Answered step by step

Verified Expert Solution

Question

1 Approved Answer

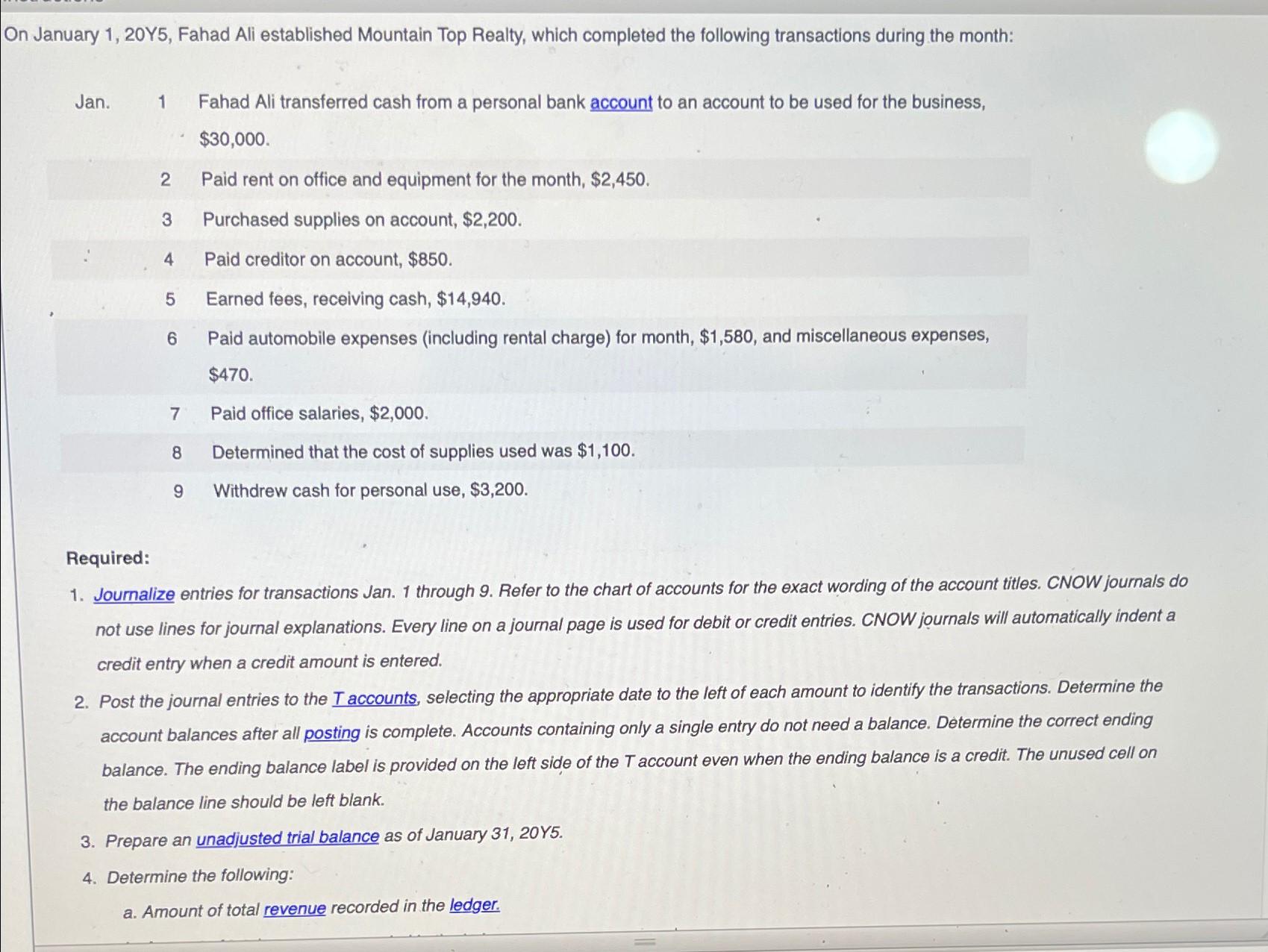

On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: Jan. 1 Fahad Ali transferred cash

On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: Jan. 1 Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $30,000. 2 Paid rent on office and equipment for the month, $2,450. 3 Purchased supplies on account, $2,200. 4 Paid creditor on account, $850. 5 Earned fees, receiving cash, $14,940. 6 Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $470. Paid office salaries, $2,000. 7 8 Determined that the cost of supplies used was $1,100. 9 Withdrew cash for personal use, $3,200. Required: 1. Journalize entries for transactions Jan. 1 through 9. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. 2. Post the journal entries to the T accounts, selecting the appropriate date to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. Determine the correct ending balance. The ending balance label is provided on the left side of the T account even when the ending balance is a credit. The unused cell on the balance line should be left blank. 3. Prepare an unadjusted trial balance as of January 31, 20Y5. 4. Determine the following: a. Amount of total revenue recorded in the ledger.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Mountain Top Realty Journal Entries and Trial Balance 1 Journal Entries Date Account Title Debit Credit Jan 1 Cash 30000 Fahad Ali Capital 30000 Jan 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664318fdafe73_952345.pdf

180 KBs PDF File

664318fdafe73_952345.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started