Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X6, Penny Corp. purchased equipment from a manufacturer for $120,000 and immediately leased it to Dragonstone Ltd. Dragonstone reports its financial

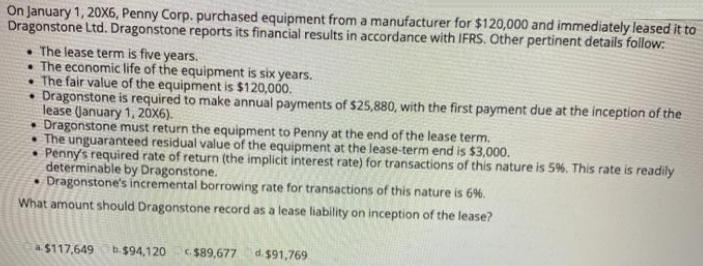

On January 1, 20X6, Penny Corp. purchased equipment from a manufacturer for $120,000 and immediately leased it to Dragonstone Ltd. Dragonstone reports its financial results in accordance with IFRS. Other pertinent details follow: . The lease term is five years. The economic life of the equipment is six years. The fair value of the equipment is $120,000. Dragonstone is required to make annual payments of $25,880, with the first payment due at the inception of the lease (January 1, 20X6). Dragonstone must return the equipment to Penny at the end of the lease term. The unguaranteed residual value of the equipment at the lease-term end is $3,000. Penny's required rate of return (the implicit interest rate) for transactions of this nature is 5%. This rate is readily determinable by Dragonstone. Dragonstone's incremental borrowing rate for transactions of this nature is 6%. What amount should Dragonstone record as a lease liability on inception of the lease? $117,649 $94,120 $89,677 d. $91,769

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of the Lease Liability Years Beginning 1 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started