Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X1, ABC Company purchased a machine for use in its factory. ABC started using the machine on February 1, 20X1. During

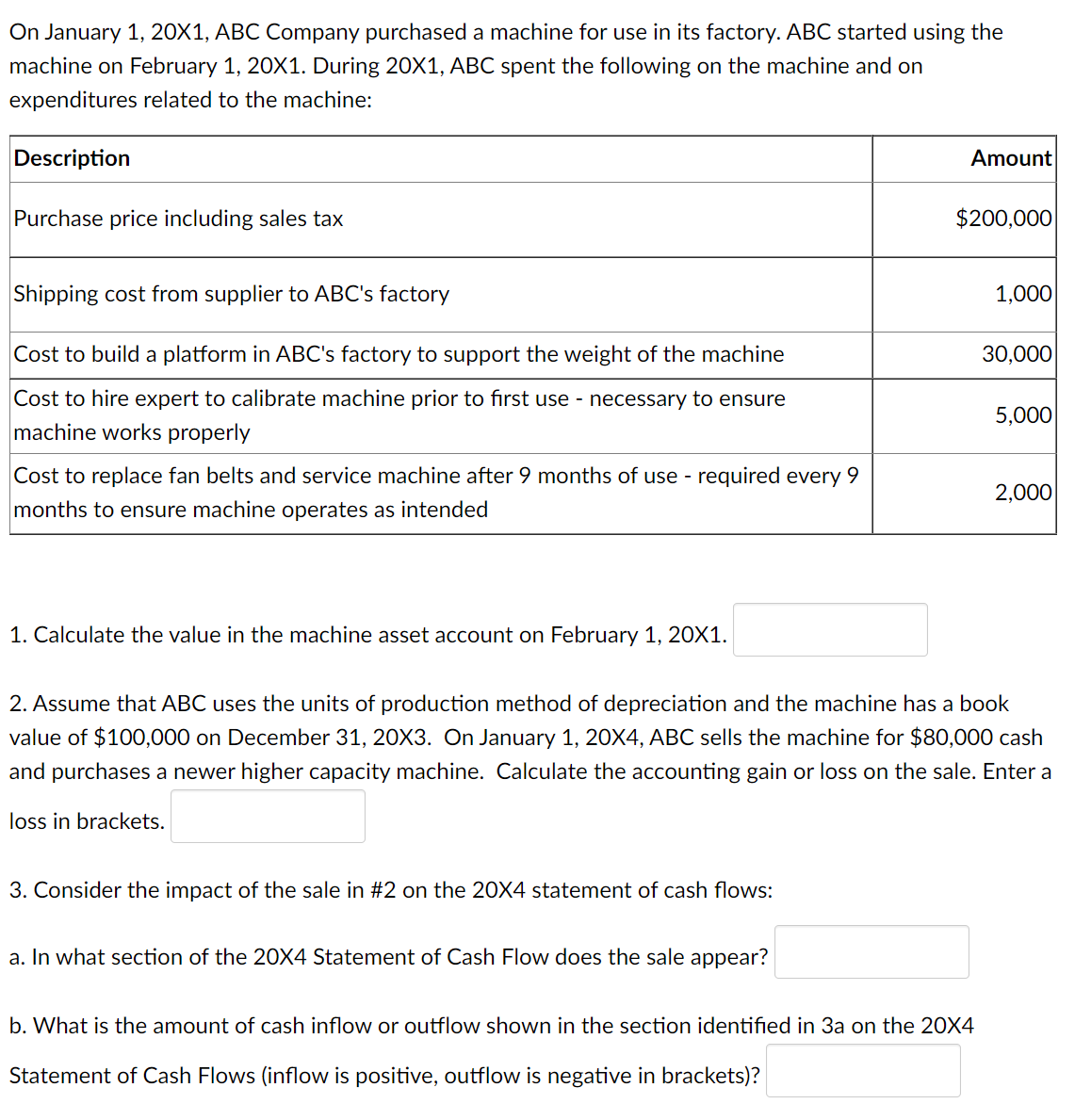

On January 1, 20X1, ABC Company purchased a machine for use in its factory. ABC started using the machine on February 1, 20X1. During 20X1, ABC spent the following on the machine and on expenditures related to the machine: Description Purchase price including sales tax Amount $200,000 Shipping cost from supplier to ABC's factory 1,000 Cost to build a platform in ABC's factory to support the weight of the machine 30,000 Cost to hire expert to calibrate machine prior to first use - necessary to ensure machine works properly 5,000 Cost to replace fan belts and service machine after 9 months of use - required every 9 months to ensure machine operates as intended 2,000 1. Calculate the value in the machine asset account on February 1, 20X1. 2. Assume that ABC uses the units of production method of depreciation and the machine has a book value of $100,000 on December 31, 20X3. On January 1, 20X4, ABC sells the machine for $80,000 cash and purchases a newer higher capacity machine. Calculate the accounting gain or loss on the sale. Enter a loss in brackets. 3. Consider the impact of the sale in #2 on the 20X4 statement of cash flows: a. In what section of the 20X4 Statement of Cash Flow does the sale appear? b. What is the amount of cash inflow or outflow shown in the section identified in 3a on the 20X4 Statement of Cash Flows (inflow is positive, outflow is negative in brackets)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Machine Asset Value and GainLoss on Sale 1 Value in the machine asset account o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e90d7e8af4_954553.pdf

180 KBs PDF File

663e90d7e8af4_954553.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started