Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X5, Company D(CD), a public company with a December 31 year-end, granted 500 options to each of its 300 senior employees.

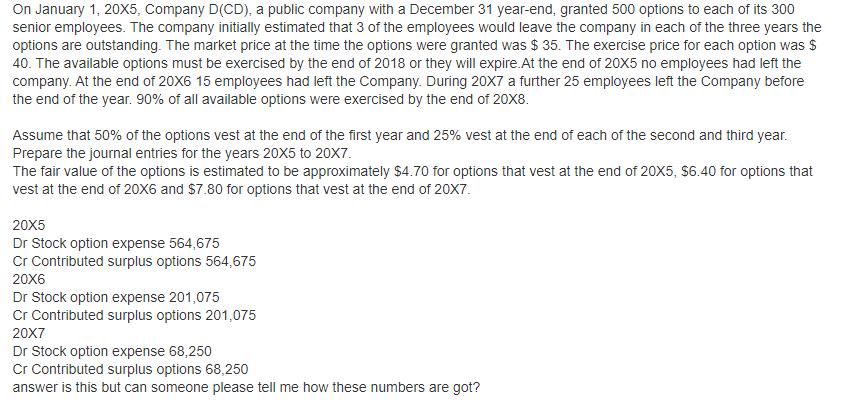

On January 1, 20X5, Company D(CD), a public company with a December 31 year-end, granted 500 options to each of its 300 senior employees. The company initially estimated that 3 of the employees would leave the company in each of the three years the options are outstanding. The market price at the time the options were granted was $ 35. The exercise price for each option was $ 40. The available options must be exercised by the end of 2018 or they will expire.At the end of 20X5 no employees had left the company. At the end of 20X6 15 employees had left the Company. During 20X7 a further 25 employees left the Company before the end of the year. 90% of all available options were exercised by the end of 20X8. Assume that 50% of the options vest at the end of the first year and 25% vest at the end of each of the second and third year. Prepare the journal entries for the years 20X5 to 20X7. The fair value of the options is estimated to be approximately $4.70 for options that vest at the end of 20X5, $6.40 for options that vest at the end of 20X6 and $7.80 for options that vest at the end of 20X7. 20X5 Dr Stock option expense 564,675 Cr Contributed surplus options 564,675 20X6 Dr Stock option expense 201,075 Cr Contributed surplus options 201,075 20X7 Dr Stock option expense 68,250 Cr Contributed surplus options 68,250 answer is this but can someone please tell me how these numbers are got?

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started