Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Leveler Corporation leased equipment to Messy Company. The present value of the lease payments is $200,000 and Levelers cost of the equipment

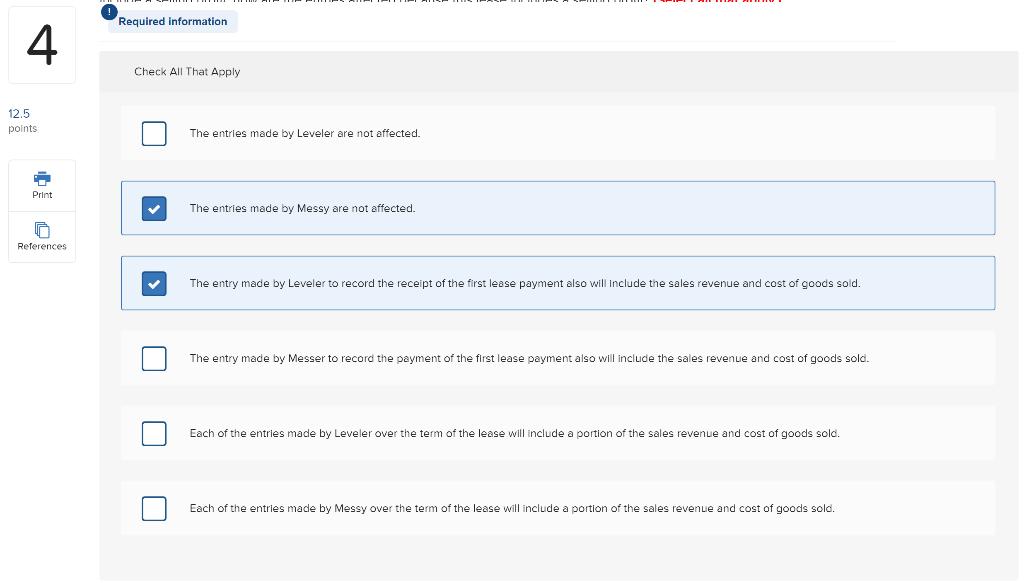

On January 1, Leveler Corporation leased equipment to Messy Company. The present value of the lease payments is $200,000 and Leveler’s cost of the equipment was $125,000. The lease is properly classified as a sales-type lease. In comparison to the entries that would have been made if this lease did not include a selling profit, how are the entries affected because this lease includes a selling profit? (Select all that apply.)

4 12.5 points Print n References Required information Check All That Apply The entries made by Leveler are not affected. The entries made by Messy are not affected. The entry made by Leveler to record the receipt of the first lease payment also will include the sales revenue and cost of goods sold. The entry made by Messer to record the payment of the first lease payment also will include the sales revenue and cost of goods sold. Each of the entries made by Leveler over the term of the lease will include a portion of the sales revenue and cost of goods sold. Each of the entries made by Messy over the term of the lease will include a portion of the sales revenue and cost of goods sold.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution The entries made by Messy are not affected The entry made by Leveler to record the rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started