Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The capital accounts of Percy and Grover at the end of the year 2022 are as follows: Beg Bal. Investments Jan 1 P210,000 Jan

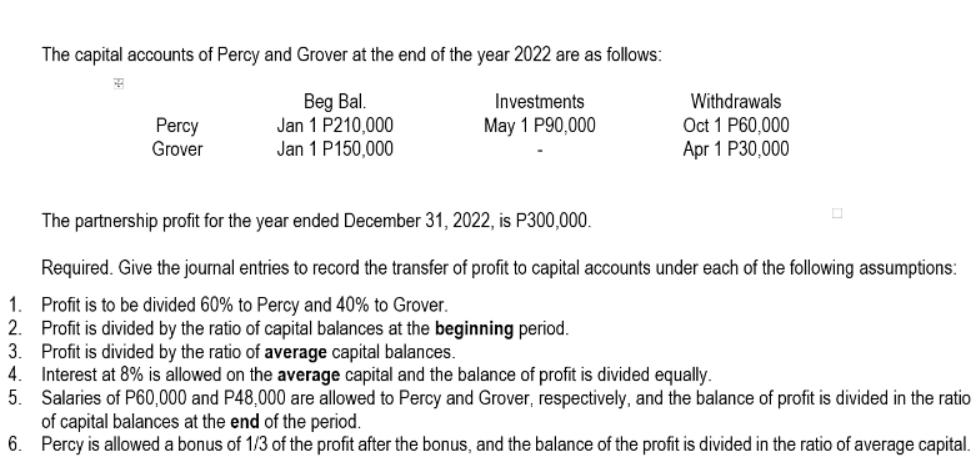

The capital accounts of Percy and Grover at the end of the year 2022 are as follows: Beg Bal. Investments Jan 1 P210,000 Jan 1 P150,000 May 1 P90,000 Percy Grover Withdrawals Oct 1 P60,000 Apr 1 P30,000 The partnership profit for the year ended December 31, 2022, is P300,000. Required. Give the journal entries to record the transfer of profit to capital accounts under each of the following assumptions: 1. Profit is to be divided 60% to Percy and 40% to Grover. 2. Profit is divided by the ratio of capital balances at the beginning period. 3. Profit is divided by the ratio of average capital balances. 4. 5. Interest at 8% is allowed on the average capital and the balance of profit is divided equally. Salaries of P60,000 and P48,000 are allowed to Percy and Grover, respectively, and the balance of profit is divided in the ratio of capital balances at the end of the period. 6. Percy is allowed a bonus of 1/3 of the profit after the bonus, and the balance of the profit is divided in the ratio of average capital.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started