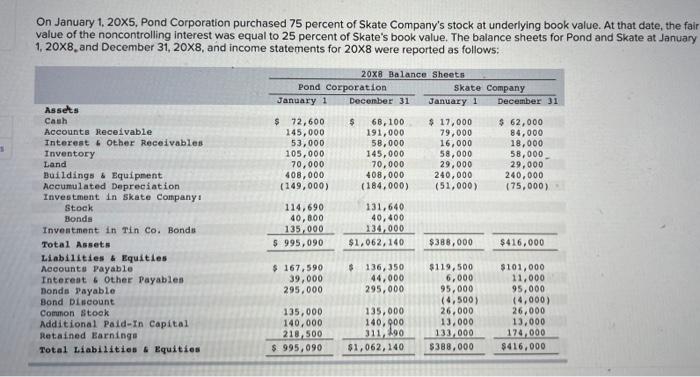

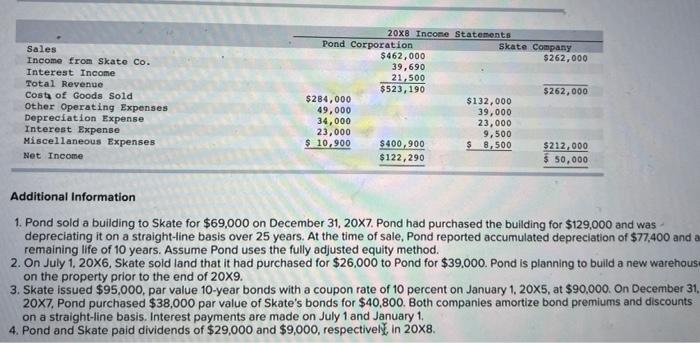

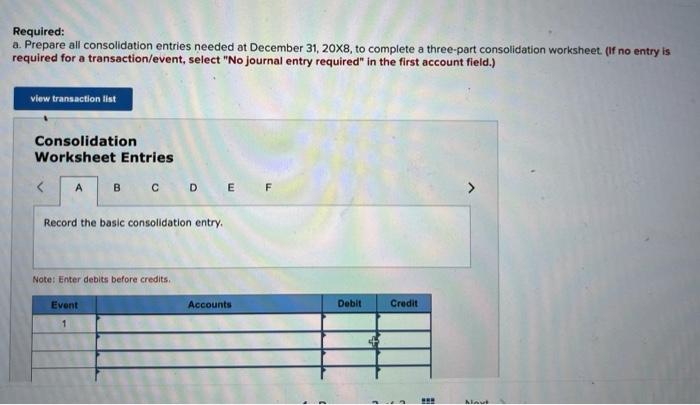

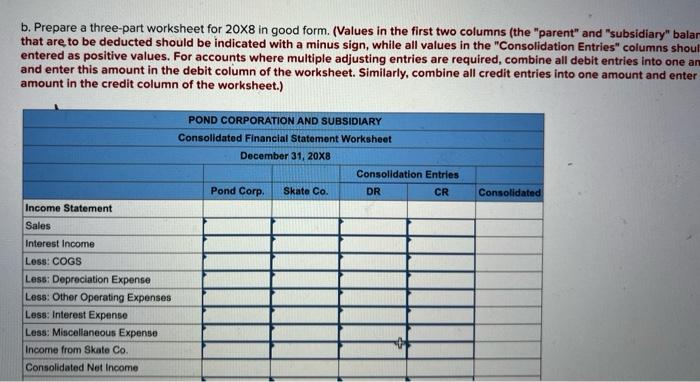

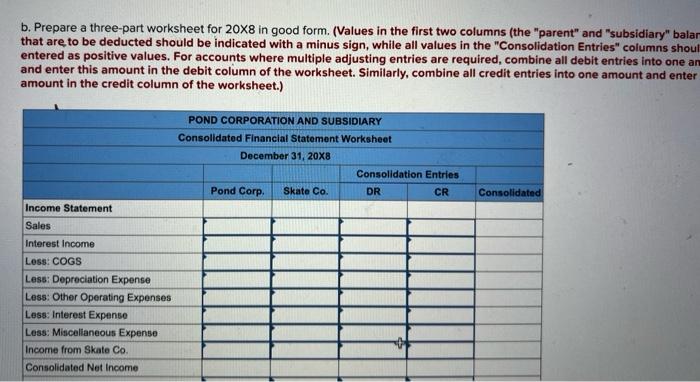

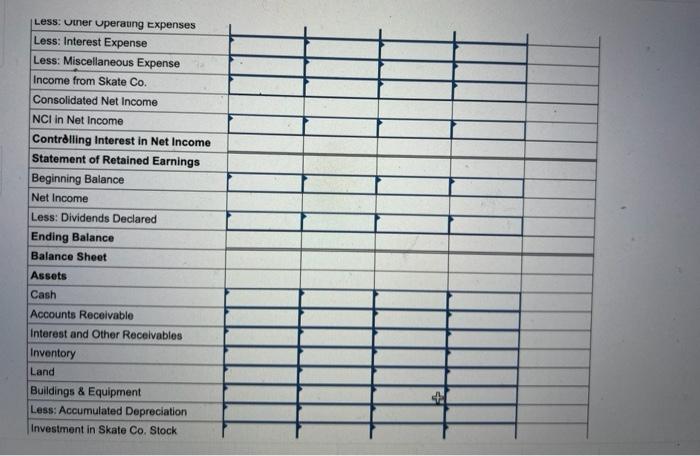

On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company's stock at underlying book value. At that date, the fain value of the noncontrolling interest was equal to 25 percent of Skate's book value. The balance sheets for Pond and Skate at January 1, 208, and December 31,208, and income statements for 208 were reported as follows: Additional Information 1. Pond sold a building to Skate for $69,000 on December 31,207. Pond had purchased the building for $129,000 and was depreciating it on a straight-line basis over 25 years. At the time of sale, Pond reported accumulated depreciation of $77,400 and a remaining life of 10 years. Assume Pond uses the fully adjusted equity method. 2. On July 1, 20X6, Skate sold land that it had purchased for $26,000 to Pond for $39.000. Pond is planning to build a new warehous on the property prior to the end of 209. 3. Skate issued $95,000, par value 10-year bonds with a coupon rate of 10 percent on January 1,205, at $90,000. On December 31 , 207. Pond purchased $38,000 par value of Skate's bonds for $40,800. Both companies amortize bond premiums and discounts on a straight-line basis. Interest payments are made on July 1 and January 1 . 4. Pond and Skate paid dividends of $29,000 and $9,000, respectively. in 208. Required: a. Prepare all consolidation entries needed at December 31, 208, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries b. Prepare a three-part worksheet for 208 in good form. (Values in the first two columns (the "parent" and "subsidiary" balar that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns shoul entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one an and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter amount in the credit column of the worksheet.) b. Prepare a three-part worksheet for 208 in good form. (Values in the first two columns (the "parent" and "subsidiary" balar that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns shoul entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one an and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter amount in the credit column of the worksheet.) On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company's stock at underlying book value. At that date, the fain value of the noncontrolling interest was equal to 25 percent of Skate's book value. The balance sheets for Pond and Skate at January 1, 208, and December 31,208, and income statements for 208 were reported as follows: Additional Information 1. Pond sold a building to Skate for $69,000 on December 31,207. Pond had purchased the building for $129,000 and was depreciating it on a straight-line basis over 25 years. At the time of sale, Pond reported accumulated depreciation of $77,400 and a remaining life of 10 years. Assume Pond uses the fully adjusted equity method. 2. On July 1, 20X6, Skate sold land that it had purchased for $26,000 to Pond for $39.000. Pond is planning to build a new warehous on the property prior to the end of 209. 3. Skate issued $95,000, par value 10-year bonds with a coupon rate of 10 percent on January 1,205, at $90,000. On December 31 , 207. Pond purchased $38,000 par value of Skate's bonds for $40,800. Both companies amortize bond premiums and discounts on a straight-line basis. Interest payments are made on July 1 and January 1 . 4. Pond and Skate paid dividends of $29,000 and $9,000, respectively. in 208. Required: a. Prepare all consolidation entries needed at December 31, 208, to complete a three-part consolidation worksheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries b. Prepare a three-part worksheet for 208 in good form. (Values in the first two columns (the "parent" and "subsidiary" balar that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns shoul entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one an and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter amount in the credit column of the worksheet.) b. Prepare a three-part worksheet for 208 in good form. (Values in the first two columns (the "parent" and "subsidiary" balar that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns shoul entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one an and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter amount in the credit column of the worksheet.)