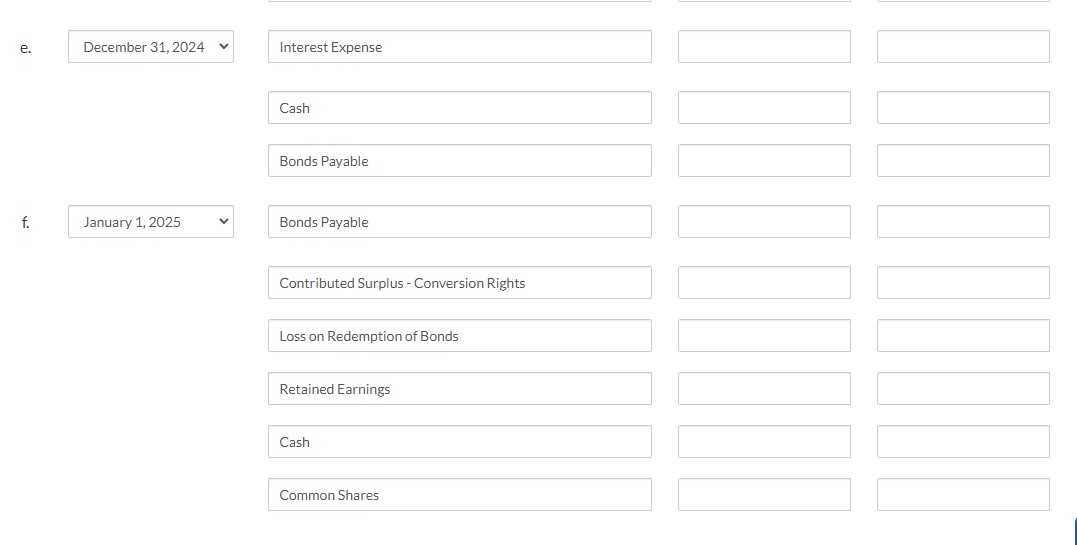

On January 1, 2023, WMT Corporation issued a series of 100 convertible bonds, maturing in 5 years. The face amount of each bond was $500. WMT received $51,500 for the bond issue. The bonds paid interest every December 31 at 5%; the market interest rate for bonds with a comparable level of risk was 5.50%. The bonds were convertible to common shares at a rate of 12 common shares per bond. WMT amortized bond premiums and discounts using the effective interest method, and the company's year-end was December 31. WMT follows ASPE. On January 1, 2024, 20 of the bonds were converted into common shares. On June 30, 2024, another 20 bonds were converted into common shares. The bondholders chose to forfeit the accrued interest on these bonds. On January 1, 2025, when the fair value of the bonds was $30,800 due to a decrease in market interest rates, a conversion inducement of $30/bond was offered to the remaining bondholders to convert their bonds to common shares. All of the remaining 60 bonds were converted into common shares at this time. a. Prepare the journal entry at January 1, 2023. b. Prepare the journal entry at December 31, 2023. C. Prepare the journal entry at January 1, 2024. d. Prepare the journal entry at June 30, 2024. e. Prepare the journal entry at December 31, 2024. f. Prepare the journal entry at January 1, 2025. Account Titles and Explanation Debit No. Date a. January 1, 2023 Cash Bonds Payable Contributed Surplus - Conversion Rights b. December 31, 2023 Interest Expense Cash Bonds Payable C. January 1, 2024 Bonds Payable Contributed Surplus - Conversion Rights Common Shares d. Jun. 30, 2024 Bonds Payable Contributed Surplus - Conversion Rights Interest Expense Common Shares 51500 Credit e. December 31, 2024 Interest Expense f. January 1, 2025 Cash Bonds Payable Bonds Payable Contributed Surplus - Conversion Rights Loss on Redemption of Bonds Retained Earnings Cash Common Shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started