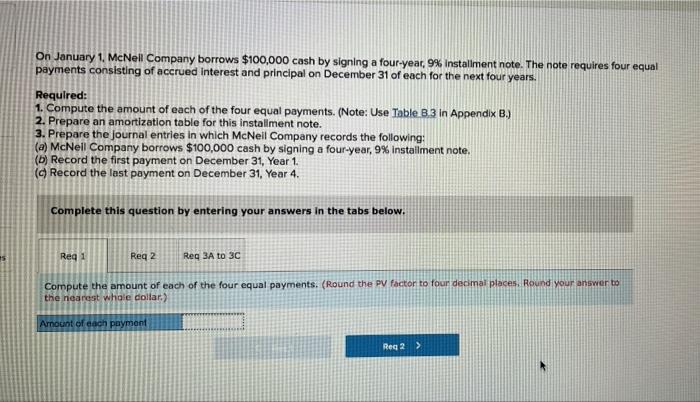

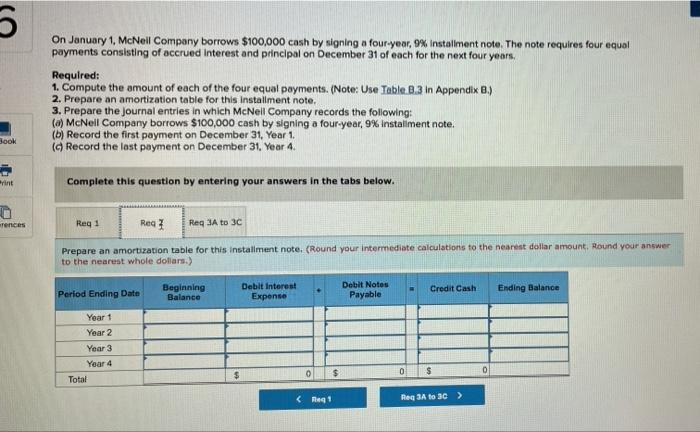

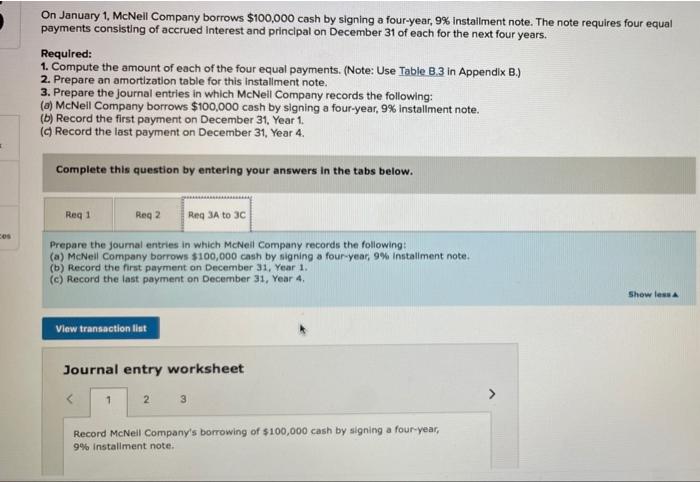

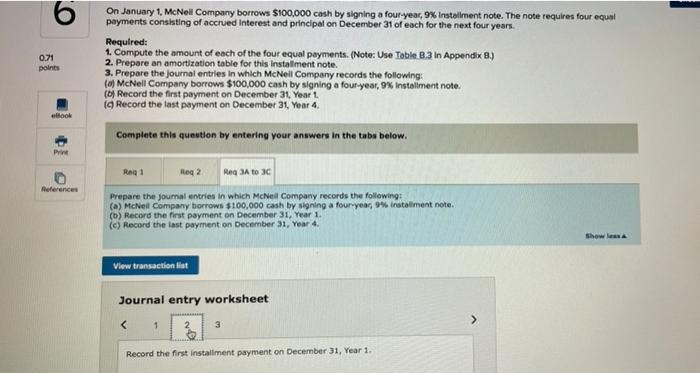

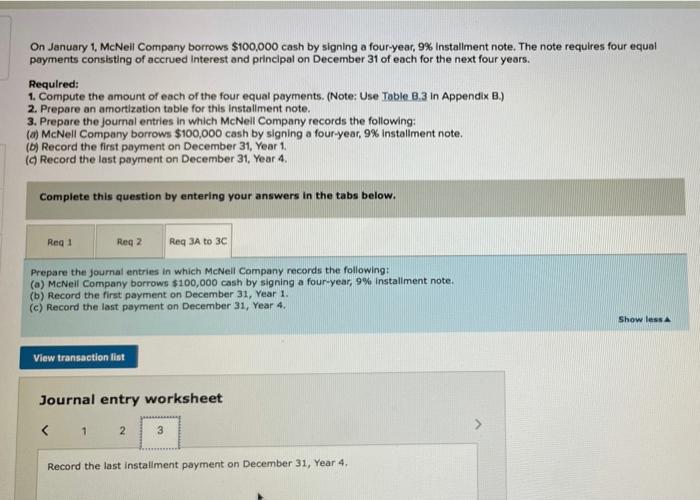

On January 1, McNell Company borrows $100,000 cash by signing a four-year, 9% installment note. The note requires four equal payments consisting of accrued Interest and principal on December 31 of each for the next four years. Required: 1. Compute the amount of each of the four equal payments. (Note: Use Table 8.3 In Appendix B.) 2. Prepare an amortization table for this installment note. 3. Prepare the journal entries in which McNeil Company records the following: (a) McNeil Company borrows $100,000 cash by signing a four-year, 9% installment note, (b) Record the first payment on December 31, Year 1. (Record the last payment on December 31, Year 4. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3A to 3C Compute the amount of each of the four equal payments. (Round the PV factor to four decimal places. Round your answer to the nearest whole dollar. Arnout of each payment Reg 2 > 5 On January 1, McNeil Company borrows $100,000 cash by signing a four-year, 9% installment note. The note requires four equal payments consisting of accrued Interest and principal on December 31 of each for the next four years, Required: 1. Compute the amount of each of the four equal payments. (Note: Use Table 0.3 in Appendix B.) 2. Prepare an amortization table for this installment note. 3. Prepare the Journal entries in which McNeil Company records the following: (6) McNeil Company borrows $100,000 cash by signing a four-year, 9% installment note. (b) Record the first payment on December 31, Year 1. (Record the last payment on December 31 Year 4. Book Print Complete this question by entering your answers in the tabs below. rences Reg 1 Req3 Reg JA to 3C Prepare an amortization table for this installment note. (Round your intermediate calculations to the nearest dollar amount. Round your answer to the nearest whole dollars.) Beginning Balance Debit interest Expense Credit Cash Period Ending Date Debit Notes Payable Ending Balance Year 1 Year 2 Year 3 Year 4 Total 0 0 $ $ $ On January 1, McNell Company borrows $100,000 cash by signing a four-year, 9% installment note. The note requires four equal payments consisting of accrued interest and principal on December 31 of each for the next four years. Required: 1. Compute the amount of each of the four equal payments. (Note: Use Table B.3 in Appendix B.) 2. Prepare an amortization table for this installment note, 3. Prepare the journal entries in which McNell Company records the following: (a) McNell Company borrows $100,000 cash by signing a four-year, 9% installment note. (b) Record the first payment on December 31, Year 1. ( Record the last payment on December 31, Year 4. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg JA to 30 Prepare the journal entries in which McNeil Company records the following: (a) McNeil Company borrows $100,000 cash by signing a four-year, 9% installment note. (b) Record the first payment on December 31, Year 1. (c) Record the last payment on December 31, Year 4, Show less View transaction list Journal entry worksheet 1 2 Record McNell Company's borrowing of $100,000 cash by signing a four-year, 9% installment note. 0.71 points On January 1, McNeill Company borrows $100,000 cash by signing a four-year, 9% Installment note. The note requires four equal payments consisting of accrued Interest and principal on December 31 of each for the next four years. Required: 1. Compute the amount of each of the four equal payments. (Note: Use Table B.3 In Appendix 8.) 2. Prepare an amortization table for this installment note. 3. Prepare the journal entries in which McNeil Company records the following: (0) McNeil Company borrows $100,000 cash by signing a four-year, 9% Installment note. (Record the first payment on December 31, Year 1 (Record the last payment on December 31, Year 4. look Complete this question by entering your answers in the tabs below. Print Rog1 te 2 Reg A to 30 References Prepare the journal entries in which McNeil Company records the following: (a) McNeil Company borrows $100,000 cash by signing a four-year, 9% installment note. (b) Record the first payment on December 31, Year 1. (e) Record the last payment on December 31, Year 4. Show less View transaction at Journal entry worksheet