Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, Corvallis Carnivals borrows $30,000 to purchase a delivery truck by agreeing to a 5%, five-year loan with the bank. Payments

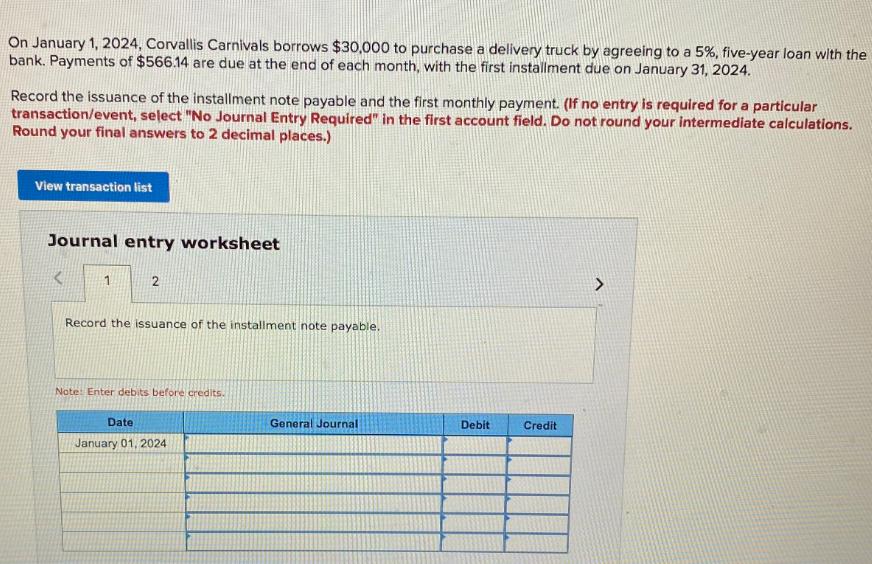

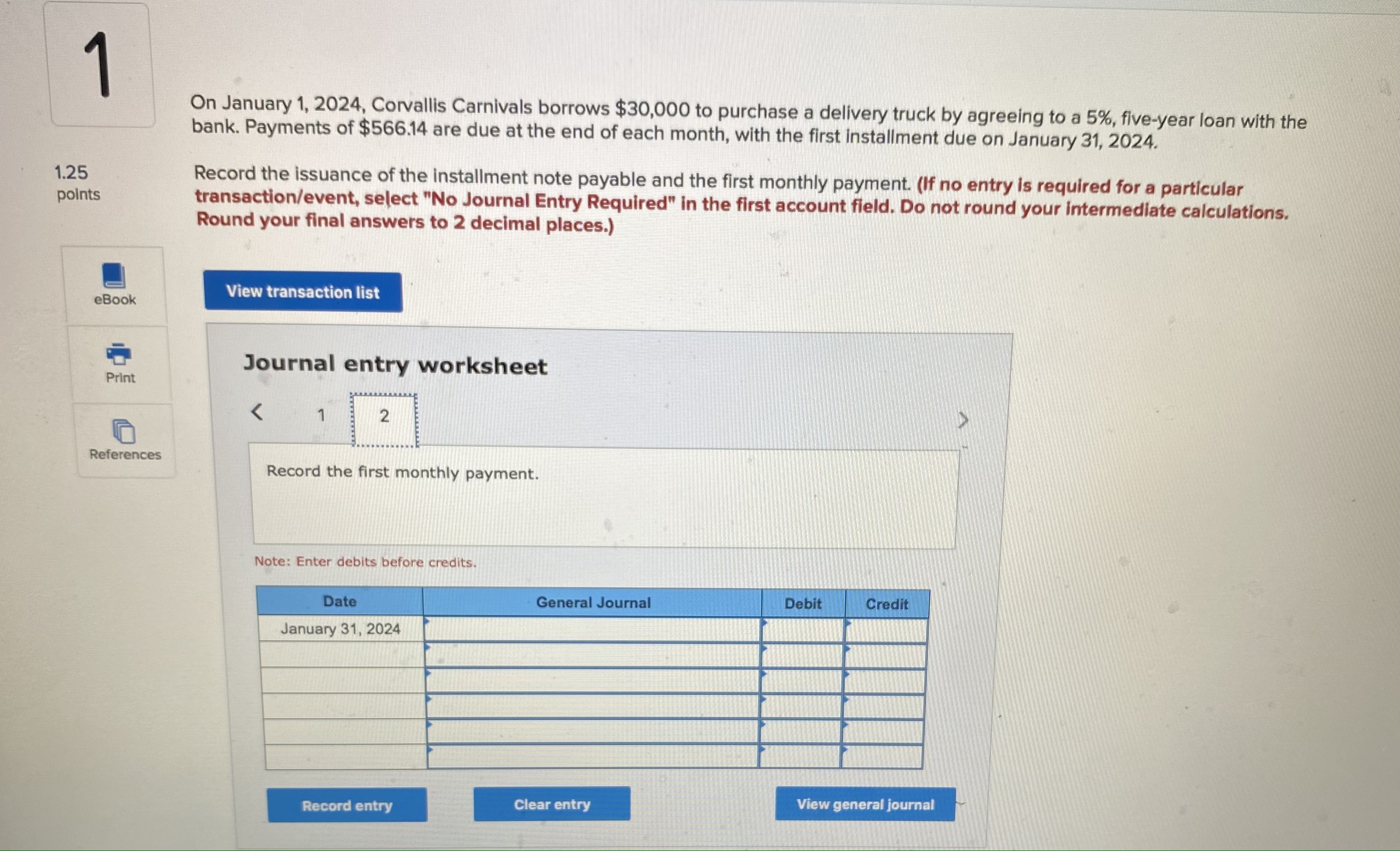

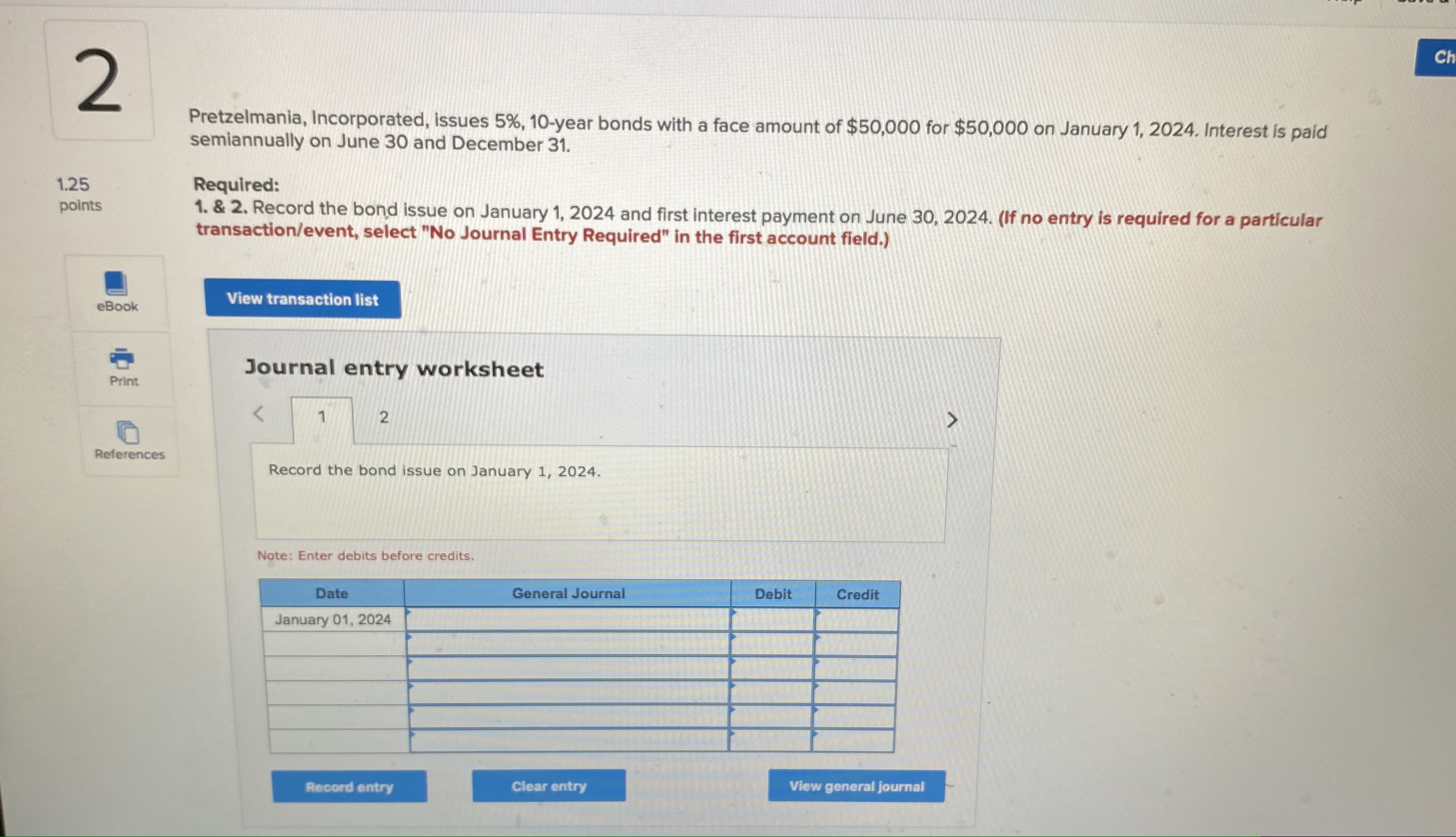

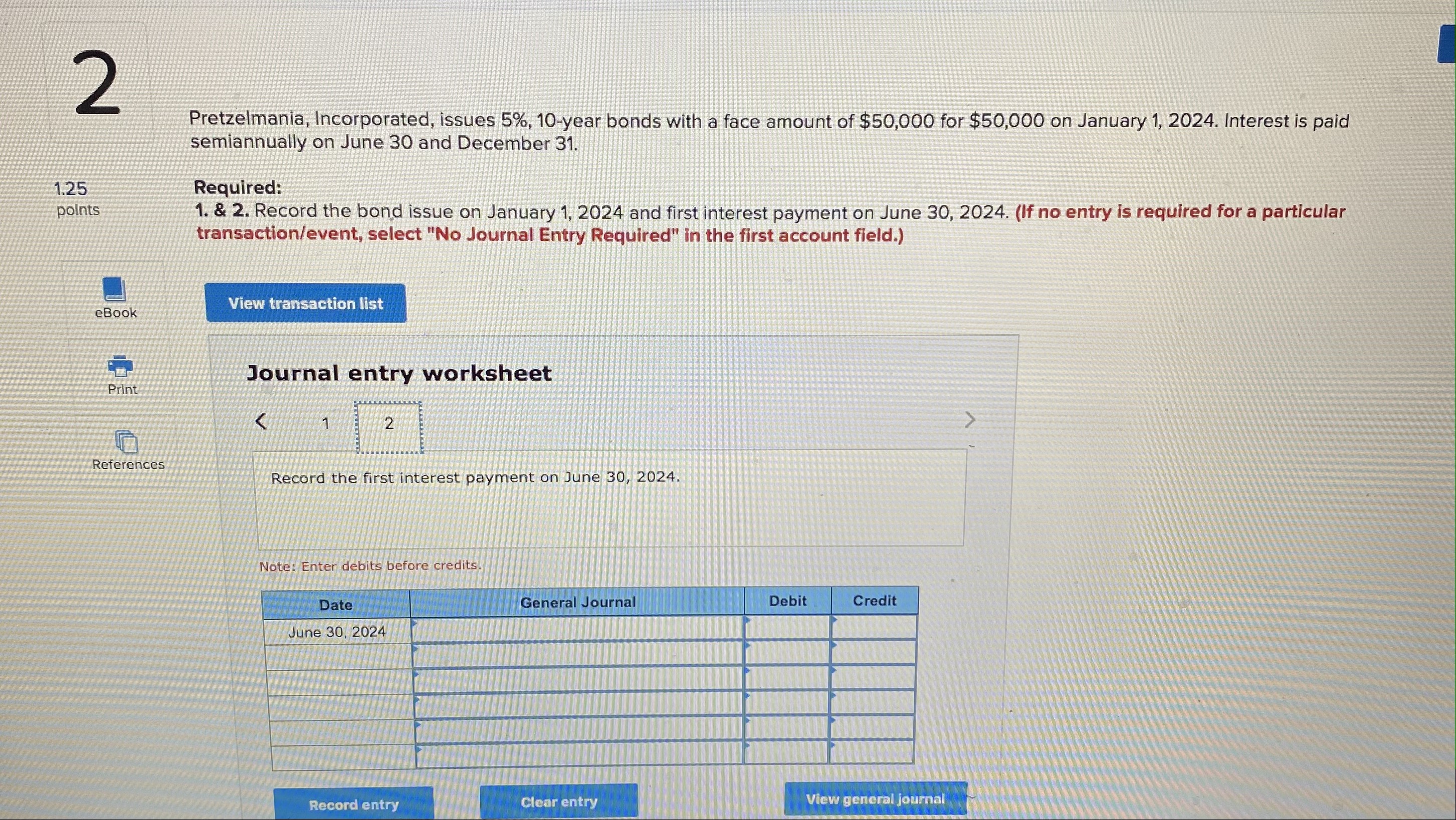

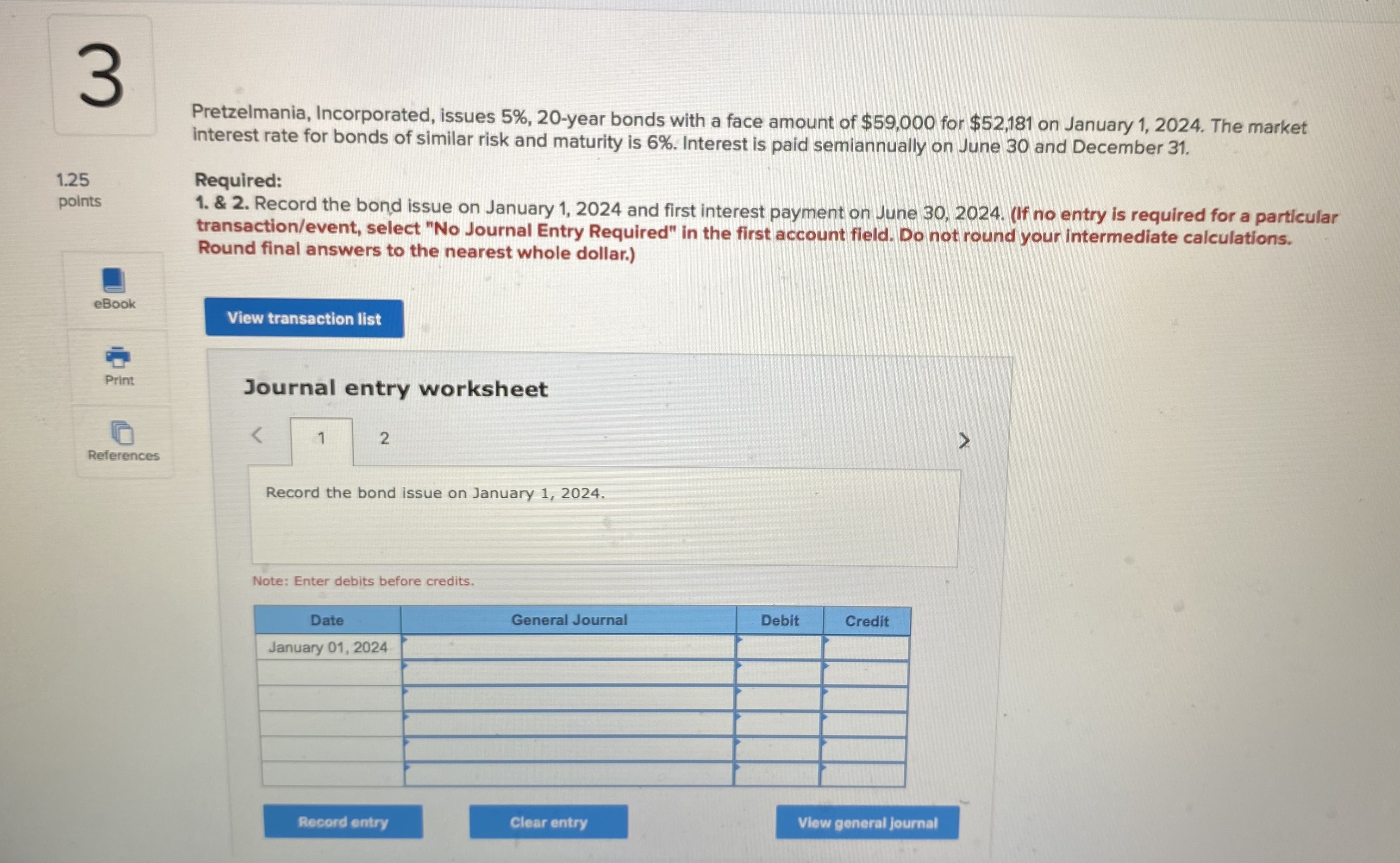

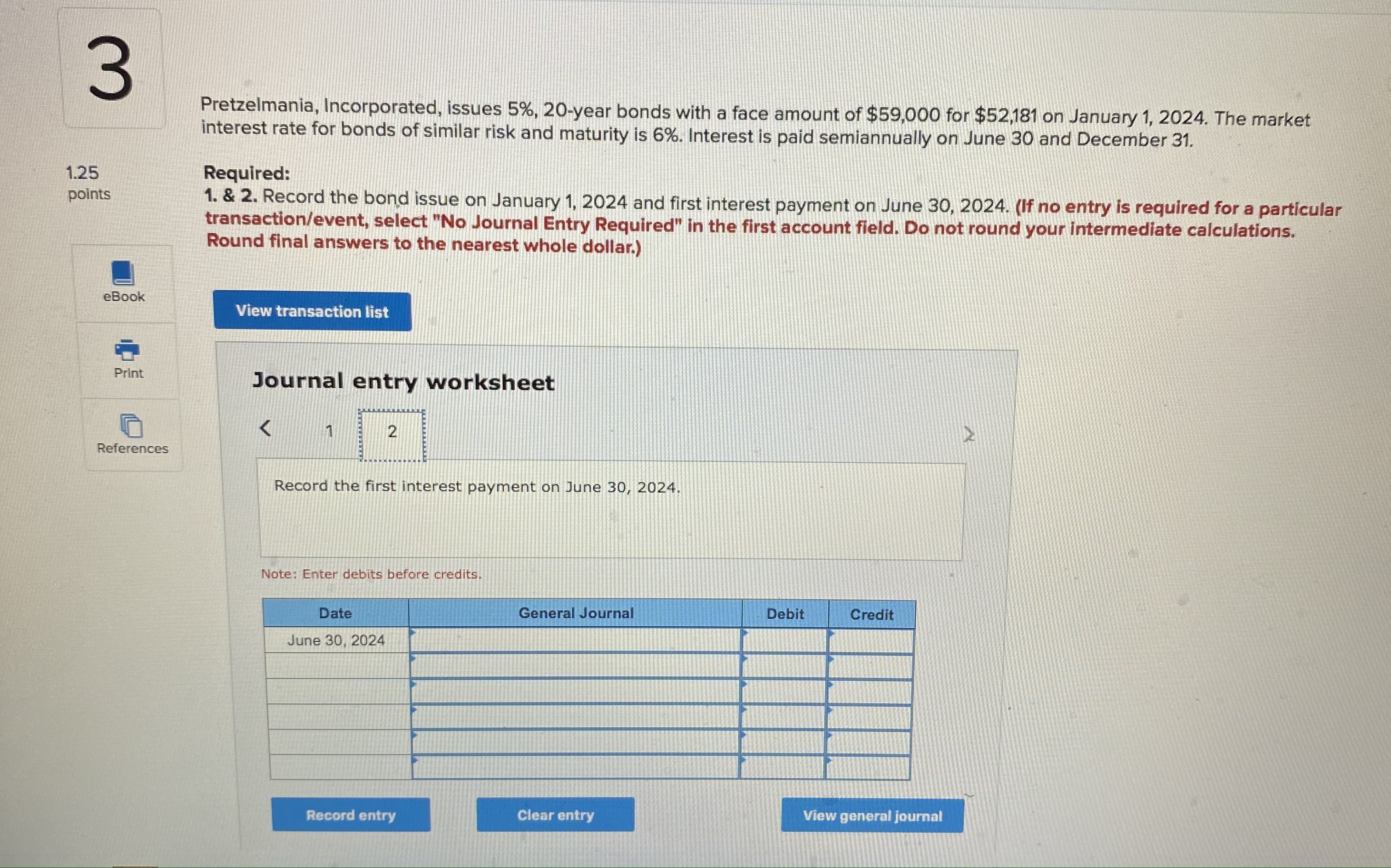

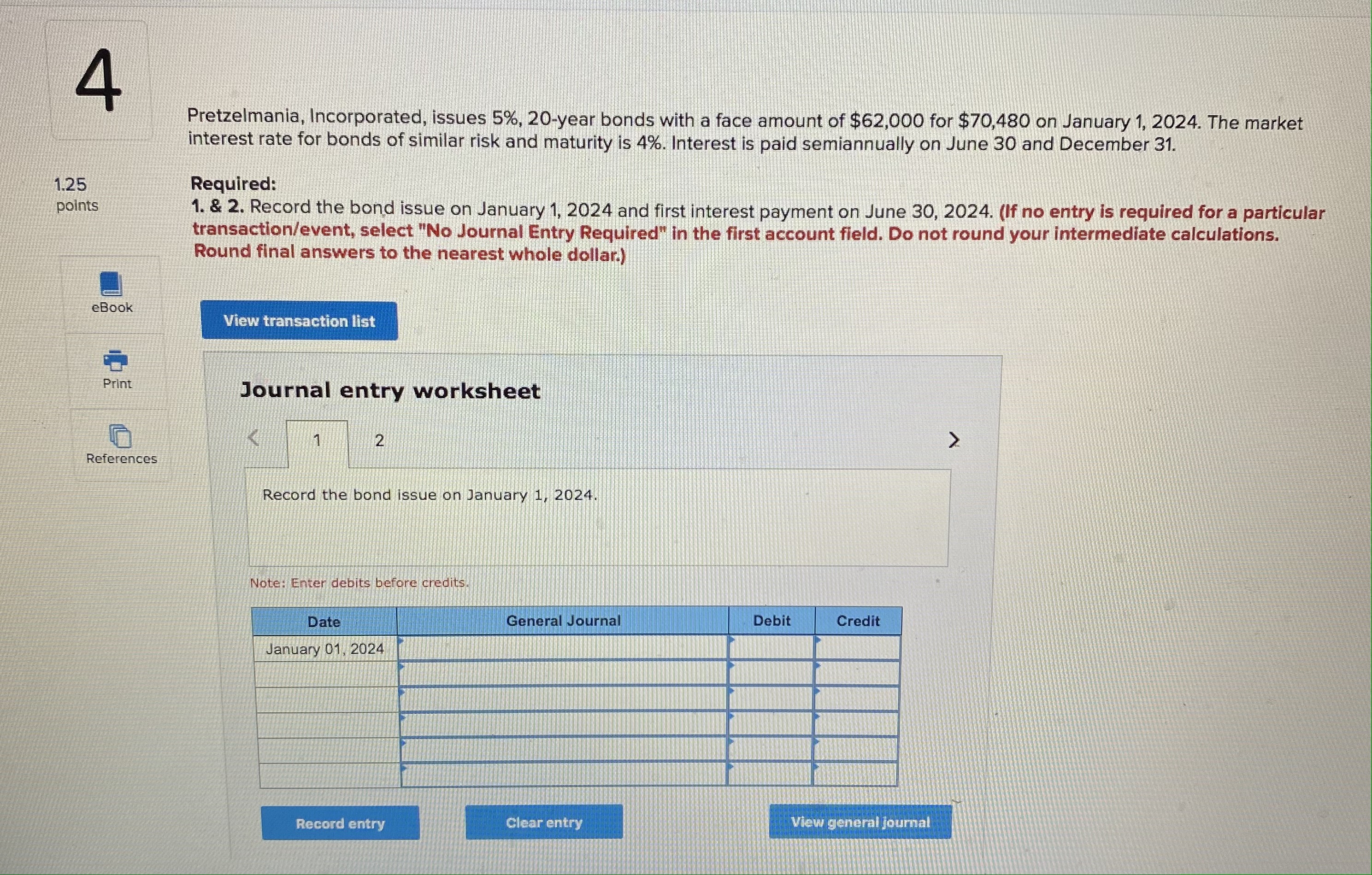

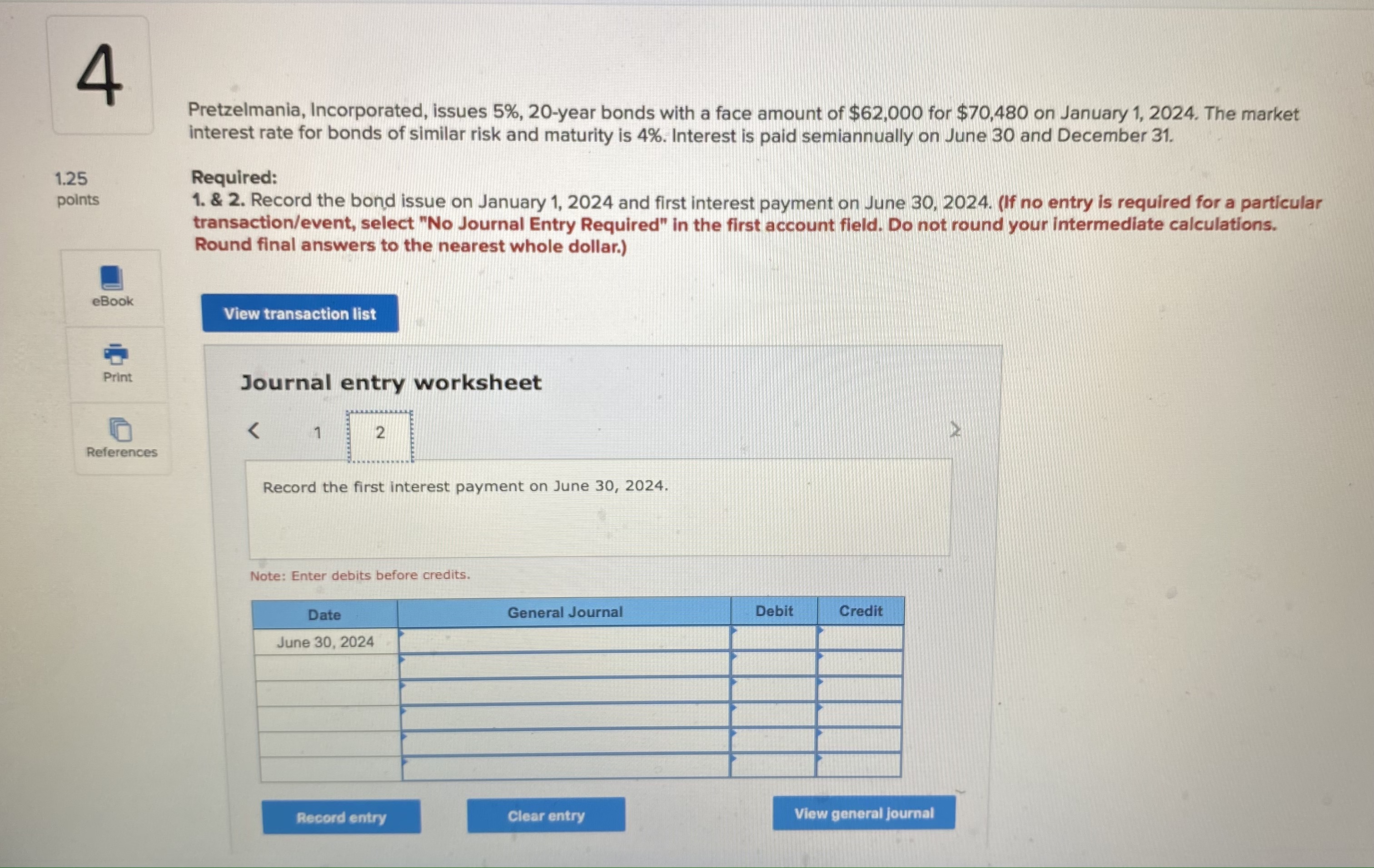

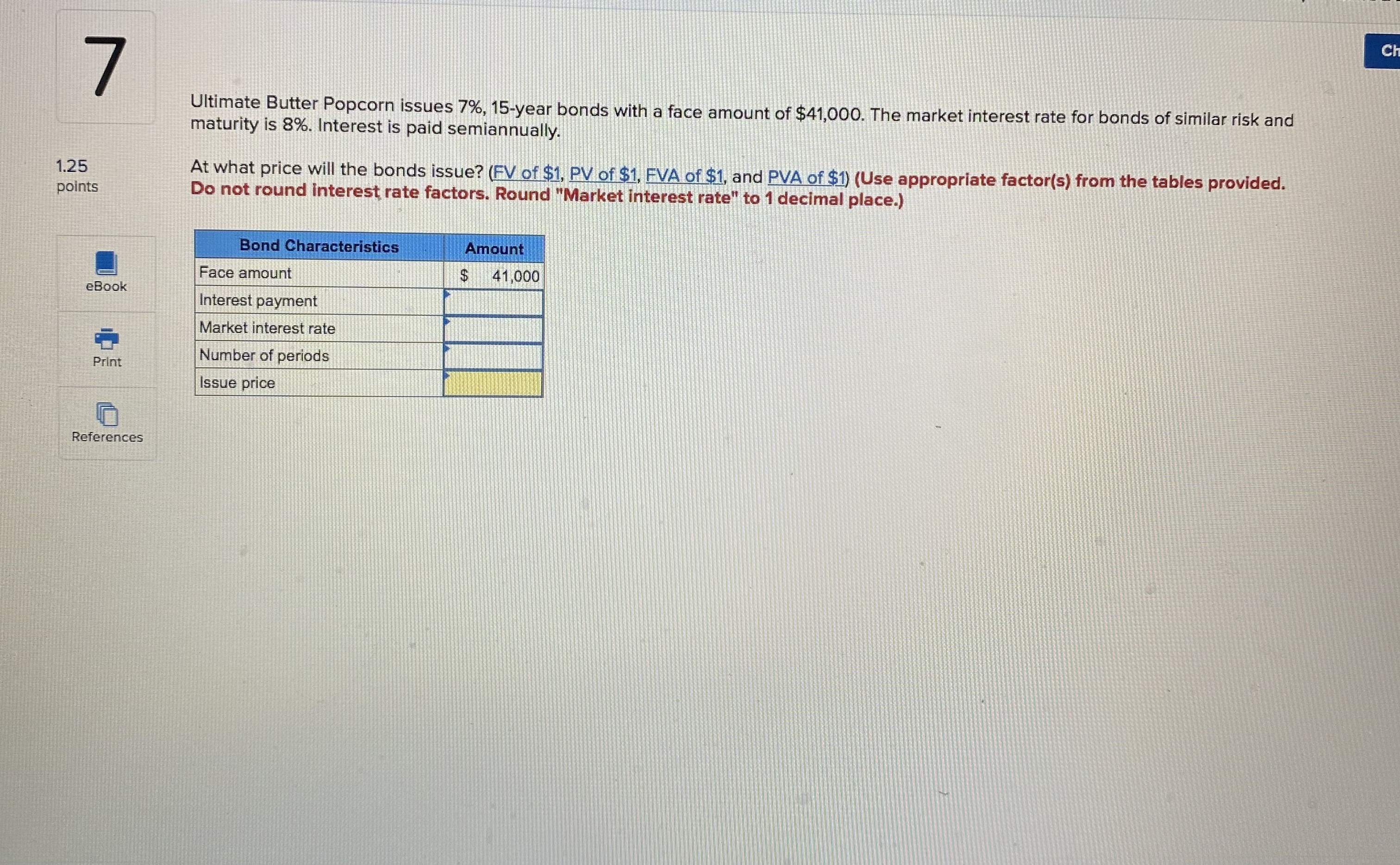

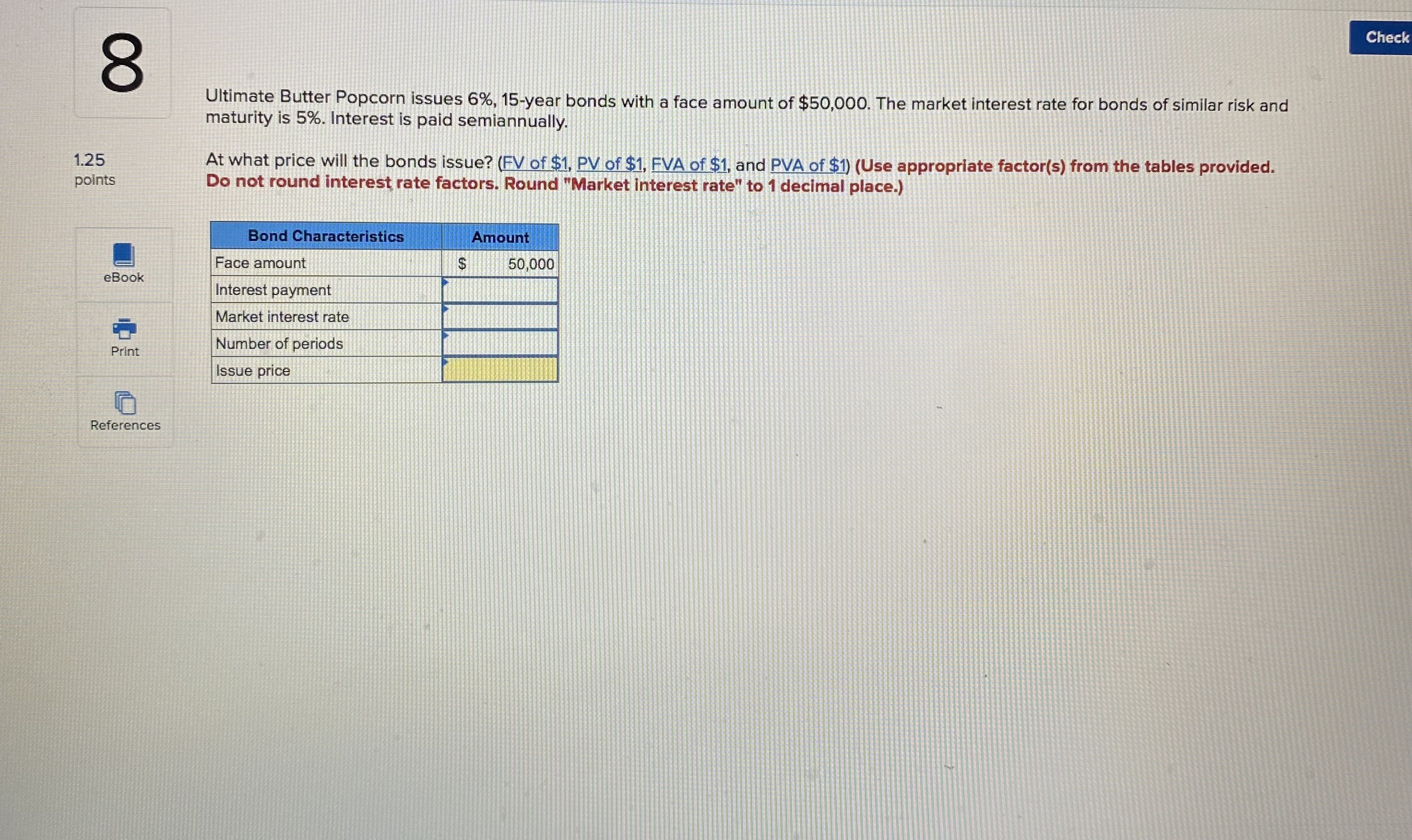

On January 1, 2024, Corvallis Carnivals borrows $30,000 to purchase a delivery truck by agreeing to a 5%, five-year loan with the bank. Payments of $566.14 are due at the end of each month, with the first installment due on January 31, 2024. Record the issuance of the installment note payable and the first monthly payment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet < 1 2 Record the issuance of the installment note payable. Note: Enter debits before credits. Date January 01, 2024 General Journal Debit Credit 1 1.25 points On January 1, 2024, Corvallis Carnivals borrows $30,000 to purchase a delivery truck by agreeing to a 5%, five-year loan with the bank. Payments of $566.14 are due at the end of each month, with the first installment due on January 31, 2024. Record the issuance of the installment note payable and the first monthly payment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Round your final answers to 2 decimal places.) eBook Print References View transaction list Journal entry worksheet < 1 2 Record the first monthly payment. Note: Enter debits before credits. Date January 31, 2024 General Journal Debit Credit Record entry Clear entry View general journal 2 1.25 points Pretzelmania, Incorporated, issues 5%, 10-year bonds with a face amount of $50,000 for $50,000 on January 1, 2024. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue on January 1, 2024 and first interest payment on June 30, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list eBook Journal entry worksheet Print < 1 2 References Record the bond issue on January 1, 2024. Note: Enter debits before credits. Date January 01, 2024 General Journal Debit Credit A Record entry Clear entry View general journal Ch 2 1.25 points Pretzelmania, Incorporated, issues 5%, 10-year bonds with a face amount of $50,000 for $50,000 on January 1, 2024. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue on January 1, 2024 and first interest payment on June 30, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) eBook Print References View transaction list Journal entry worksheet < 1 2 Record the first interest payment on June 30, 2024. Note: Enter debits before credits. Date June 30, 2024 General Journal Debit Credit Record entry Clear entry View general journal 3 1.25 points Pretzelmania, Incorporated, issues 5%, 20-year bonds with a face amount of $59,000 for $52,181 on January 1, 2024. The market interest rate for bonds of similar risk and maturity is 6%. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue on January 1, 2024 and first interest payment on June 30, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Round final answers to the nearest whole dollar.) eBook View transaction list Print References Journal entry worksheet < 1 2 Record the bond issue on January 1, 2024. Note: Enter debits before credits. Date January 01, 2024 General Journal Debit Credit Record entry Clear entry View general journal > 3 1.25 points Pretzelmania, Incorporated, issues 5%, 20-year bonds with a face amount of $59,000 for $52,181 on January 1, 2024. The market interest rate for bonds of similar risk and maturity is 6%. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue on January 1, 2024 and first interest payment on June 30, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Round final answers to the nearest whole dollar.) eBook View transaction list Print References Journal entry worksheet < 2 Record the first interest payment on June 30, 2024. Note: Enter debits before credits. Date June 30, 2024 General Journal Debit Credit Record entry Clear entry View general journal 4 1.25 points Pretzelmania, Incorporated, issues 5%, 20-year bonds with a face amount of $62,000 for $70,480 on January 1, 2024. The market interest rate for bonds of similar risk and maturity is 4%. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue on January 1, 2024 and first interest payment on June 30, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Round final answers to the nearest whole dollar.) eBook Print View transaction list Journal entry worksheet 1 2 References Record the bond issue on January 1, 2024. Note: Enter debits before credits. Date January 01, 2024 General Journal Debit Credit Record entry Clear entry View general journal > 4 1.25 points Pretzelmania, Incorporated, issues 5%, 20-year bonds with a face amount of $62,000 for $70,480 on January 1, 2024. The market interest rate for bonds of similar risk and maturity is 4%. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue on January 1, 2024 and first interest payment on June 30, 2024. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Round final answers to the nearest whole dollar.) eBook View transaction list Print References Journal entry worksheet < 1 2 Record the first interest payment on June 30, 2024. Note: Enter debits before credits. Date June 30, 2024 General Journal Debit Credit A Record entry Clear entry View general journal 5 1.25 points On January 1, 2024, Paradise Tours borrows $39,000 by agreeing to a 6%, four-year note with the bank. Loan payments of $915.92 are due at the end of each month with the first installment due on January 31, 2024. Required: Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) eBook Hint Print References View transaction list Journal entry worksheet < 1 2 3 Record the issuance of a note payable. Note: Enter debits before credits. Date January 01, 2024 General Journal Debit Credit Record entry Clear entry View general journal > 5 1.25 points eBook Hint Print On January 1, 2024, Paradise Tours borrows $39,000 by agreeing to a 6%, four-year note with the bank. Loan payments of $915.92 are due at the end of each month with the first installment due on January 31, 2024. Required: Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 References Record the first monthly payment. Note: Enter debits before credits. Date January 31, 2024 General Journal Debit Credit View general journal Record entry Clear entry > 5 1.25 points On January 1, 2024, Paradise Tours borrows $39,000 by agreeing to a 6%, four-year note with the bank. Loan payments of $915.92 are due at the end of each month with the first installment due on January 31, 2024. Required: Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) eBook View transaction list Hint Print References Journal entry worksheet < 1 2 3 Record the second monthly payment. Note: Enter debits before credits. Date February 29, 2024 General Journal Debit Credit Record entry Clear entry View general journal 6 1.25 points Ultimate Butter Popcorn issues 7%, 10-year bonds with a face amount of $44,000. The market interest rate for bonds of similar risk and maturity is 7%. Interest is paid semiannually. At what price will the bonds issue? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Do not round interest rate factors. Round "Market interest rate" to 1 decimal place.) Bond Characteristics Face amount eBook Interest payment Market interest rate Number of periods Print References Issue price Amount $ 44,000 C 1.25 7 points Ultimate Butter Popcorn issues 7%, 15-year bonds with a face amount of $41,000. The market interest rate for bonds of similar risk and maturity is 8%. Interest is paid semiannually. At what price will the bonds issue? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Do not round interest rate factors. Round "Market interest rate" to 1 decimal place.) Bond Characteristics Face amount eBook Interest payment Market interest rate Number of periods Print References Issue price Amount $ 41,000 Ch 8 1.25 points Ultimate Butter Popcorn issues 6%, 15-year bonds with a face amount of $50,000. The market interest rate for bonds of similar risk and maturity is 5%. Interest is paid semiannually. At what price will the bonds issue? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Do not round interest rate factors. Round "Market interest rate" to 1 decimal place.) Bond Characteristics Face amount eBook Interest payment Market interest rate Number of periods Print References Issue price Amount $ 50,000 Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Heres the journal entries Date Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started