On January 1, 20XX, Milton Company purchased a, a $1,000, 6% bond at 95 that pays interest on each January 1 starting the next

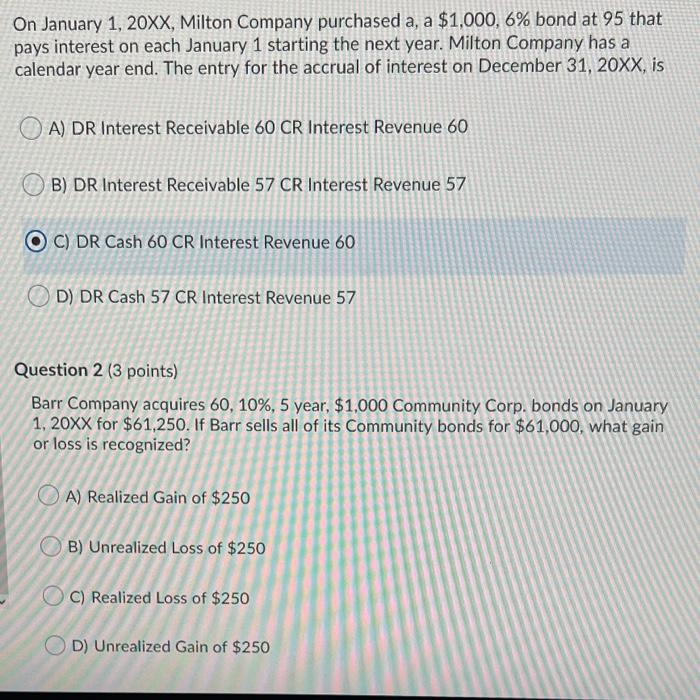

On January 1, 20XX, Milton Company purchased a, a $1,000, 6% bond at 95 that pays interest on each January 1 starting the next year. Milton Company has a calendar year end. The entry for the accrual of interest on December 31, 20XX, is A) DR Interest Receivable 60 CR Interest Revenue 60 B) DR Interest Receivable 57 CR Interest Revenue 57 C) DR Cash 60 CR Interest Revenue 60 D) DR Cash 57 CR Interest Revenue 57 Question 2 (3 points) Barr Company acquires 60, 10%, 5 year. $1,000 Community Corp. bonds on January 1, 20XX for $61,250. If Barr sells all of its Community bonds for $61,000, what gain or loss is recognized? A) Realized Gain of $250 O B) Unrealized Loss of $250 C) Realized Loss of $250 D) Unrealized Gain of $250

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solutlon Questloni Preparatlon of Journal Entry for Accrual of Interest as a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started