Answered step by step

Verified Expert Solution

Question

1 Approved Answer

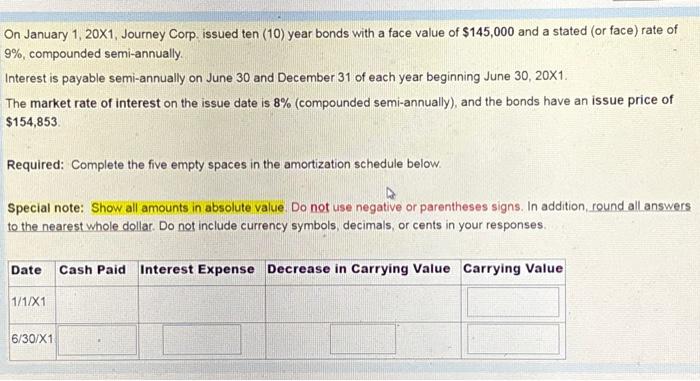

On January 1, 20X1, Journey Corp. issued ten (10) year bonds with a face value of $145,000 and a stated (or face) rate of 9%,

On January 1, 20X1, Journey Corp. issued ten (10) year bonds with a face value of $145,000 and a stated (or face) rate of 9%, compounded semi-annually. Interest is payable semi-annually on June 30 and December 31 of each year beginning June 30, 20X1. The market rate of interest on the issue date is 8% (compounded semi-annually), and the bonds have an issue price of $154,853. Required: Complete the five empty spaces in the amortization schedule below. 4 Special note: Show all amounts in absolute value. Do not use negative or parentheses signs. In addition, round all answers to the nearest whole dollar. Do not include currency symbols, decimals, or cents in your responses. Date Cash Paid Interest Expense Decrease in Carrying Value Carrying Value 1/1/X1 6/30/X1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started