Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20x2, Penn Co.(parent) purchased 90% of the outstanding common shares of Senn Co. (Subsidiary). On January 2, 20x2, Senn Co. purchased

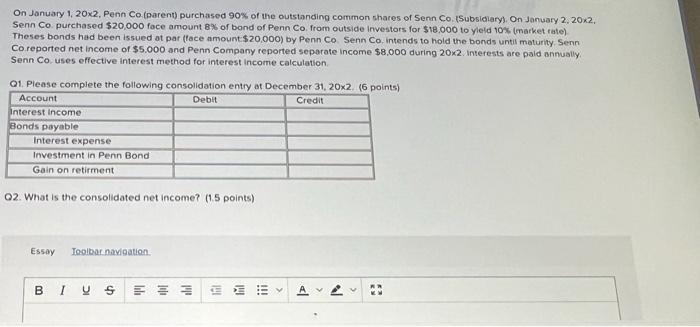

On January 1, 20x2, Penn Co.(parent) purchased 90% of the outstanding common shares of Senn Co. (Subsidiary). On January 2, 20x2, Senn Co. purchased $20,000 face amount 8% of bond of Penn Co. from outside Investors for $18,000 to yield 10% (market rate) Theses bonds had been issued at par (face amount: $20,000) by Penn Co. Senn Co. intends to hold the bonds until maturity. Senni Co.reported net income of $5.000 and Penn Company reported separate income $8,000 during 20x2. Interests are paid annually. Senn Co. uses effective interest method for interest income calculation. Q1. Please complete the following consolidation entry at December 31, 20x2. (6 points) Account Debit Credit Interest Income Bonds payable Interest expense Investment in Penn Bond Gain on retirment Q2. What is the consolidated net income? (1.5 points) Essay Toolbar navigation. BIUS = = lil Mil W !!! 4

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Amount Paid by Senn Co for the 8 Bonds of Penn Co 18000 Required rate of return 10 I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started