Answered step by step

Verified Expert Solution

Question

1 Approved Answer

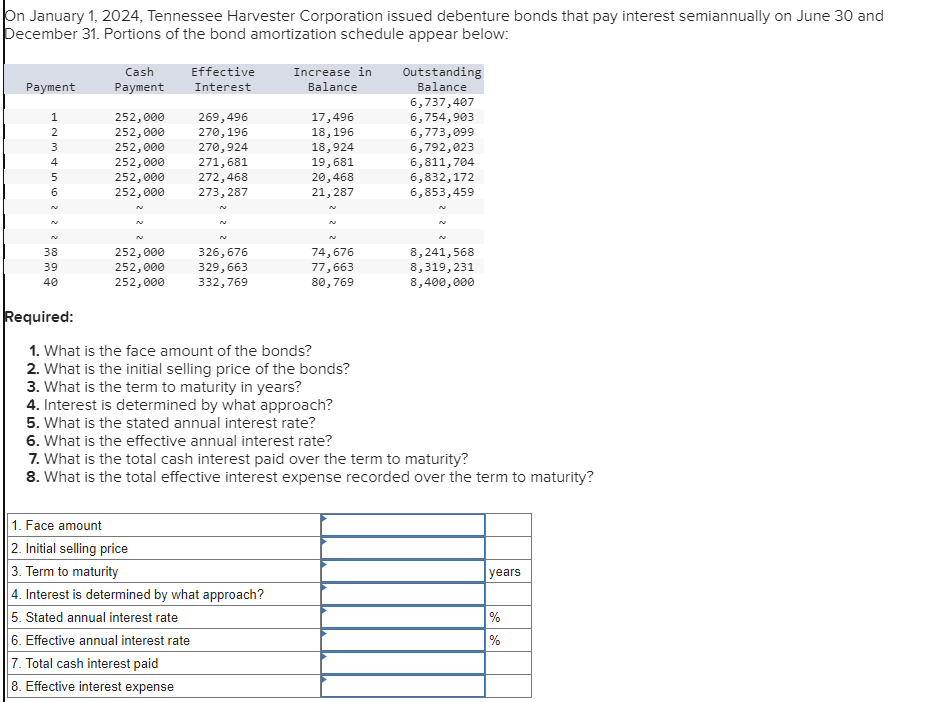

On January 1, 2024, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond

On January 1, 2024, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Payment Cash Effective Payment Interest Increase in Outstanding Balance Balance 6,737,407 12345622 2 00 0 252,000 269,496 17,496 6,754,903 252,000 270,196 18,196 6,773,099 252,000 270,924 18,924 6,792,023 252,000 271,681 19,681 6,811,704 252,000 252,000 272,468 20,468 6,832,172 273,287 21,287 6,853,459 N N N N N ~ mm 4 38 252,000 326,676 74,676 8,241,568 39 252,000 329,663 77,663 8,319,231 40 252,000 332,769 80,769 8,400,000 Required: 1. What is the face amount of the bonds? 2. What is the initial selling price of the bonds? 3. What is the term to maturity in years? 4. Interest is determined by what approach? 5. What is the stated annual interest rate? 6. What is the effective annual interest rate? 7. What is the total cash interest paid over the term to maturity? 8. What is the total effective interest expense recorded over the term to maturity? 1. Face amount 2. Initial selling price 3. Term to maturity 4. Interest is determined by what approach? 5. Stated annual interest rate 6. Effective annual interest rate 7. Total cash interest paid 8. Effective interest expense years % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Face Amount of the Bonds The face amount of the bonds is the outstanding balance on the last line of the bond amortization schedule Face Amount 8400...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started