Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1 of Year 1, a borrower signed a long-term note, face amount of $340,000; time to maturity is three years; stated rate

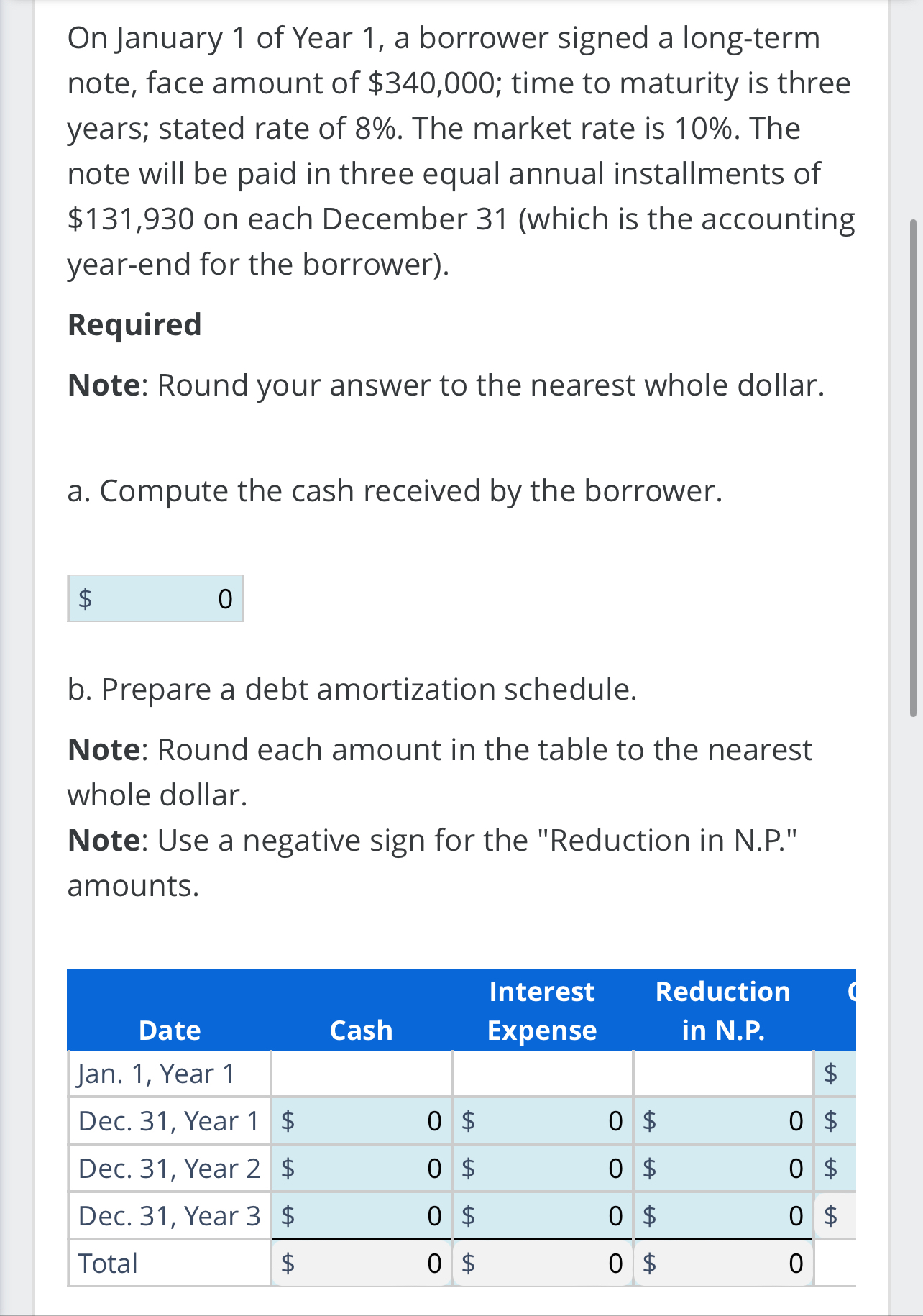

On January 1 of Year 1, a borrower signed a long-term note, face amount of $340,000; time to maturity is three years; stated rate of 8%. The market rate is 10%. The note will be paid in three equal annual installments of $131,930 on each December 31 (which is the accounting year-end for the borrower). Required Note: Round your answer to the nearest whole dollar. a. Compute the cash received by the borrower. 0 b. Prepare a debt amortization schedule. Note: Round each amount in the table to the nearest whole dollar. Note: Use a negative sign for the "Reduction in N.P." amounts. Interest Reduction Date Jan. 1, Year 1 Cash Expense in N.P. +A Dec. 31, Year 1 +A 0 $ 0 $ 0 $ Dec. 31, Year 2 $ 0 $ 0 0 $ Dec. 31, Year 3 $ 0 $ 0 $ 0 $ Total $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The provided information contains an error The cash received by the borrower cannot be 0 for a longt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started