Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of this year, Ikuta Company issued a bond with a face value of $160,000 and a coupon rate of 4 percent. The

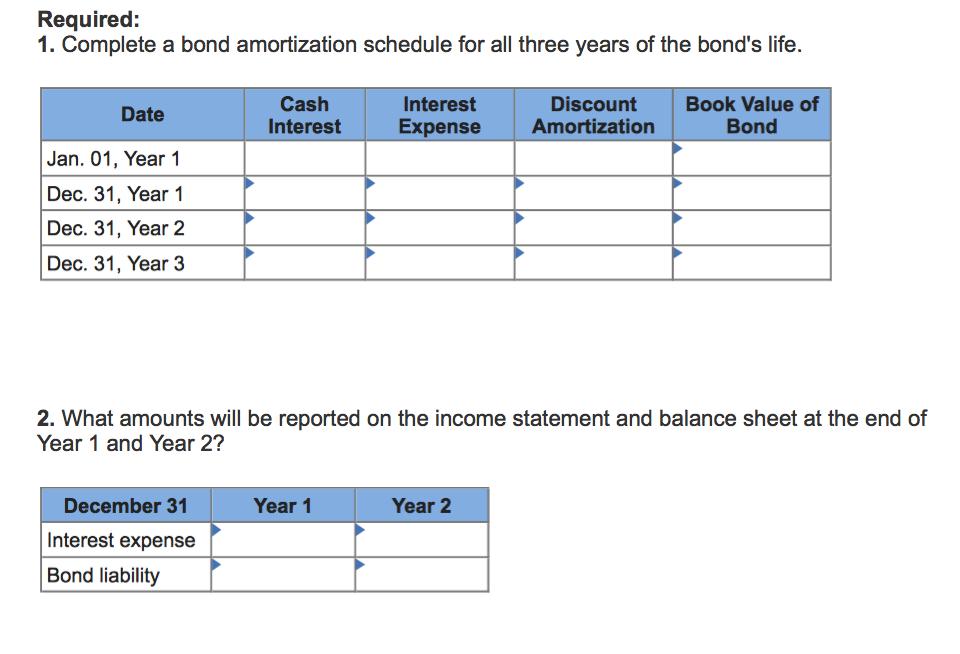

On January 1 of this year, Ikuta Company issued a bond with a face value of $160,000 and a coupon rate of 4 percent. The bond matures in 3 years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 5 percent. Ikuta uses the effective-interest amortization method. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided. Round your final answer to whole dollars.)

Required: 1. Complete a bond amortization schedule for all three years of the bond's life. Date Jan. 01, Year 1 Dec. 31, Year 1 Dec. 31, Year 2 Dec. 31, Year 3 Cash Interest December 31 Interest expense Bond liability Interest Expense Year 1 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2? Discount Amortization Year 2 Book Value of Bond

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Year Cash Interest Interest Expense Dicount amortization Book Value of bond Jan 01 Year 1 155643 D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started