Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, the Excel Delivery Company purchased a delivery van for $33,300. At the end of its five-year service life, it is

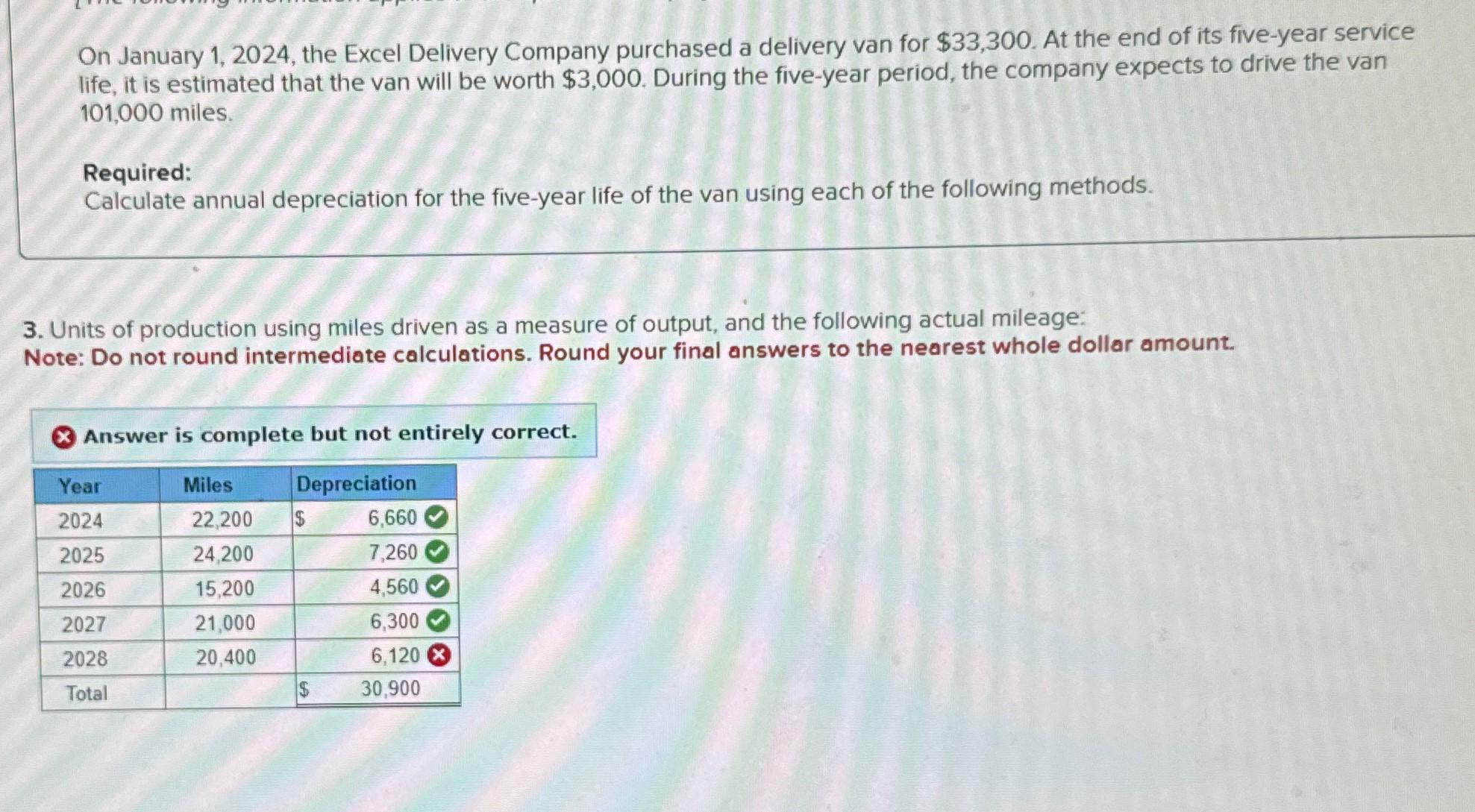

On January 1, 2024, the Excel Delivery Company purchased a delivery van for $33,300. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 101,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. 3. Units of production using miles driven as a measure of output, and the following actual mileage: Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Year Miles Depreciation 2024 22,200 $ 6,660 2025 24,200 7,260 2026 15,200 4,560 2027 21,000 6,300 2028 20,400 6,120 Total 30,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 To calculate the financial advantage or disadvantage of accepting the special order from the large retail chain we need to compare the costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664210362f8d3_986626.pdf

180 KBs PDF File

664210362f8d3_986626.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started