Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X1, Wade Crimbring, Inc., a dealer in used manufacturing equipment, sold a CNC milling machine to Fletcher Bros., a new business

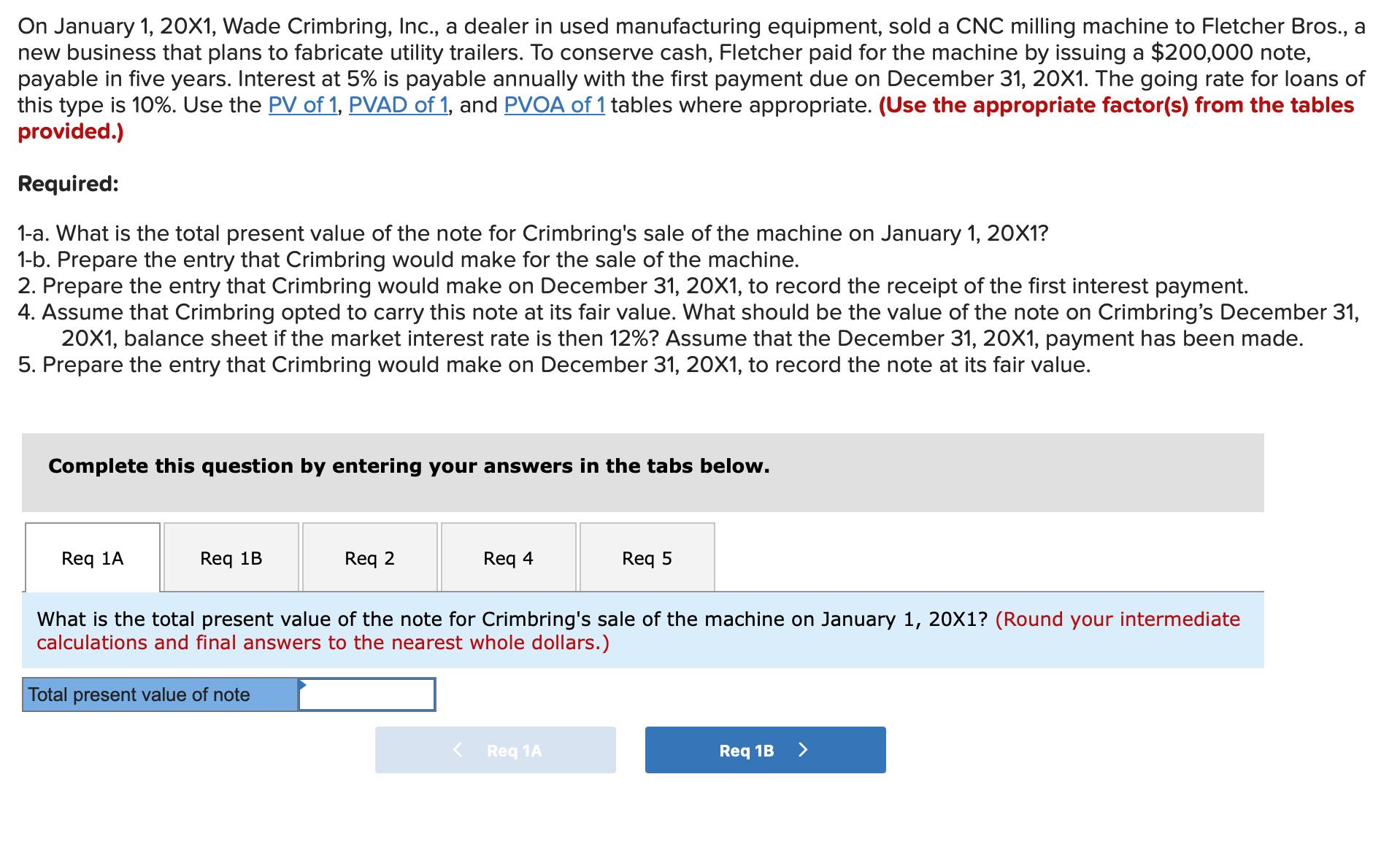

On January 1, 20X1, Wade Crimbring, Inc., a dealer in used manufacturing equipment, sold a CNC milling machine to Fletcher Bros., a new business that plans to fabricate utility trailers. To conserve cash, Fletcher paid for the machine by issuing a $200,000 note, payable in five years. Interest at 5% is payable annually with the first payment due on December 31, 20X1. The going rate for loans of this type is 10%. Use the PV of 1, PVAD of 1, and PVOA of 1 tables where appropriate. (Use the appropriate factor(s) from the tables provided.) Required: 1-a. What is the total present value of the note for Crimbring's sale of the machine on January 1, 201? 1-b. Prepare the entry that Crimbring would make for the sale of the machine. 2. Prepare the entry that Crimbring would make on December 31, 20X1, to record the receipt of the first interest payment. 4. Assume that Crimbring opted to carry this note at its fair value. What should be the value of the note on Crimbring's December 31, 20X1, balance sheet if the market interest rate is then 12%? Assume that the December 31, 20X1, payment has been made. 5. Prepare the entry that Crimbring would make on December 31, 20X1, to record the note at its fair value. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Req 4 Req 5 What is the total present value of the note for Crimbring's sale of the machine on January 1, 20X1? (Round your intermediate calculations and final answers to the nearest whole dollars.) Total present value of note < Req 1A Req 1B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started