Answered step by step

Verified Expert Solution

Question

1 Approved Answer

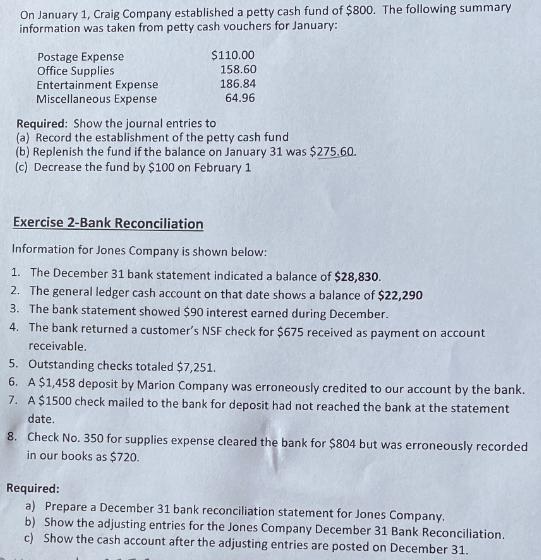

On January 1, Craig Company established a petty cash fund of $800. The following summary information was taken from petty cash vouchers for January:

On January 1, Craig Company established a petty cash fund of $800. The following summary information was taken from petty cash vouchers for January: Postage Expense Office Supplies Entertainment Expense Miscellaneous Expense $110.00 158.60 186.84 64.96 Required: Show the journal entries to (a) Record the establishment of the petty cash fund (b) Replenish the fund if the balance on January 31 was $275.60. (c) Decrease the fund by $100 on February 1 Exercise 2-Bank Reconciliation Information for Jones Company is shown below: 1. The December 31 bank statement indicated a balance of $28,830. 2. The general ledger cash account on that date shows a balance of $22,290 3. The bank statement showed $90 interest earned during December. 4. The bank returned a customer's NSF check for $675 received as payment on account receivable. 5. Outstanding checks totaled $7,251. 6. A $1,458 deposit by Marion Company was erroneously credited to our account by the bank. 7. A $1500 check mailed to the bank for deposit had not reached the bank at the statement date. 8. Check No. 350 for supplies expense cleared the bank for $804 but was erroneously recorded in our books as $720. Required: a) Prepare a December 31 bank reconciliation statement for Jones Company. b) Show the adjusting entries for the Jones Company December 31 Bank Reconciliation. c) Show the cash account after the adjusting entries are posted on December 31.

Step by Step Solution

★★★★★

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries to record the establishment of the petty cash fund Jan 1 2023 Petty Cash 800 Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started