Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X1, Popular Creek Corporation organized SunTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 67,000.

On January 1, 20X1, Popular Creek Corporation organized SunTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 67,000. SunTimes December 31, 20X1, trial balance in SFr is as follows:

| Debit | Credit | ||||||

| Cash | SFr | 8,800 | |||||

| Accounts Receivable (net) | 25,000 | ||||||

| Receivable from Popular Creek | 5,600 | ||||||

| Inventory | 27,000 | ||||||

| Plant & Equipment | 107,000 | ||||||

| Accumulated Depreciation | SFr | 11,800 | |||||

| Accounts Payable | 13,100 | ||||||

| Bonds Payable | 54,500 | ||||||

| Common Stock | 67,000 | ||||||

| Sales | 163,600 | ||||||

| Cost of Goods Sold | 74,500 | ||||||

| Depreciation Expense | 11,800 | ||||||

| Operating Expense | 33,500 | ||||||

| Dividends Paid | 16,800 | ||||||

| Total | SFr | 310,000 | SFr | 310,000 | |||

Additional Information

- The receivable from Popular Creek is denominated in Swiss francs. Popular Creek's books show a $4,600 payable to SunTime.

- Purchases of inventory goods are made evenly during the year. Items in the ending inventory were purchased November 1.

- Equipment is depreciated by the straight-line method with a 10-year life and no residual value. A full years depreciation is taken in the year of acquisition. The equipment was acquired on March 1.

- The dividends were declared and paid on November 1.

- Exchange rates were as follows:

| SFr | $ | |||

| January 1 | 1 | = | 0.73 | |

| March 1 | 1 | = | 0.74 | |

| November 1 | 1 | = | 0.77 | |

| December 31 | 1 | = | 0.80 | |

| 20X1 average | 1 | = | 0.75 | |

- The Swiss franc is the functional currency.

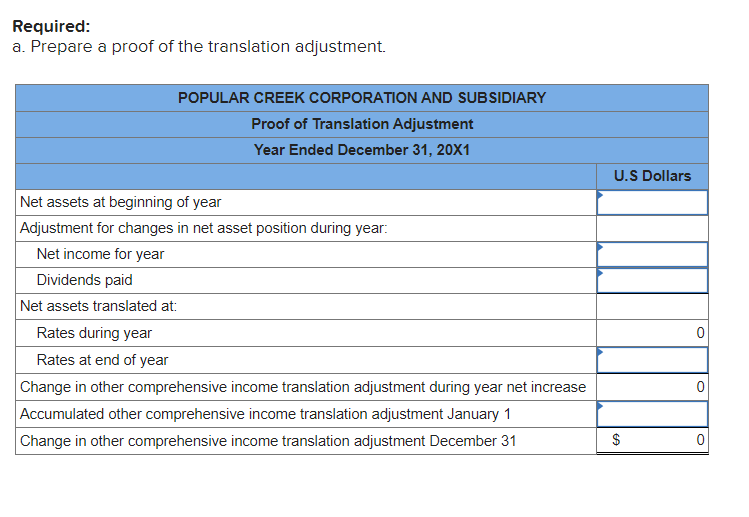

Required: a. Prepare a proof of the translation adjustment.

b. Where is the translation adjustment reported on Popular Creeks consolidated financial statements and its foreign subsidiary? (Select all that apply.)

Required: a. Prepare a proof of the translation adjustment. POPULAR CREEK CORPORATION AND SUBSIDIARY Proof of Translation Adjustment Year Ended December 31, 20X1 U.S Dollars Net assets at beginning of year Adjustment for changes in net asset position during year: Net income for year Dividends paid Net assets translated at: Rates during year Rates at end of year Change in other comprehensive income translation adjustment during year net increase Accumulated other comprehensive income translation adjustment January 1 Change in other comprehensive income translation adjustment December 31 0 0 $ GA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started