Question

On January 1, 2025, Nash Corporation purchased 349 of the $1,000 face value, 9%, 10-year bonds of Walters Inc. The bonds mature on January

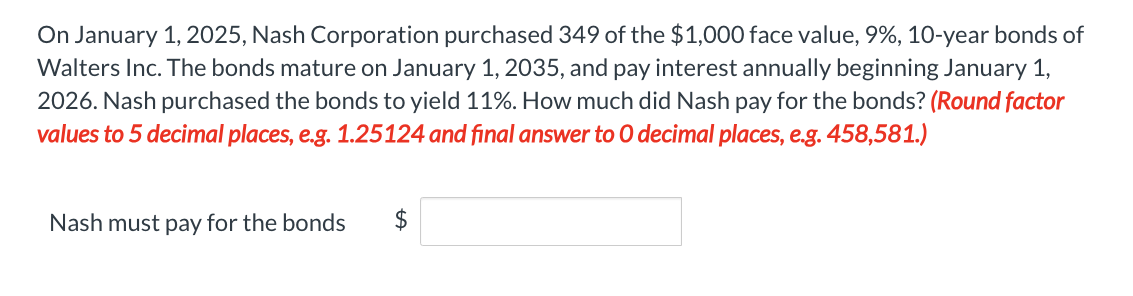

On January 1, 2025, Nash Corporation purchased 349 of the $1,000 face value, 9%, 10-year bonds of Walters Inc. The bonds mature on January 1, 2035, and pay interest annually beginning January 1, 2026. Nash purchased the bonds to yield 11%. How much did Nash pay for the bonds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Nash must pay for the bonds $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate the price Nash Corporation paid for the bonds 1 Define variables Face value F ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

18th Edition

1119790972, 9781119790976

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App