Question

On January 1, 20X5, Taft Company acquired all of the outstanding stock of Vikix, Inc., a Norwegian company, at a cost of $153,000. Vikixs net

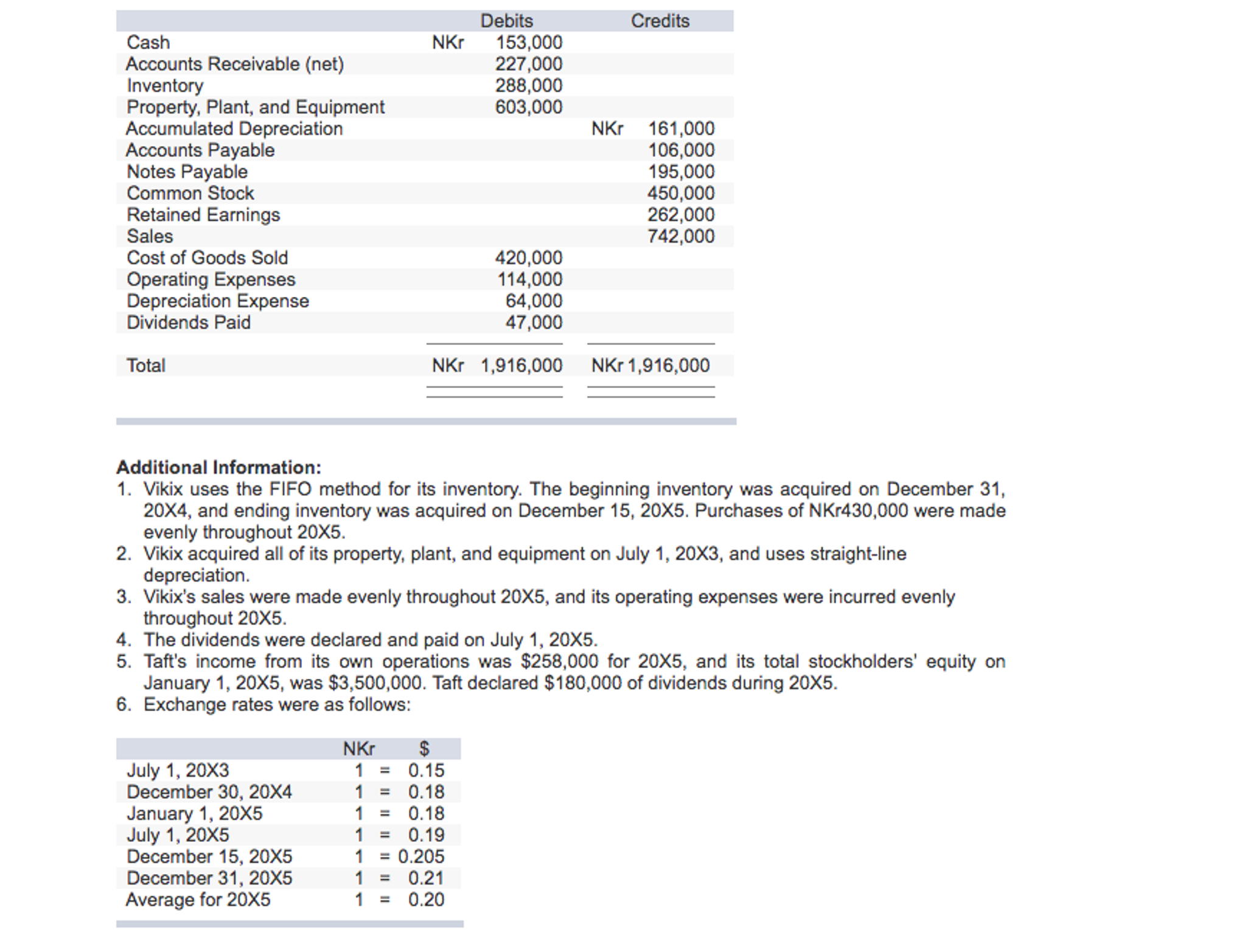

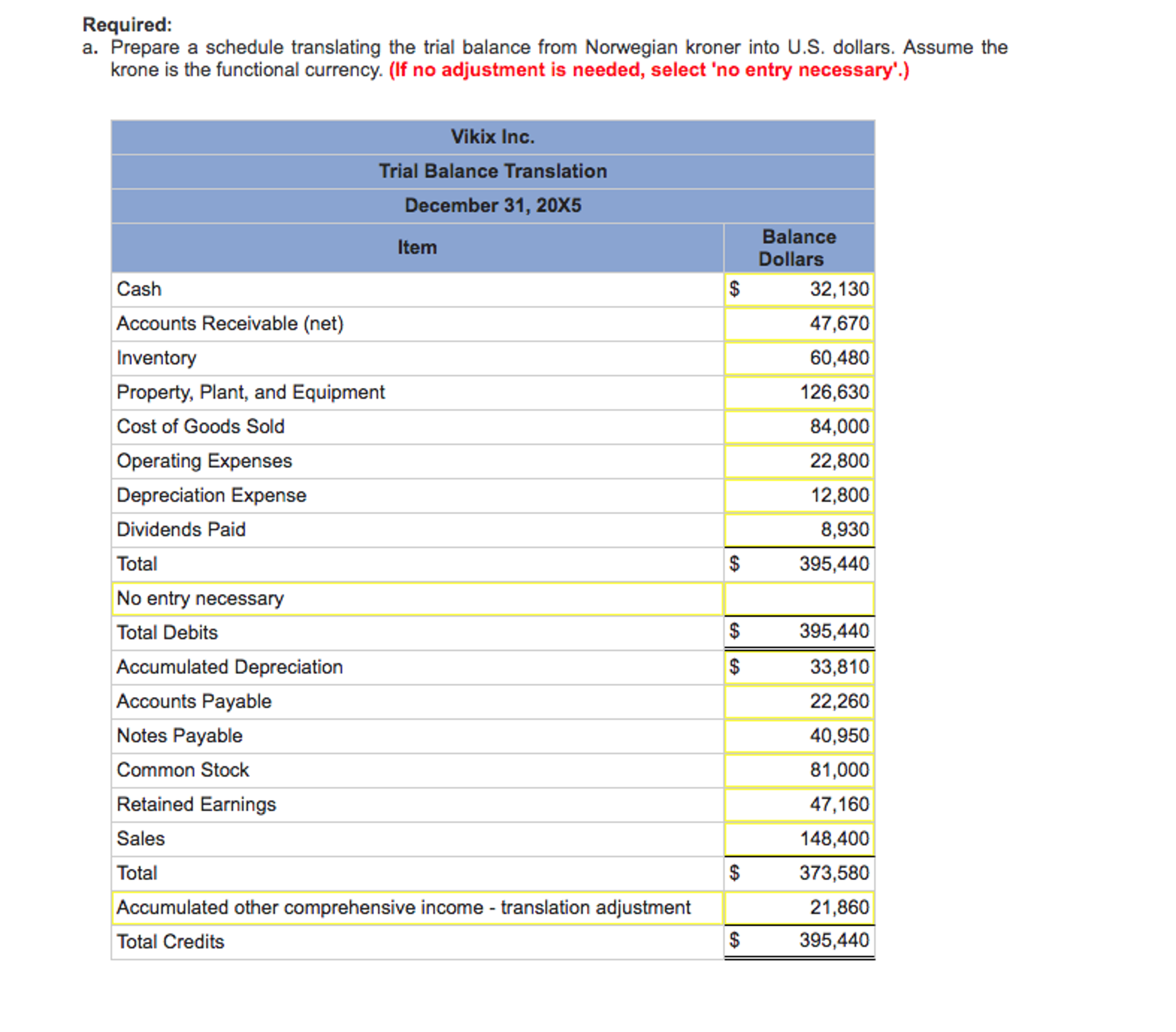

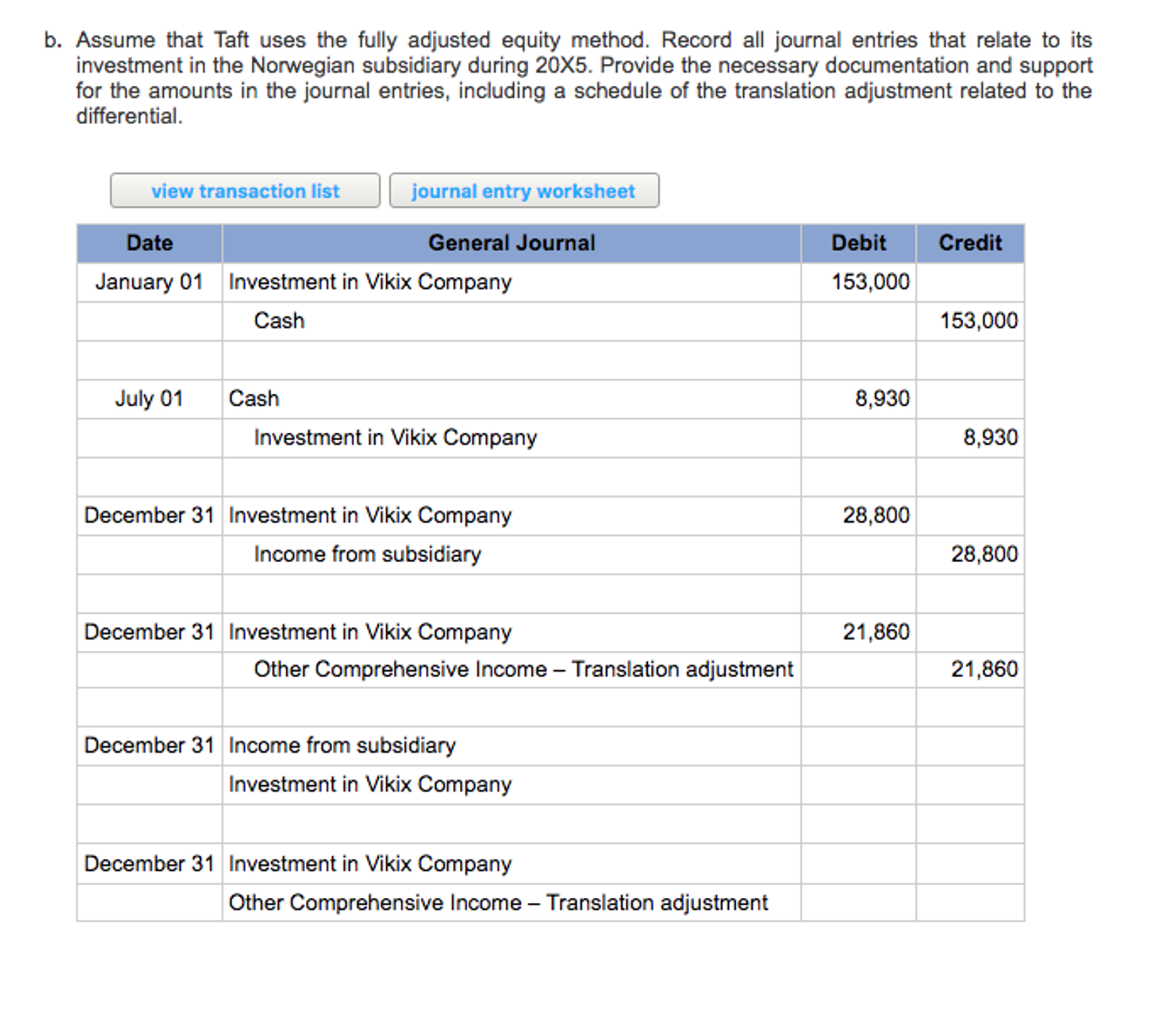

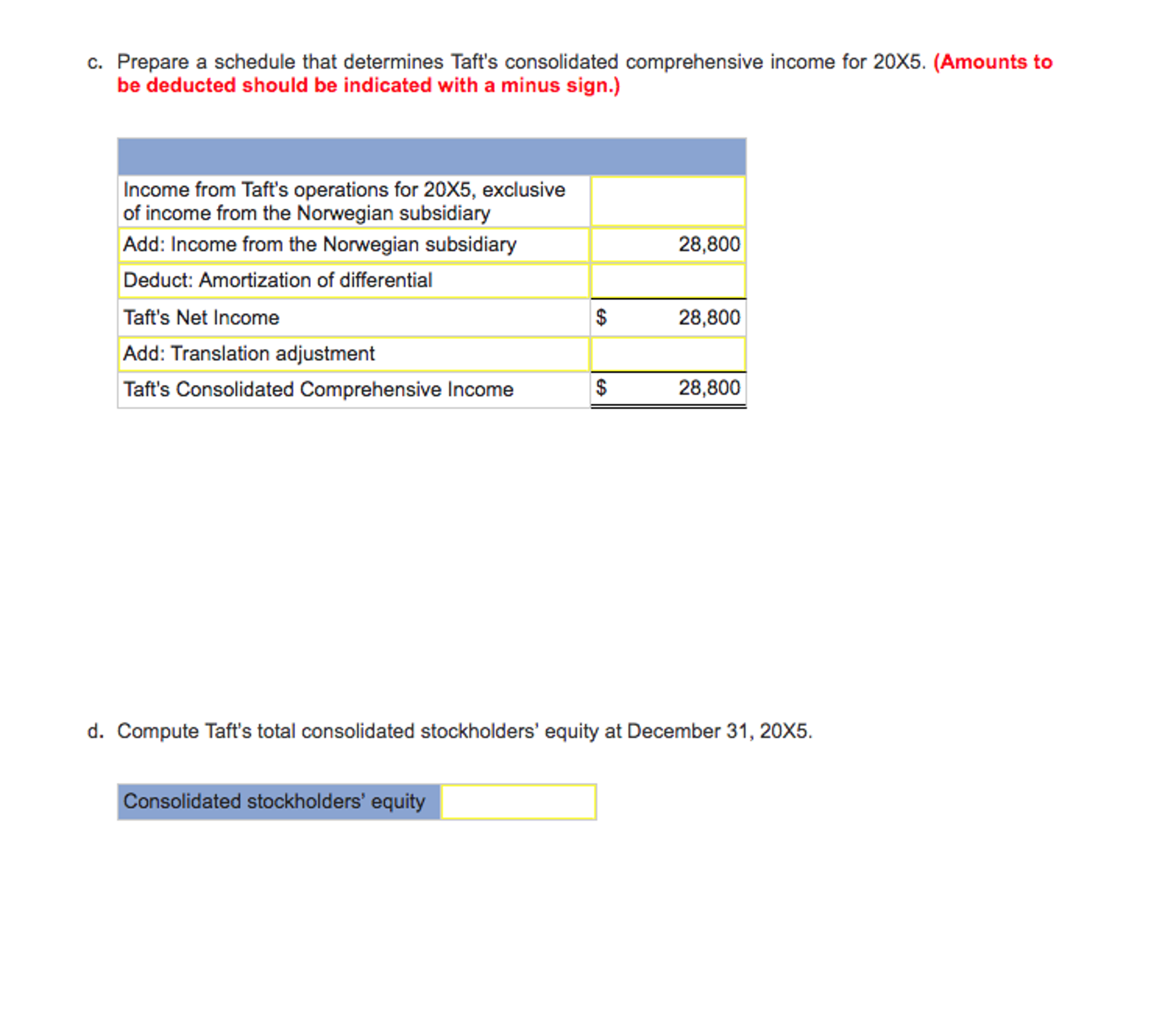

| On January 1, 20X5, Taft Company acquired all of the outstanding stock of Vikix, Inc., a Norwegian company, at a cost of $153,000. Vikixs net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and fair values of the Norwegian subsidiarys identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and patents acquired. The fair value of Vikixs property, plant, and equipment exceeded its book value by $18,000. The remaining useful life of Vikixs equipment at January 1, 20X5, was 10 years. The remainder of the differential was attributable to a patent having an estimated useful life of 5 years. Vikixs trial balance on December 31, 20X5, in kroner, follows: i need to solve last 2 journal entries in section b. And also all section c and d.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started