Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of

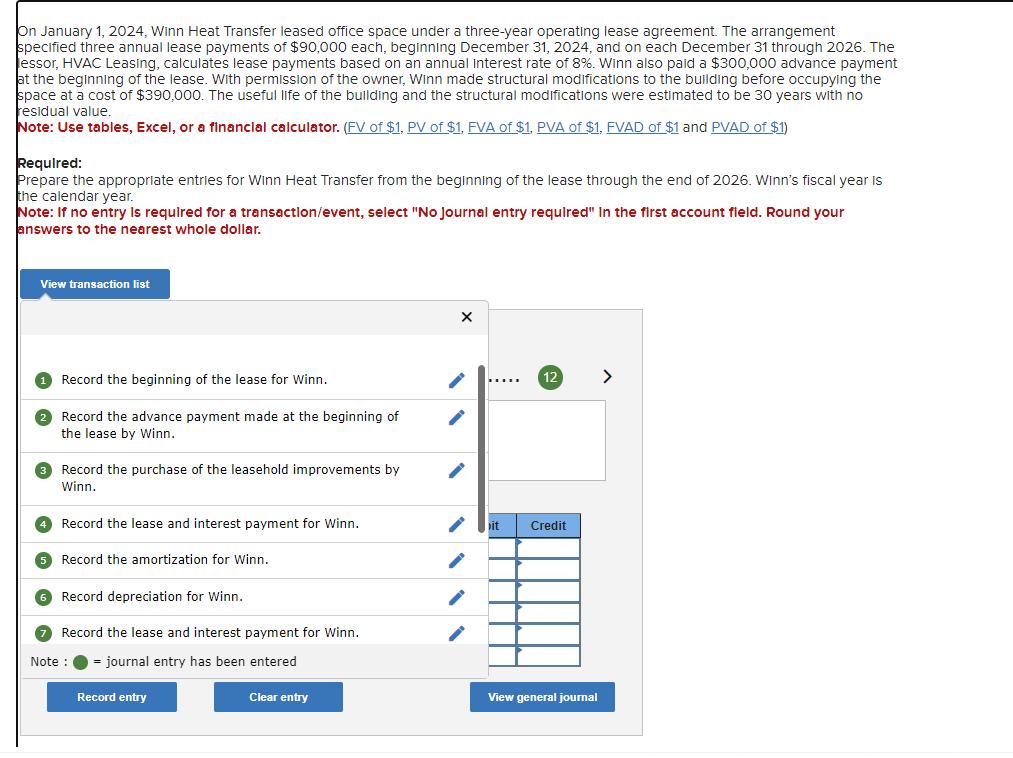

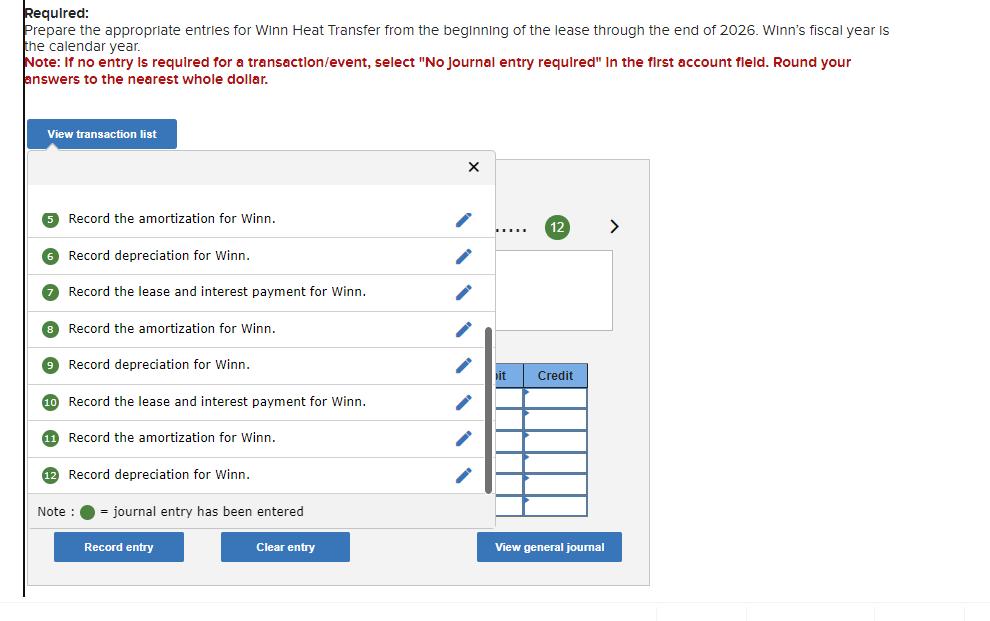

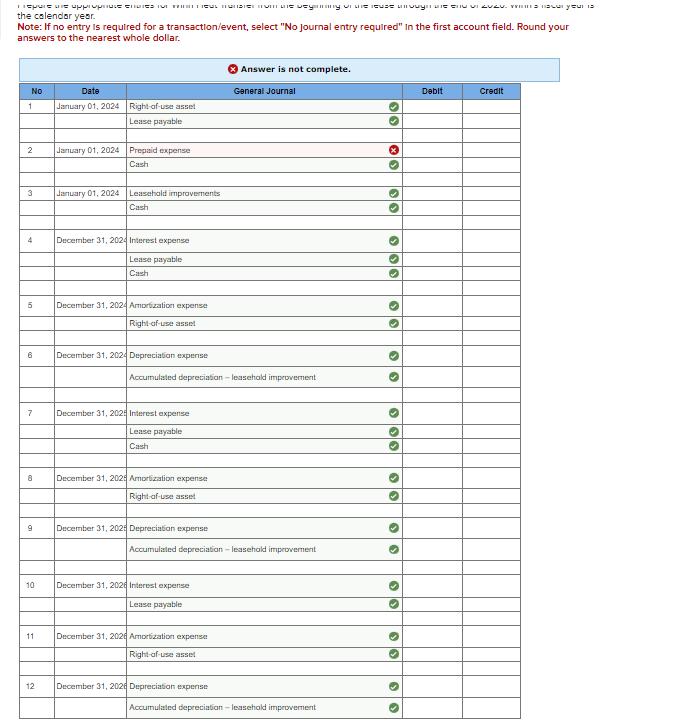

On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $90,000 each, beginning December 31, 2024, and on each December 31 through 2026. The essor, HVAC Leasing, calculates lease payments based on an annual interest rate of 8%. Winn also paid a $300,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $390,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Round your answers to the nearest whole dollar. View transaction list Record the beginning of the lease for Winn. 2 Record the advance payment made at the beginning of the lease by Winn. 3 Record the purchase of the leasehold improvements by Winn. 4 Record the lease and interest payment for Winn. 5 Record the amortization for Winn. 6 Record depreciation for Winn. Record the lease and interest payment for Winn. Note: journal entry has been entered Record entry Clear entry 12 > it Credit View general journal Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Round your answers to the nearest whole dollar. View transaction list 5 Record the amortization for Winn. 6 Record depreciation for Winn. 7 Record the lease and interest payment for Winn. 8 Record the amortization for Winn. X 12 > 9 Record depreciation for Winn. it Credit 10 Record the lease and interest payment for Winn. 11 Record the amortization for Winn. 12 Record depreciation for Winn. journal entry has been entered Note: Record entry Clear entry View general journal spore we appropriate en WHOUL HUDE nomme beginning on the reuse unvogn ESI VIVEN. WILLS HOLUI your is the calendar year. Note: If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Round your answers to the nearest whole dollar. 1 No Date January 01, 2024 Right-of-use asset 2 Lease payable January 01, 2024 Prepaid expense Cash Answer is not complete. General Journal Debit Credit 0 3 January 01, 2024 Leasehold improvements Cash 4 5 6 7 8 9 10 11 December 31, 2024 Interest expense Lease payable Cash December 31, 2024 Amortization expense Right-of-use asset December 31, 2024 Depreciation expense Accumulated depreciation-leasehold improvement December 31, 2025 Interest expense Lease payable Cash December 31, 2025 Amortization expense Right-of-use asset December 31, 202 Depreciation expense Accumulated depreciation - leasehold improvement December 31, 2026 Interest expense Lease payable December 31, 202 Amortization expense Right-of-use asset 12 December 31, 2026 Depreciation expense Accumulated depreciation-leasehold improvement S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started