Answered step by step

Verified Expert Solution

Question

1 Approved Answer

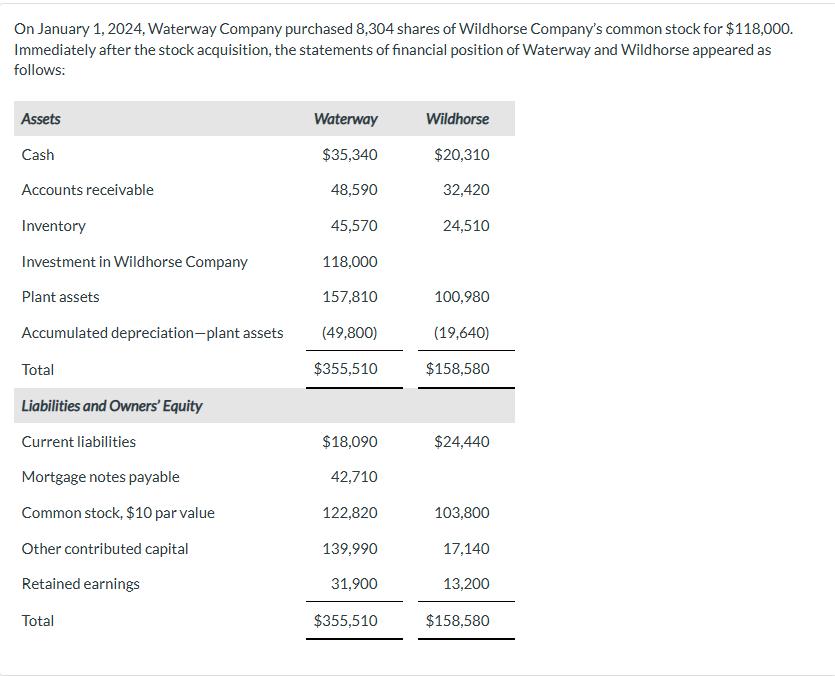

On January 1, 2024, Waterway Company purchased 8,304 shares of Wildhorse Company's common stock for $118,000. Immediately after the stock acquisition, the statements of

On January 1, 2024, Waterway Company purchased 8,304 shares of Wildhorse Company's common stock for $118,000. Immediately after the stock acquisition, the statements of financial position of Waterway and Wildhorse appeared as follows: Assets Cash Accounts receivable Inventory Investment in Wildhorse Company Plant assets Accumulated depreciation-plant assets Total Liabilities and Owners' Equity Current liabilities Mortgage notes payable Common stock, $10 par value Other contributed capital Retained earnings Total Waterway $35,340 48,590 45,570 118,000 157,810 (49,800) $355,510 $18,090 42,710 122,820 139,990 31,900 $355,510 Wildhorse $20,310 32,420 24,510 100,980 (19,640) $158,580 $24,440 103,800 17,140 13,200 $158,580 Cash Accounts Receivable Inventory Investment in Wildhorse Difference between Implied and Book Value Plant Assets Accumulated Depreciation Total Current Liabilities Mortgage Note Payable Common Stock: Waterway Company Wildhorse Company Other Contributed Capital Waterway Company Wildhorse Company Retained Earnings: Waterway Company Wildhorse Company Noncontrolling Interest Total Waterway Wildhorse Company Company 35,340 48,590 45,570 118,000 157,810 (49,800) 355,510 18,090 42,710 122,820 139,990 31,900 355,510 20,310 32,420 24,510 100,980 (19,640) 158,580 24,440 103,800 17,140 13,200 158,580 S $ Debit Eliminations 0000000 $ Credit S Noncontrolling Interest 1000 00 00 Consolidated Balance

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION It seems that the information provided is a snapshot of the statements of financial position also known as balance sheets for Waterway Company and Wildhorse Company after Waterway Company pur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started