Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, Wildhorse Ltd. issued bonds with a maturity value of $8.60 million when the market rate of interest was 4%. The bonds

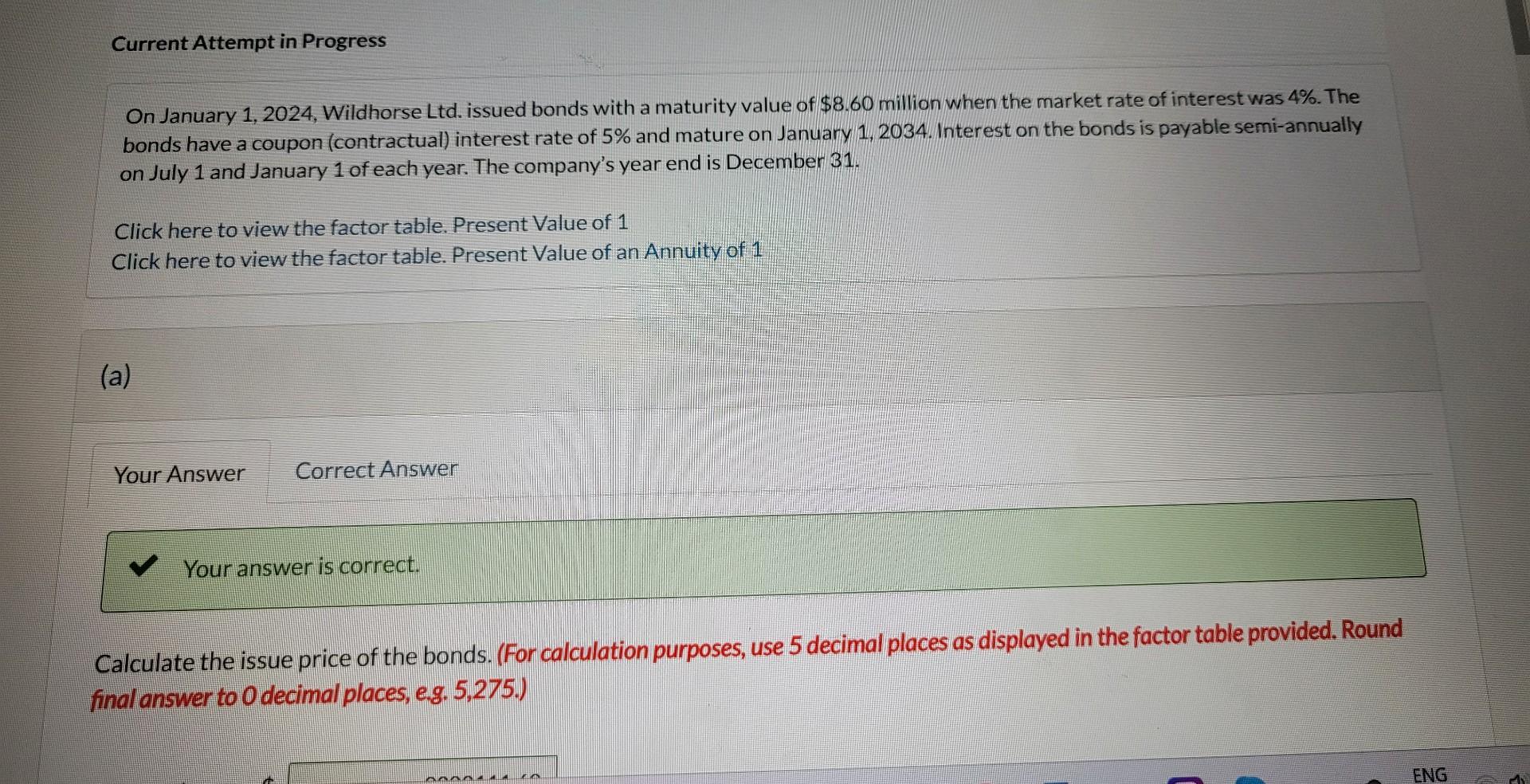

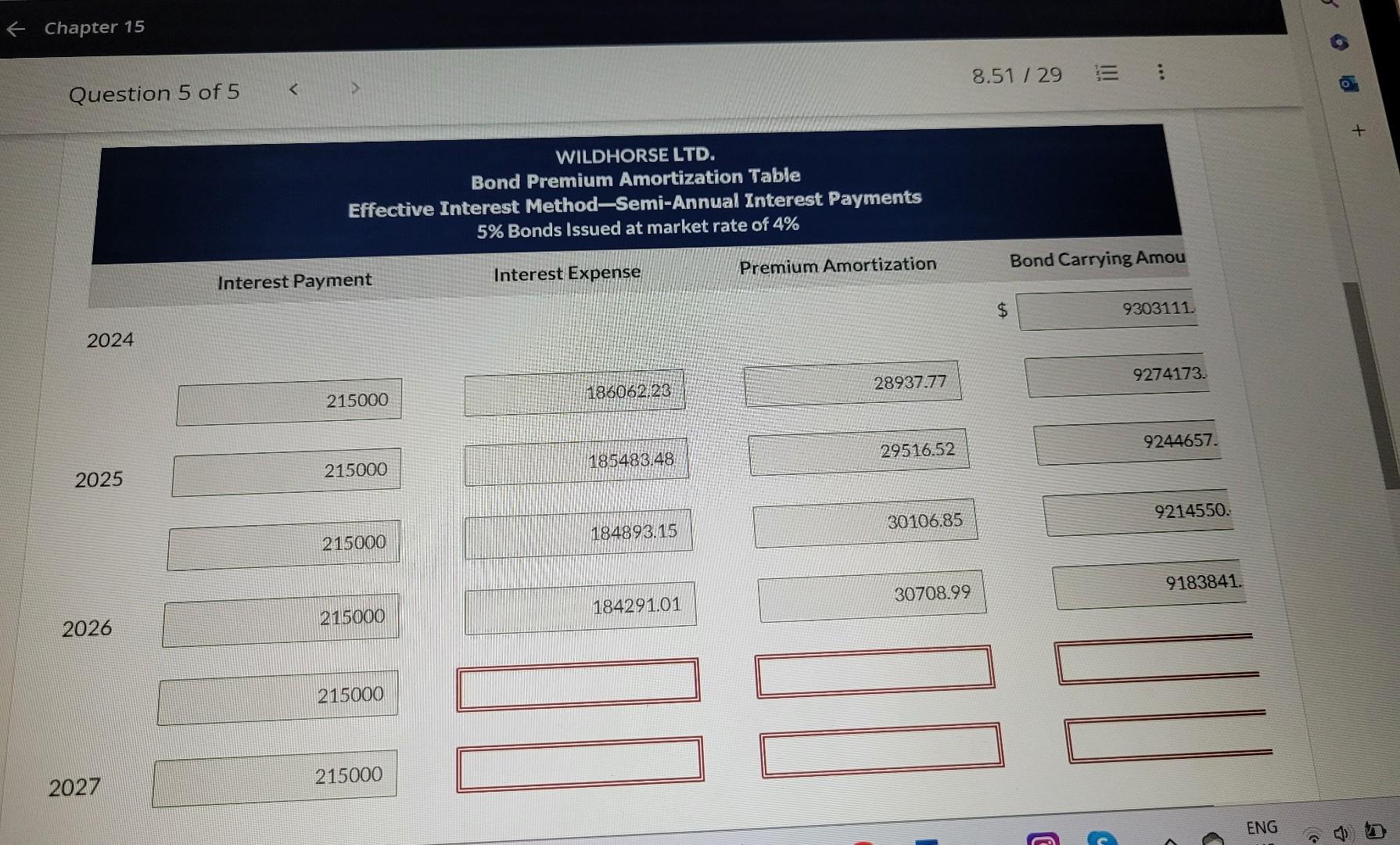

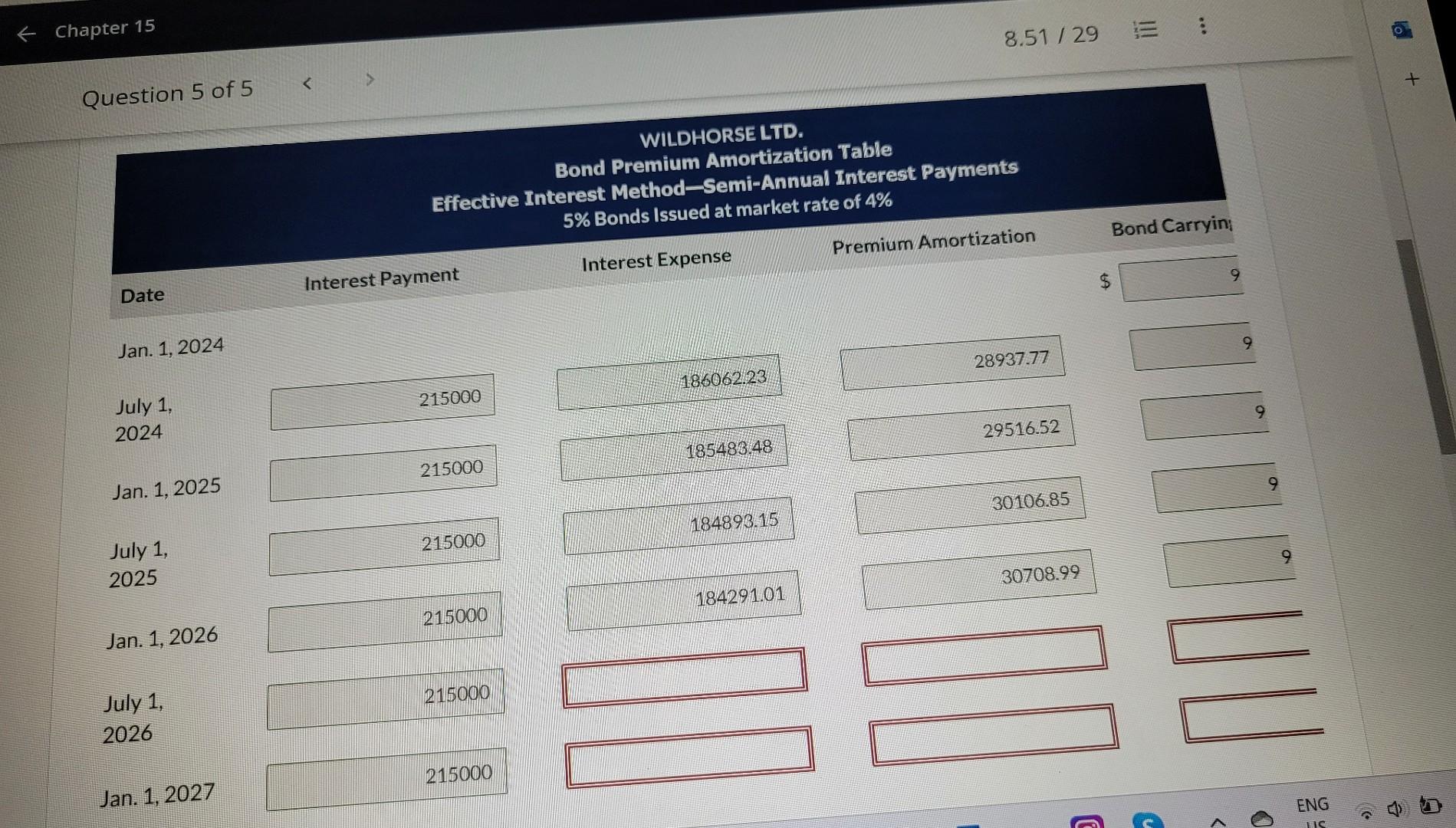

On January 1, 2024, Wildhorse Ltd. issued bonds with a maturity value of $8.60 million when the market rate of interest was 4%. The bonds have a coupon (contractual) interest rate of 5% and mature on January 1, 2034. Interest on the bonds is payable semi-annually on July 1 and January 1 of each year. The company's year end is December 31. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 (a) Your answer is correct. Calculate the issue price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answer to 0 decimal places, e.g. 5,275.) Chapter 15 Question 5 of 5 8.51/29 WILDHORSE LTD. Bond Premium Amortization Table Effective Interest Method-Semi-Annual Interest Payments 5% Bonds Issued at market rate of 4% \begin{tabular}{|rrrr} \hline 186062.23 & 28937.77 & 9274173. \\ \hline 185483.48 & 29516.52 & 9244657. \\ \hline 184893.15 & 30106.85 & 9214550. \\ \hline 184291.01 & 30708.99 & 9183841. \\ \hline \end{tabular} Chapter 15 Question 5 of 5 WILDHORSE LTD. Bond Premium Amortization Table Effective Interest Method-Semi-Annual Interest Payments 5% Bonds issued at market rate of 4% (c) The parts of this question must be completed in order. This part will be available when you complete the part above. (d) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started