Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20x6, Colemont Corporation issued 4 percent, five-year bonds having a face value of $1,000,000 for $915,480. The bonds were dated January

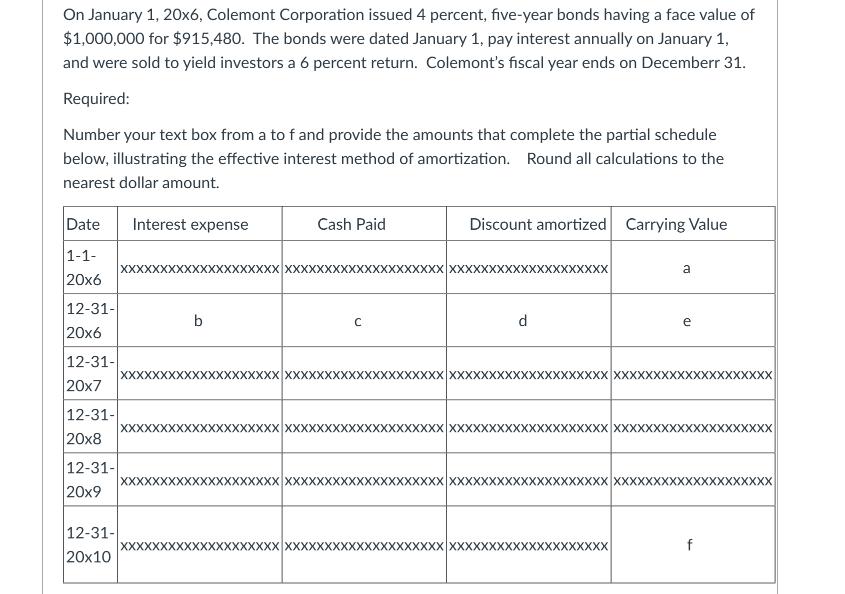

On January 1, 20x6, Colemont Corporation issued 4 percent, five-year bonds having a face value of $1,000,000 for $915,480. The bonds were dated January 1, pay interest annually on January 1, and were sold to yield investors a 6 percent return. Colemont's fiscal year ends on Decemberr 31. Required: Number your text box from a to f and provide the amounts that complete the partial schedule below, illustrating the effective interest method of amortization. Round all calculations to the nearest dollar amount. Date Interest expense 1-1- 20x6 12-31- 20x6 12-31- 20x7 12-31- 20x8 12-31- 20x9 12-31- 20x10 XX XX b XXXXXX XXXXXXX XXXXXX XXXXXX XXX Cash Paid C Discount amortized Carrying Value d XXXXXXXX a XXXX XXXXXXXXXX XXXXXXX XXXXXXXXXXXXXXXXXX f

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To complete the partial schedule using the effective interest method of amortization for the Colemon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started