Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Midwest Specialty Foods purchased equipment for $22,000. Residual value at the end of an estimated four-year service life is expected to

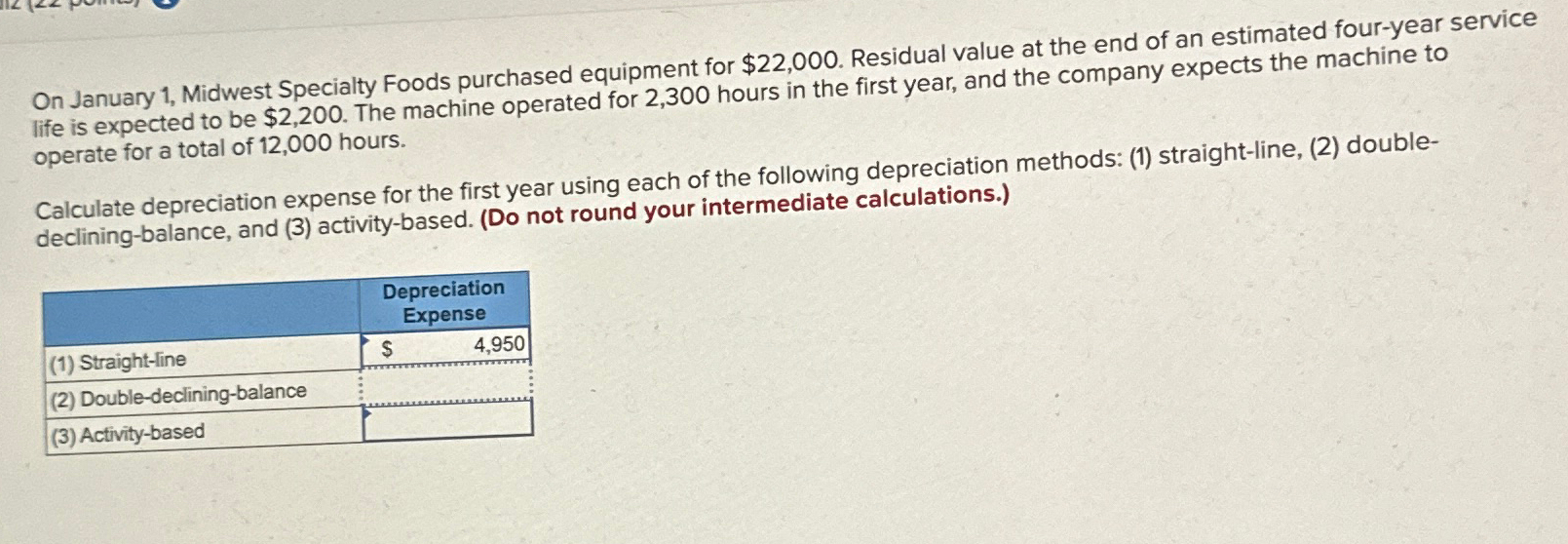

On January 1, Midwest Specialty Foods purchased equipment for $22,000. Residual value at the end of an estimated four-year service life is expected to be $2,200. The machine operated for 2,300 hours in the first year, and the company expects the machine to operate for a total of 12,000 hours. Calculate depreciation expense for the first year using each of the following depreciation methods: (1) straight-line, (2) double- declining-balance, and (3) activity-based. (Do not round your intermediate calculations.) (1) Straight-line (2) Double-declining-balance (3) Activity-based Depreciation Expense $ 4,950

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Straightline Depreciation The formula for straightline depreciati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66421ad9b3373_986267.pdf

180 KBs PDF File

66421ad9b3373_986267.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started