Question

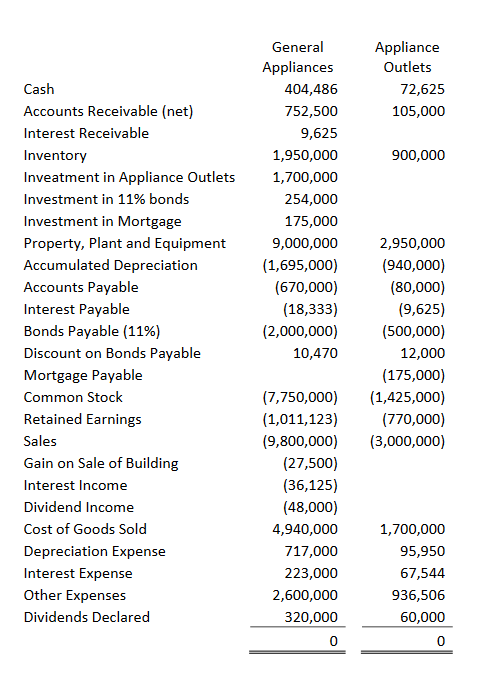

On January 1, 20x3, Appliance Outlets had the following balances in its shareholders equity accounts: Common Stock, $1,425,000, and Retained Earnings, $450,000. General Appliances acquired

| On January 1, 20x3, Appliance Outlets had the following balances in its shareholders equity accounts: Common Stock, $1,425,000, and Retained Earnings, $450,000. General Appliances acquired 64,000 (80%) shares of Appliance Outlets common stock for $1,700,000 on that date. The fair value of the Property, Plant, and Equipment was $50,000 in excess of Appliance Outlets book value. Also, General Appliances identified an unrecorded Patent with a fair value of $70,000. The PP&E had an expected remaining useful life of ten years and the Patent four years. |

| Appliance Outlets issued $500,000 of 8-year, 11% bonds on December 31,20X2. The bonds sold for $476,000. General Appliances purchased one-half of these bonds in the market on January 1. 20x5, for $256,000. Both companies use the straight-line method of amortization of premiums and discounts. |

| General Appliances sold $1,000,000 of inventory to Appliance Outlets during 20x6 with a markup of 30%. Appliance Outlets had $500,000 (General Appliances cost) of General Appliances inventory unsold in their beginning inventory and $400,000 (General Appliances cost) unsold in their ending inventory. |

| On July 1, 20x6, General Appliances sold to Appliance Outlets an old building and land with book values of $100,000, and $67,500 respectively. The building had a remaining life of 10 years and a $30,000 salvage value. The sale was made for $195,000 ($110,000 applied to building and $85,000 to land) The building is being depreciated on a straight-line basis. Appliance Outlets paid $20,000 in cash and signed a mortgage note with its parent for the balance. Interest, at 11% of the unpaid balance, and principal payments are due annually beginning July 1, 20x7.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started