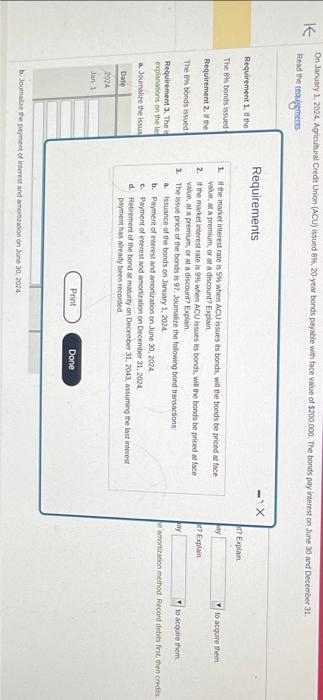

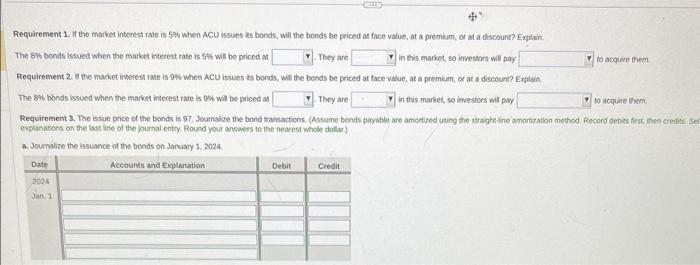

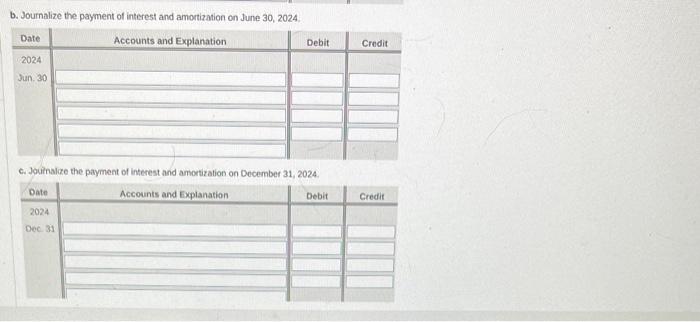

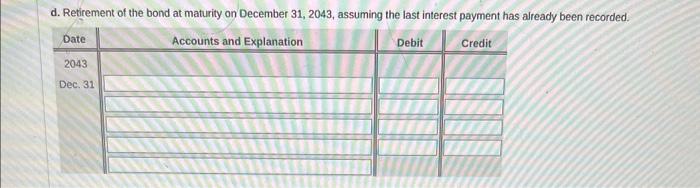

On January 1, 2024. Agricultual Credt Union (ACU) issued 87, 20-year bonds psyable with face value of $200,000. The bonds pay interest on June 30 and December 31 . Fiead the tecuirgments: Requirements Requirement 1. It the The 8 th bonds issued 1. If the market intereut rato is 5% when ACU issues its bonds; wal the bonds be priced at tace. value, at a premium, or at a discount? Explain. 2. If the maket inerest rate is 94 when ACU bssues its bonds, wil the bonds be priced an tsce vilue, at a premium, or at a discount? Explain. 3. The issue price of the bonds is 97 . Jouralize the following bend transactions: a. issuance of the bonds an Jaruary 1, 2024. b. Payment of interest and amorization on June 30,2024. c. Payment of keerest and amotiration on December 31,2024 . d. Retiement of the bond at matuity on December 31, 2043, assuming the last interest payment has already beco recorsed B. Joumaker the prymert of inerest and amortzavion on sune 30,20024 Requirement 1. If the market interest rate is 5%6 When ACU issues as bonds, will the bonds be peiced at face value, at a premium, or at a discount? Explain. The 876 bonds issued whinen the market interest rate is 5% will be pricod at They are in this markec, so imvestars will pay to acquive thinn Requirement 2 . If the market inherest rane is 9% when ACU issues is bonds, will the bonds be priced at tace value, at a premkim, or at a discount? Explan. The 896 bonds issued when the market intecest rate is 9% wit be priced at They are in this market, so investoes will pay to acquire them. Requirement 3. The issue price of the bends is 97 Joumaise the bond transactions. (Assume bonds payable are amcetized using the straght ine amortiation method. Fecond dehits firs, then eredit. explanations on the last ine of the fournal entry. Round your answers to the nearest whole dollar) b. Journalize the payment of interest and amortization on June 30, 2024. c. Jouinalize the payment of interest and amortization on December 31, 2024. d. Retirement of the bond at maturity on December 31, 2043, assuming the last interest payment has already been recorded