On January 1, 2024, Hobart Manufacturing Company purchased a drill press at a cost of $36,000. The drill press is expected to last 10

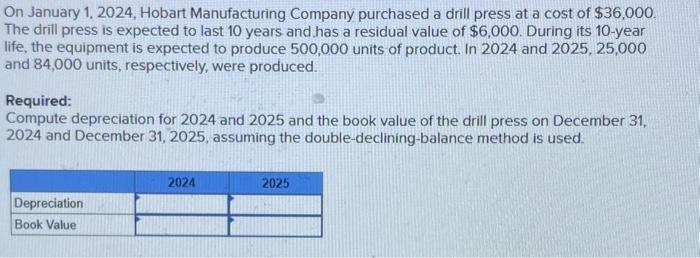

On January 1, 2024, Hobart Manufacturing Company purchased a drill press at a cost of $36,000. The drill press is expected to last 10 years and has a residual value of $6,000. During its 10-year life, the equipment is expected to produce 500,000 units of product. In 2024 and 2025, 25,000 and 84,000 units, respectively, were produced. Required: Compute depreciation for 2024 and 2025 and the book value of the drill press on December 31, 2024 and December 31, 2025, assuming the double-declining-balance method is used. Depreciation Book Value 2024 2025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understanding the Problem Were tasked with calculating depreciation and book value for a drill press using the doubledeclining balance method Given In... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards