Answered step by step

Verified Expert Solution

Question

1 Approved Answer

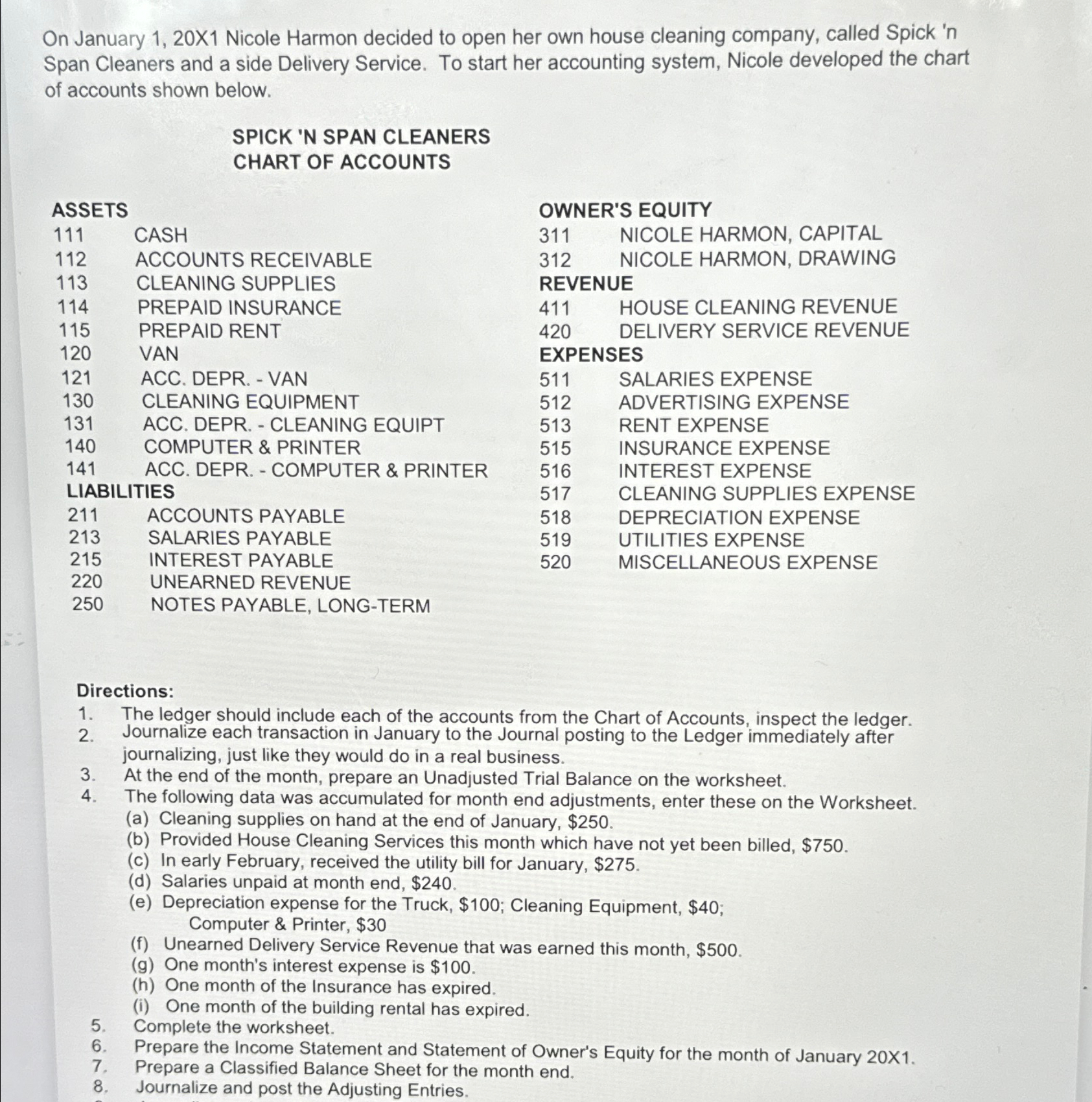

On January 1, 20X1 Nicole Harmon decided to open her own house cleaning company, called Spick 'n Span Cleaners and a side Delivery Service.

On January 1, 20X1 Nicole Harmon decided to open her own house cleaning company, called Spick 'n Span Cleaners and a side Delivery Service. To start her accounting system, Nicole developed the chart of accounts shown below. SPICK 'N SPAN CLEANERS CHART OF ACCOUNTS ASSETS 111 CASH OWNER'S EQUITY 311 112 ACCOUNTS RECEIVABLE 113 CLEANING SUPPLIES 114 PREPAID INSURANCE 411 115 PREPAID RENT 420 NICOLE HARMON, CAPITAL 312 NICOLE HARMON, DRAWING REVENUE HOUSE CLEANING REVENUE DELIVERY SERVICE REVENUE 120 VAN EXPENSES 121 ACC. DEPR.- VAN 511 SALARIES EXPENSE 130 CLEANING EQUIPMENT 512 ADVERTISING EXPENSE 131 ACC. DEPR.- CLEANING EQUIPT 513 RENT EXPENSE 140 COMPUTER & PRINTER 515 INSURANCE EXPENSE 141 ACC. DEPR.- COMPUTER & PRINTER 516 INTEREST EXPENSE LIABILITIES 517 CLEANING SUPPLIES EXPENSE 211 ACCOUNTS PAYABLE 518 DEPRECIATION EXPENSE 213 SALARIES PAYABLE 519 UTILITIES EXPENSE 215 INTEREST PAYABLE 520 MISCELLANEOUS EXPENSE 220 UNEARNED REVENUE 250 NOTES PAYABLE, LONG-TERM The ledger should include each of the accounts from the Chart of Accounts, inspect the ledger. Journalize each transaction in January to the Journal posting to the Ledger immediately after journalizing, just like they would do in a real business. Directions: 1. 2. 3. 4. 6. 5198 8. At the end of the month, prepare an Unadjusted Trial Balance on the worksheet. The following data was accumulated for month end adjustments, enter these on the Worksheet. (a) Cleaning supplies on hand at the end of January, $250. (b) Provided House Cleaning Services this month which have not yet been billed, $750. (c) In early February, received the utility bill for January, $275. (d) Salaries unpaid at month end, $240. (e) Depreciation expense for the Truck, $100; Cleaning Equipment, $40; Computer & Printer, $30 (f) Unearned Delivery Service Revenue that was earned this month, $500. (g) One month's interest expense is $100. (h) One month of the Insurance has expired. (i) One month of the building rental has expired. Complete the worksheet. Prepare the Income Statement and Statement of Owner's Equity for the month of January 20X1. Prepare a Classified Balance Sheet for the month end. Journalize and post the Adjusting Entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started