Answered step by step

Verified Expert Solution

Question

1 Approved Answer

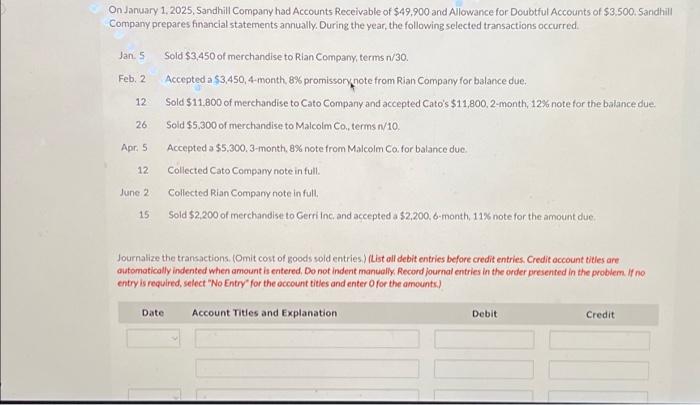

On January 1, 2025, Sandhill Company had Accounts Receivable of $49,900 and Allowance for Doubtful Accounts of $3,500. Sandhill Company prepares financial statements annually.

On January 1, 2025, Sandhill Company had Accounts Receivable of $49,900 and Allowance for Doubtful Accounts of $3,500. Sandhill Company prepares financial statements annually. During the year, the following selected transactions occurred. Jan. 5 Sold $3,450 of merchandise to Rian Company, terms n/30. Feb. 2 Accepted a $3,450, 4-month, 8% promissory note from Rian Company for balance due. 12 26 Apr. 5 12 June 2 15 Sold $11,800 of merchandise to Cato Company and accepted Cato's $11,800, 2-month, 12% note for the balance due. Sold $5,300 of merchandise to Malcolm Co., terms n/10. Accepted a $5,300, 3-month, 8% note from Malcolm Co. for balance due. Collected Cato Company note in full. Collected Rian Company note in full. Sold $2,200 of merchandise to Gerri Inc. and accepted a $2,200, 6-month, 11% note for the amount due. Journalize the transactions. (Omit cost of goods sold entries.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries with detailed calculations for the transactions provided Sandhill Compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e12a2a635f_960356.pdf

180 KBs PDF File

663e12a2a635f_960356.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started