Answered step by step

Verified Expert Solution

Question

1 Approved Answer

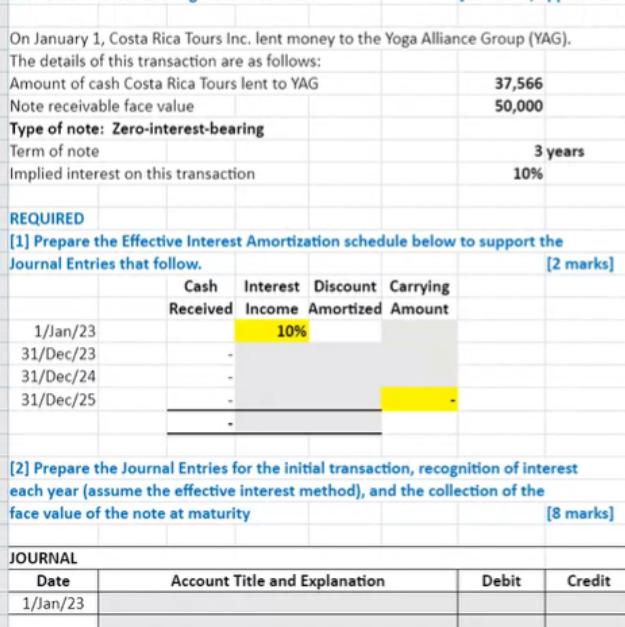

On January 1, Costa Rica Tours Inc. lent money to the Yoga Alliance Group (YAG). The details of this transaction are as follows: Amount

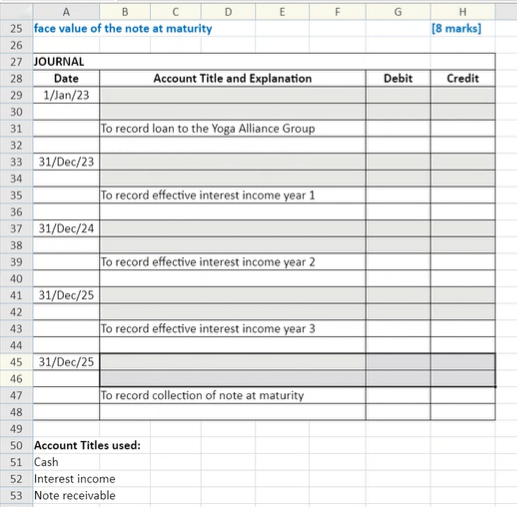

On January 1, Costa Rica Tours Inc. lent money to the Yoga Alliance Group (YAG). The details of this transaction are as follows: Amount of cash Costa Rica Tours lent to YAG Note receivable face value Type of note: Zero-interest-bearing Term of note Implied interest on this transaction REQUIRED 37,566 50,000 3 years 10% [1] Prepare the Effective Interest Amortization schedule below to support the Journal Entries that follow. Cash Interest Discount Carrying Received Income Amortized Amount [2 marks] 1/Jan/23 31/Dec/23 31/Dec/24 31/Dec/25 10% [2] Prepare the Journal Entries for the initial transaction, recognition of interest each year (assume the effective interest method), and the collection of the face value of the note at maturity JOURNAL [8 marks] Date Account Title and Explanation Debit Credit 1/Jan/23 B 25 face value of the note at maturity 26 27 JOURNAL 28 Date 29 1/Jan/23 30 31 32 33 31/Dec/23 34 D E F G H [8 marks] Account Title and Explanation Debit Credit To record loan to the Yoga Alliance Group 35 36 37 31/Dec/24 38 To record effective interest income year 1 39 40 41 42 43 44 31/Dec/25 45 31/Dec/25 46 To record effective interest income year 2 To record effective interest income year 3 To record collection of note at maturity 47 48 49 50 Account Titles used: 51 Cash 52 Interest income 53 Note receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started